Image source: vision china

"In the past two years, Yongao has taken over several new energy brands (Wenjie, Ai ‘an, etc.) to prepare for the resurrection, and the result is still poor." An industry insider lamented.

Automobile dealer groups in Dongguan, Zhongshan, Huizhou, Zhuhai and other cities, with nearly 80 4S stores, fell into a situation of no solution for a time. Now the cars were seized by banks, the delivery was fruitless, and the employees’ wages were not paid back. After the storm in Yongao, they left a chicken feather all over the place.

With the fermentation of Yong ‘ao Thunderstorm, the survival dilemma of traditional car dealers has been put on the table again. Yongao is not a case, but a microcosm of the real living conditions of traditional car dealers. But at the same time, we also see that in this century-old wave of automobile revolution, automobile dealers are also accelerating their transformation.

With the continuous improvement of the penetration rate of new energy vehicles, the automobile sales model is also undergoing drastic changes, and the traditional dealer model is constantly being subverted.

China automobile dealers association once released a report that 2362 4S stores withdrew from the Internet in 2020, nearly 1400 in 2021 and 1757 in 2022.

Similarly, according to the statistics of the Federation, in 2022, 40% of automobile dealers closed down, and about 11 4S shops closed down every day. At that time, more than half of automobile 4S shops were at a loss.

In 2023, according to incomplete statistics, about 1,500 ~ 2,000 automobile dealers in China quit the network, among which there are many large and medium-sized dealer groups.

In February 2023, Zhejiang Zhongtong Holding Group, the largest automobile distribution group in Taizhou, Zhejiang Province, suddenly closed its doors and ran away due to financial problems. The 19 4S stores under Zhongtong Group have all been closed, and a large number of employees have not been paid.

In April of the same year, the stores of Chongqing Longhua Industrial Group, a veteran 4S group that has been operating for nearly 30 years, closed down or transferred, and its Longao Automobile Sales and Service Co., Ltd. was planned to be acquired by Dachanghang Automobile Holding Group Co., Ltd.

Similar cases of bankruptcy, lightning storm and road running are still happening. The lightning storm of Guangdong Yongao Group is not an accidental event, but a reflection of the realistic dilemma faced by the entire automobile dealer system.

According to china automobile dealers association’s "Investigation Report on the Living Conditions of National Automobile Dealers in the First Half of 2023", in the first half of 2023, less than 1/4 of the automobile dealers achieved the semi-annual sales target, and more than 55% of the dealers judged the profitability as a loss.

Even the head dealer group cannot escape from it. According to Zhongsheng Group,Yongda automobile、Guang hui Bao Xin、Zhengtong automobile、Harmonious automobileJudging from the financial report data of listed companies in the first half of 2023, compared with the data of the first half of 2022, the gross profit margin of these dealers all declined and their profitability declined.

"Even if the head dealer, the monthly salary will be discounted. For example, if you sell a commission of 20,000 yuan, it will be good to get 15,000 yuan." A frontline salesperson spoke to the titanium media App.

This is still the case for head dealers, not to mention small and medium-sized dealers. "We haven’t paid for half a year." The sales consultant of Guangzhou Suitian Automobile Sales Co., Ltd. (Guangqi Honda 4S shop) said. In April last year, this dealer was also complained that the boss ran away because of financial difficulties.

Front-end operations encountered obstacles, and the capital market began to respond. Last year, the huge group of auto dealers, the first IPO in China, embarked on the road of delisting. You know, at its peak, its revenue in Ceng Chao was 70 billion, there were nearly 100 cooperative automobile brands and more than 1,400 outlets of its 4S stores.

It is not difficult to see from the financial report data of the huge group that this once brilliant dealer is also facing greater operational and financial pressure. In 2020 -2022, the net profit of returning to the mother was 580 million yuan, 902 million yuan and-1.441 billion yuan respectively.

In addition, listed auto dealer enterprises include Zhengtong, Xinfengtai,Harmonious automobileCentury United stock has been lower than 1 yuan for many days, which shows the attitude of the capital market.

Although the Yong ‘ao-style thunderstorm has the factors of poor individual management, with the disappearance of one 4S shop after another, it is actually a series of chain reactions brought about by the transformation and development of the entire automobile industry.

In 2013,TeslaEnter the China market with the direct operation mode, and quickly open the brand recognition by opening a direct operation store in the city shopping center. Compared with the traditional dealer model, the direct sales model is more transparent and open, and has stronger control over offline channels, which can realize unified price control, avoid mutual internal friction among dealers in the past, and damage brand pricing and image.

TeslaAfter the opening of the road, domestic brands of new forces in car-making followed suit, and the direct sales model was regarded as the main trend of new energy vehicle distribution. Some new brands of traditional car companies also began to open direct sales stores or brand stores in Shangchao.

The blossoming of direct sales model has impacted the traditional dealer model, and dealers and car companies have changed from partners to competitors. This role change has undoubtedly increased the sales pressure of dealers.

"The sales of direct sales outlets don’t care how much the company loses, thinking of ways to give extra discounts to promote orders, but dealers have to control costs and can’t stand it." An industry salesperson told the titanium media App.

At the same time, most dealer channels are fuel vehicles, but in recent years, the rapid penetration of the market share of new energy vehicles has hindered the sales of fuel vehicles, and under multiple pressures such as frequent price wars, it has accelerated the collapse of traditional car dealers.

The terminal transaction price continues to drop, and the result of price-for-volume exchange is that the increment does not increase profits, but most of the increment is new energy vehicles, and the sales of traditional fuel vehicles continue to decline. "Fuel vehicles are basically losing money. By the end of the year, manufacturers will make rebates and meet the standards and barely survive." An industry insider bluntly said.

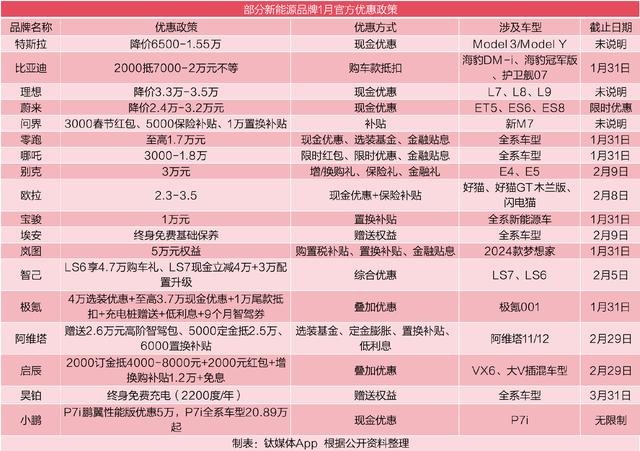

The price war has not stopped. On January 1, 2024,TeslaOnce again, the first shot of the price war was fired, and the official announced the preferential policies. Subsequently, other car brands followed closely, or announced the reduction of the price of the model, or introduced limited-time car purchase benefits and subsidies.

In addition to external factors, the survival problems of automobile dealers also have their own reasons, such as the low efficiency of distribution model and the pressure on profits caused by serious inventory squeeze.

Under the distribution mode, car dealers will approve some models from car companies for sale. Whenever the market is under pressure periodically, car companies often "sell" new cars to dealers for their own revenue performance, which is the so-called "pressure inventory". However, car dealers mostly borrow money from banks to pledge their cars. Once the inventory increases and the leverage is unbalanced, car dealers will face a thunderstorm crisis.

According to an industry insider, titanium media App revealed that a car dealer approved a certain model of a traditional car company, and the car of the previous year was still in stock and not sold. Similar situations have occurred from time to time in various dealers.

It can be seen that the survival problem of automobile dealers is not caused by a single factor, but by the joint action of the whole marketing system reform, price war and other factors. It should be pointed out that the painful period of industry transformation is hard to avoid, but it is in every change and under the new market screening mechanism that the industry can finally be rejuvenated.

When God closes this door, he will open another door for you. For car dealers, it is not without new opportunities in the period of industry transformation.

"4S stores have experienced an explosive period and a comfortable period from scratch in China, and now they are caught in an’ economic crisis’ in a sense. The way to solve the crisis is to adjust the structure and change the way." Yang Xiaoyong, chairman of Lanchi Dealer Group, pointed out.

Shen Jinjun, president of china automobile dealers association, also pointed out that,Automobile dealers are going through a painful period of deep adjustment, which should be optimized from two dimensions: brand structure and regional structure.

"Dealers should make full use of policy dividends and fully promote the development of used cars; It is necessary to fully embrace new energy and change with the trend to create a new model of new energy vehicle sales service; It is necessary to hold the digital "bull nose", realize lean operation and promote the growth of user value; To be driven by the new retail of automobilesOnline and offlineDeep integration. "Shen Jinjun put forward.

According to titanium media App, in order to alleviate the revenue dilemma, some dealers have set their sights on the export business of used cars and automobiles. A car dealer employee told Titanium Media App, "Dealers have started to make used cars now. If new cars don’t make money, they rely on used cars and after-sales to support the facade. Now, the sales of oil cars have a high proportion of used car performance appraisal."

In terms of automobile export, it ranked 29 th in the list of top 100 automobile dealer groups in 2023.Harmonious automobileIt is already on the way to the sea. After undertaking the business of Guangzhou Automobile’s Ai ‘an last year, it jointly opened the Ai ‘an automobile distribution network in Thailand in January this year.Zhongda productsZhejiang Zhongda Yuantong International Trading Co., Ltd., a subsidiary of Yuantong Industrial Group Co., Ltd., isChangan automobileInternational companies joined hands to go to sea and shipped 800 cars into the Mexican market.

Of course, in the face of the new energy trend, some car dealers have also begun to access new energy brand models.This is a two-way trip between traditional dealers and new forces. Under the mode of direct sales for several years, the expansion of sales scale has also brought heavier financial pressure.

If the average cost of a direct store is about 4 million yuan per year, if a brand of new power wants to cover 200 major cities in China, it will cost 1.6 billion yuan a year, which is only the level of one store in a city. In this case, the dealer channel is obviously more cost-effective because it does not need too much capital investment in the early stage.

In order to expand sales contacts and reduce the pressure of direct sales, new force car companies have also begun to actively contact dealers.

Last March,XPENG MotorsTake the lead in "moving the knife" on the sales system, merge the auto trade team of the direct sales system and the user development center team of the dealer system, and implement unified management. In September, a channel reform plan named "Jupiter Plan" was announced, and a meeting of distributors was held.

Image source: He XiaopengWeibo

It is reported that in the first three quarters of last year, nearly 100 stores with low sales capacity were eliminated, including direct stores and authorized stores. It is said that the implementation of "Jupiter Plan" aims to gradually replace the previous direct sales model with the dealer model, so as to reduce operating costs. However, judging from a series of measures taken by Tucki last year, it has basically formed a "direct sales+agency authorization" system, and reached cooperation with ten domestic dealer groups such as Yongda and Guanghui.

exceptXPENG MotorsIn addition, some other new energy automobile companies are also reducing the number of direct-operated stores and expanding the scale of agent dealers. For example, Krypton has also carried out channel adjustment, increasing the proportion of authorized dealer stores (comprehensive 4S stores that provide one-stop service experiences such as experience, sales, delivery and after-sales).

According to the new sales channel plan of Kyoko in 2024, it is planned to build at least 500 stores, including nearly 200 new stores, and the proportion of "Kyoko" in new stores is about 50%. It is reported that some dealers of Geely’s Link have reached cooperation with Krypton.

Besides,WeilaiIt also prepares for the opening dealer model of its sub-brand code-named Alps. According to external sources,WeilaiIt is planned that the after-sales service and delivery center of Alps will be undertaken by a nationwide dealer group, while Shangchao Store will still adopt the direct mode.

For a Xiaomi car that has just entered the market with one foot, its new retail model is also a combination of direct sales and dealers. At the end of 2023, 14 dealers announced their intention to cooperate with Xiaomi Automobile, including national dealer groups such as Hengxin Automobile, Sichuan Ganghong, Jianguo Automobile and Yuantong Automobile.

Compared with the traditional cooperation mode between car companies and dealers,XPENG MotorsThe dealers of Guangzhou Automobile Ai ‘an don’t have to bear a lot of capital and vehicle inventory pressure as in the traditional distribution mode, but only bear the daily operating costs and don’t undertake the procurement tasks stipulated by the manufacturers. But even so, it is not a good business for dealers to undertake new energy brands.

"A (new energy) car dealer only earns thousands of dollars, and the manufacturer’s rebate requirements are not so simple to get." The sales of a dealer system are blunt to the titanium media App. It said that the homogenization of products is serious now, and it is the time to fight for marketing and channels. It is not easy to sell products and meet the rebate requirements.

However, it can be seen that under the background that the sales of fuel vehicles are blocked and the price war forces the channel competition to intensify,Automobile dealers have begun to take targeted measures, or strengthen after-sales, or add second-hand cars and new energy vehicles, or open stores in overseas markets. Even though some dealers are unable to withstand the operational pressure and disappear in the wave of transformation, there are also players who rely on transformation to stay at the table.

car dealerZhongsheng holdingIn the 2023 semi-annual report, it was mentioned: "The electrification competition in China automobile market has just begun, and it is more likely to be a marathon than a sprint competition."

This auto industry knockout not only happened between car companies, but also staged in dealer channels.

(This article is the first titanium media App, written by Xiao Man, edited by Sharla Cheung)