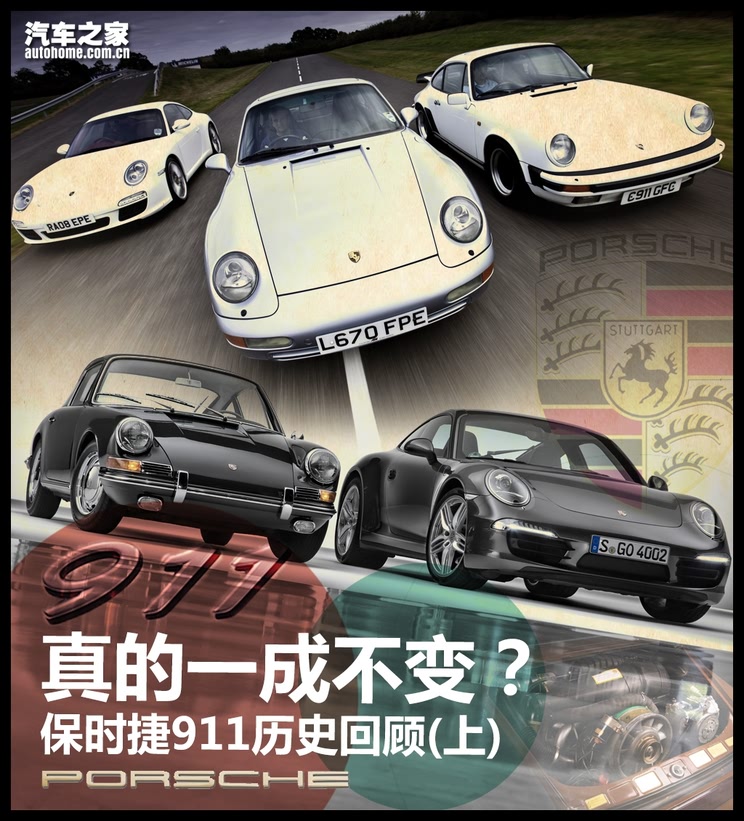

[History of car home Car Series] There is a car, which has been unchanged for more than 50 years and has a pair of big eyes that are harmless to people and animals, which makes every car fan dream. From the origin to the present, everything has been put together by mistake, and it has become a world classic because of such a mistake. This car, yes, is a Porsche 911.

Introduction of the Old-timers-Porsche 356 Series (1948-1965)

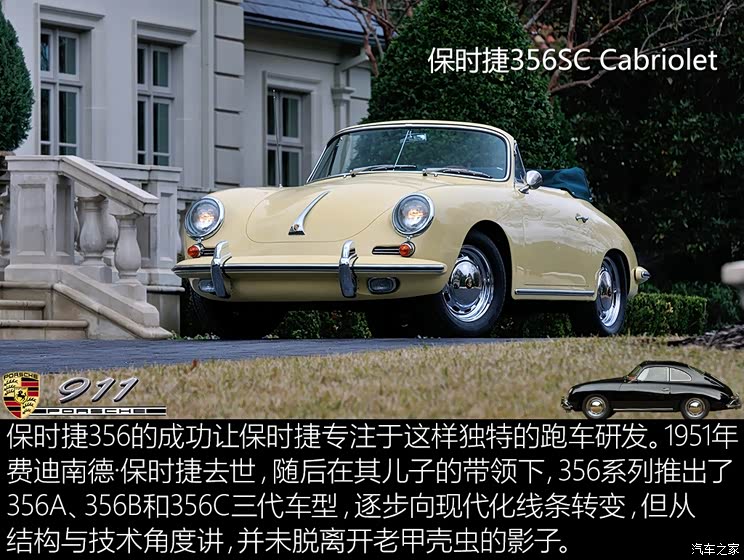

If we want to talk about how Porsche 911 has become like this step by step, we should start with its predecessor, Porsche 356. Porsche 356 series is Porsche’s first mass-produced sports car with its own brand, which was born out of Beetle technology and focused on optimizing the lightweight, aerodynamics and handling of the car body. All these laid the foundation for the design features of the Porsche 911 in the future, and passed it on to this day, making it unique.

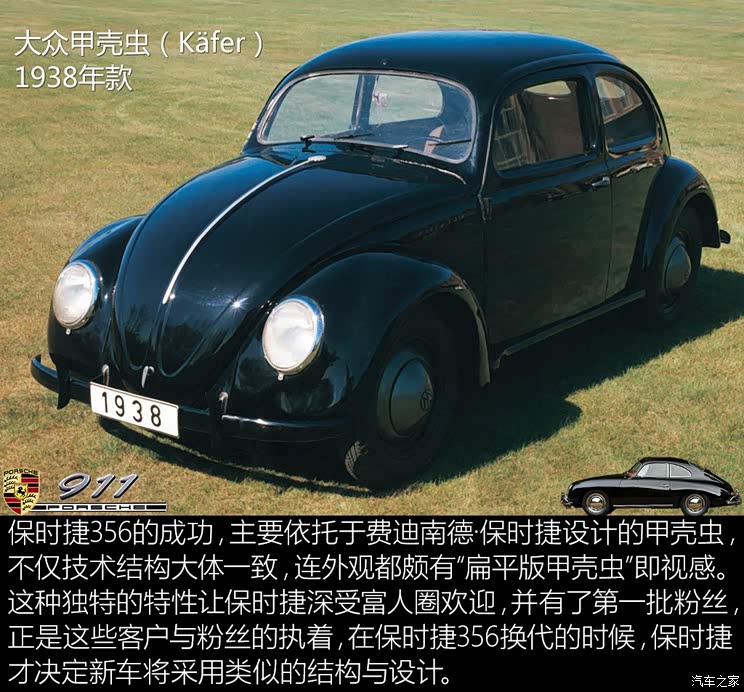

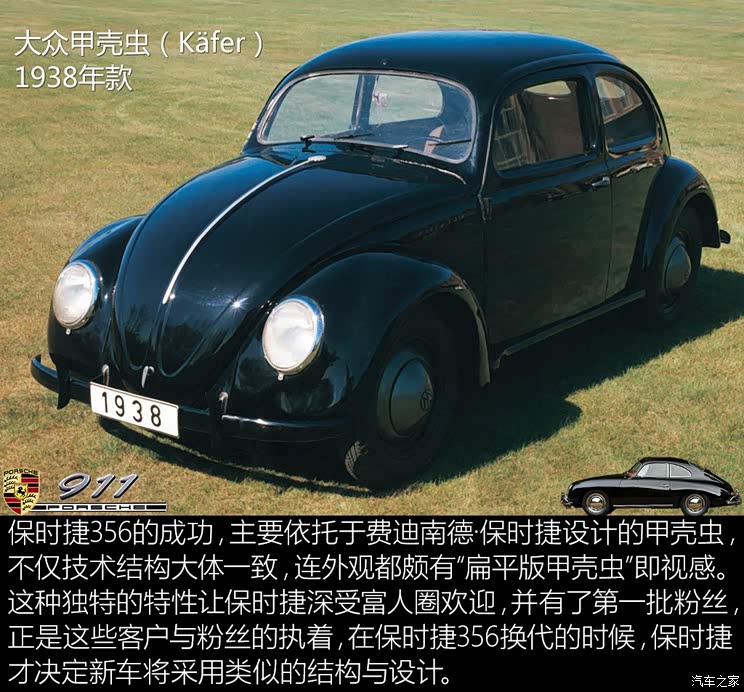

In 1931, in Stuttgart, Germany, Dr. ferdinand porsche founded his own design company. The brilliant road of a generation of mechanical design masters has since reached its peak. Before World War II, ferdinand porsche was entrusted by Hitler to participate in the national car program, and in 1937, he "designed" the Volkswagen Beetle (then called K?fer). Although nominally designed independently, it is rumored that this car has made a lot of reference to the Tatra V570 model designed by Hans Ledwinka and Tatra in 1930. Indeed, it is really impossible to build such a classic model from scratch in a short time.

So such a "reference work" makes Porsche get attention instead of Hans Ledwinka. Why? In fact, Hitler didn’t know that this work had reference elements, but due to his close personal relationship with Porsche (this can be seen from the fact that the tank designed by Porsche failed in bidding, and the tank that was successfully tendered was forcibly assembled with Porsche chassis), Hitler said "turning a blind eye" to this matter.

Then why didn’t Hans Ledwinka pursue this matter in depth? First of all, they did fight a lawsuit for a long time. In 1965, Volkswagen personally compensated Hans Ledwinka for 3 million marks (equivalent to the income of Porsche for about 3 months). Secondly, Hans Ledwinka became a war criminal after World War II, and it was the Porsche family that spared no effort to bail him out. Finally, ferdinand porsche once admitted in his personal letter that his success was on Hans Ledwinka’s shoulders.

Type 64 is specially built for Berlin-Rome rally, based on Volkswagen Beetle, horizontally opposed engine, rear-mounted rear-drive design, aluminum body, fully considering wind resistance and lightweight. And this car has also become the origin of Porsche’s sports car in the future. Although this car has not been mass-produced, for Porsche, this car has laid a good foundation for Porsche’s determination to make a sports car in the future and laid a good conceptual foundation for Porsche to realize its dream of a sports car.

After the war, Germany was in a mess, and ferdinand porsche was jailed for participating in the design of various military products, and was released in 1947. Of course, this fanatical technical fan will not stop his obsession with vehicle development and performance because he regained his freedom. On the contrary, ferdinand Porsche hoped to make a sports car of his own brand. This wish was supported by his son Ferry Porsche, and Porsche had the technology of the Beatles at that time, so with the support of his children, he quickly launched a new car plan-the Porsche 356 sports car with Porsche brand instead of Volkswagen brand was released in 1948.

Porsche 356 sports car can be simply understood as a "sports car model" of Volkswagen Beetle in its early days, and more than 40% of its parts are common with Beetle. In fact, from a technical point of view, relying on Beetle technology is more out of helplessness, because Porsche after the war only has some drawings of Volkswagen Beetle, and if it wants to realize production quickly, it is necessary to adopt some ready-made things. Therefore, it is not difficult to understand that in the development process of Porsche 356, relying on Beetle technology, and it is for this reason that Porsche has achieved great success.

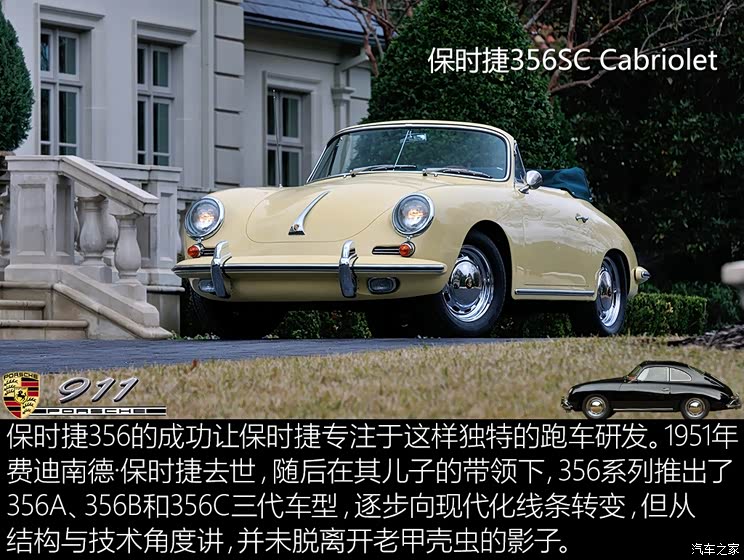

The unique structure and shape, combined with the handling brought by the short body, make the Porsche 356 distinctive among many sports cars. Although there is no high power reserve, the light body and low wind resistance design have indeed made a lot of contributions to the market. Think about the current car companies want to develop a car. Lightweight and low wind resistance are definitely the focus of research and development. As early as the late 1940s, Porsche already had mass-produced models under this concept. From this point, it can be seen that Porsche is really far-sighted.

The increasingly complex line design makes Porsche 356 gradually get rid of its original simple appearance. The wider track and tires make it look more or less like a sports car. However, even if it is upgraded, it is still the cute look of the Beatles and the rear drive structure that is being passed down.

This rear-mounted rear-drive structure+simple and lightweight sports car brought Porsche the first bucket of gold, and the success of this sports car brought a group of loyal customers and fans, which made Porsche have an idea: the future generation of sports cars will still adopt this design concept. This is also the origin of why Porsche 911 is loyal to the rear drive structure.

A new beginning-the first generation Porsche 911(1964-1973)

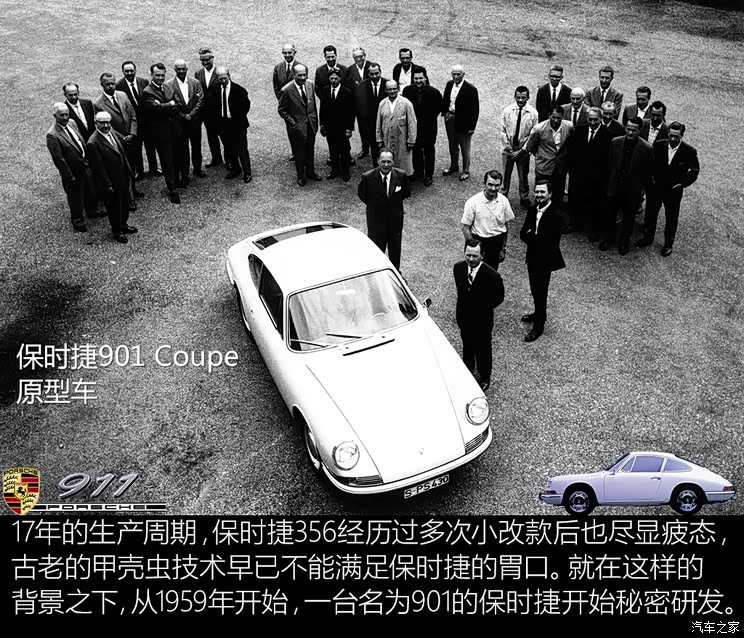

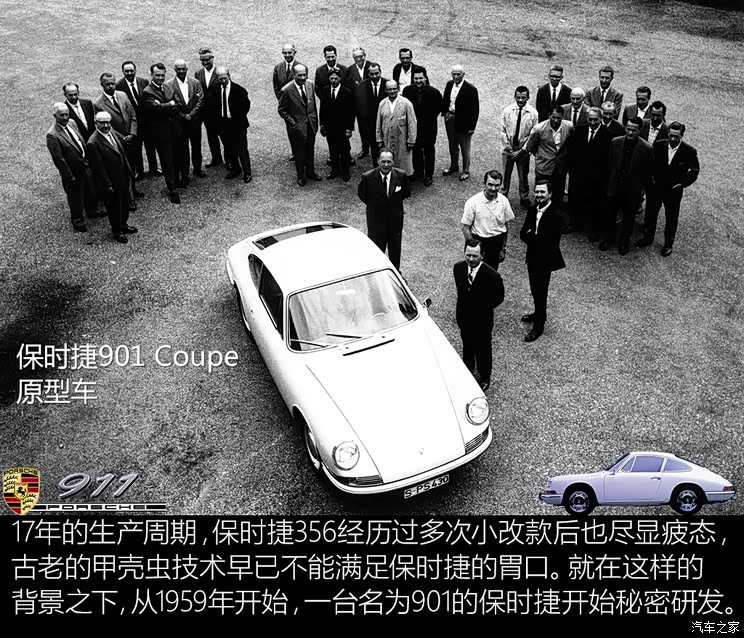

The 356 model, which was born out of Beetle technology, has been exhausted after 17 years of production and can’t keep up with the progress of the times. Porsche urgently needs a new car to inherit the mission of the 356 model, and at the same time of innovation, it must inherit the classics, be unique, be full of power and be the best in its class. Based on this idea, the famous Porsche 911 (hereinafter referred to as 911) was born.

In fact, in the design process, Porsche once thought about giving up the structure of rear-mounted rear drive and switching to the structure of center-mounted rear drive or front-mounted rear drive, which has a relatively balanced front and rear axle load, so that the vehicle has a relatively stable handling characteristic. However, due to the persistence of fans and people’s subconscious concept that "only rear-mounted rear-drive is the most authentic Porsche sports car", Porsche 911 finally adopted this rear-mounted rear-drive structure and adopted the front McPherson rear torsion beam suspension. As for the middle rear-drive and front rear-drive sports cars? Leave it to other series.

Porsche 901 model generally inherits the classic design of "Flat Beetle" in appearance, but it has no technical intersection with Beetle. Everything is brand-new and its appearance is more modern. The engine has been upgraded from horizontally opposed 4 cylinders to horizontally opposed 6 cylinders, with more power, larger body and greatly improved comfort.

Because Peugeot registered the copyright of all three-digit combinations with 0 in the middle (such as Peugeot 307 and Peugeot 508, which we are now familiar with), due to the dissatisfaction of Peugeot, only 82 models named 901 were manufactured and then renamed Porsche 911. As for why the number 911 is used, there is actually no special reason-simply changing 0 to 1.

However, this does not mean that the number 901 has come to an end. Because in the research and development stage, the first-generation 911 has always been named by 901, Porsche simply represents the first-generation model of 911 with the code name 901, so the first-generation 911 is often called 901.

Although from the perspective of inheritance, 911 is the replacement model of 356 in terms of structure and concept, from the technical point of view, 356 has no direct technical inheritance model because it completely surpasses 356 (the price is the same). For this reason, Porsche replaced the 911 with a 1.6-liter horizontally opposed 4-cylinder engine (output 90Ps) on the 356C, and renamed the car 912 to fill the gap in the 356 market. There was only one generation of the 912 model, and then the 912 was replaced by the 914 with the middle rear drive structure.

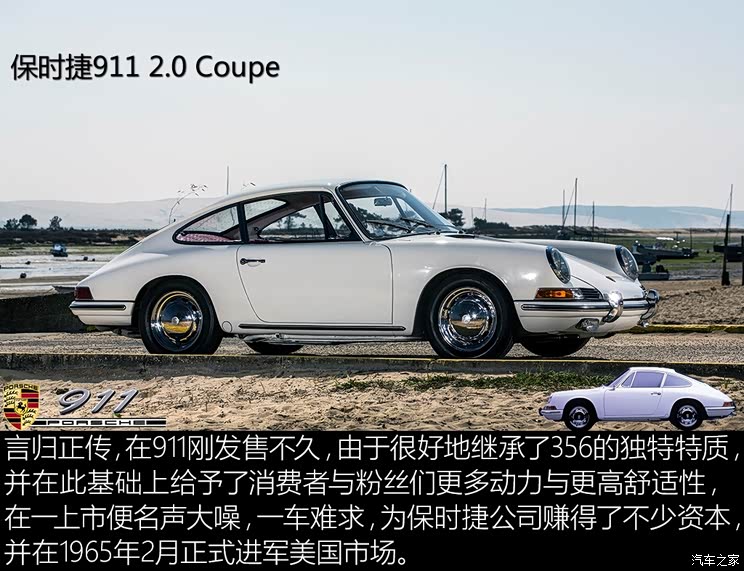

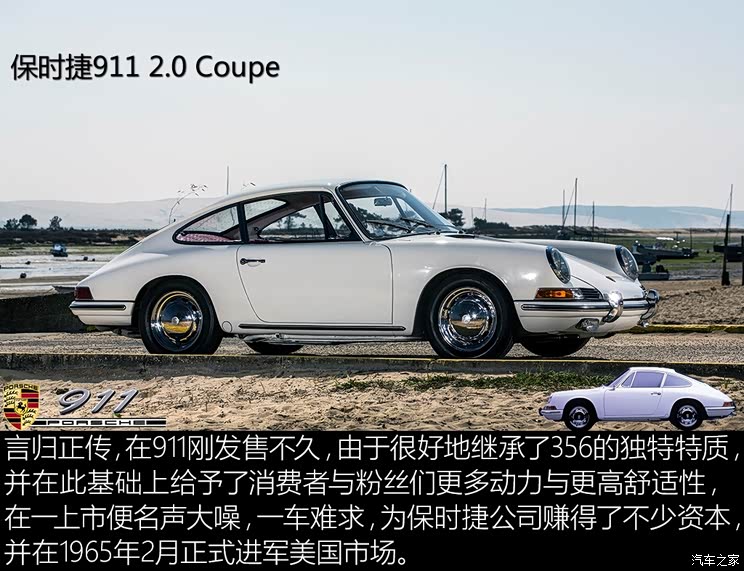

With sufficient capital, it is impossible for Porsche to sell only one model of 911 in the market. In addition, with the increasingly diversified needs of users, Porsche began to segment the market for its 911 models. From the initial only 2.0 horizontally opposed 6-cylinder engine of Type 901/01 (the output power is 130Ps, equipped with a 5-speed manual dense-tooth gearbox, and the maximum speed is 210km/h), to the different power levels adjusted by various later versions, 911 has accurately positioned different customer groups.

In terms of interior, some elements of Porsche 356 can be seen in the first generation Porsche 911: green dashboard and a large number of chrome-plated decorative pieces. However, the five-link meter and the key jack on the outer side have been formed, and the instrument panel with the upper part protruding inward will become the classic interior elements of Porsche 911 in the future.

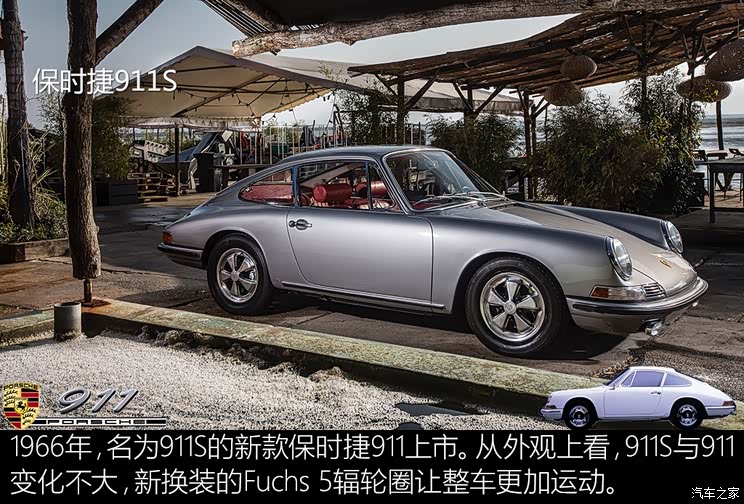

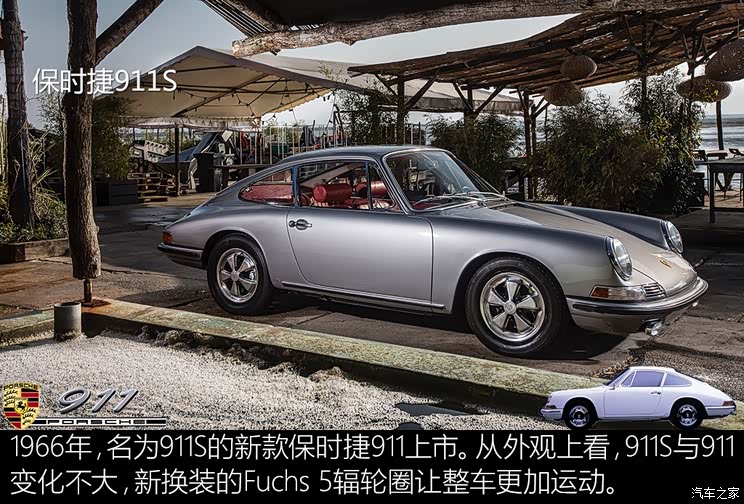

The newly changed 5-spoke Fuchs wheel has become one of the classic elements of the old 911 because of the success of the Porsche 911 in the future. Even in many nostalgic 911 models, we can still see this wheel style (such as the Speedster model of the sixth generation 911).

As for the power system, the horizontally opposed 6-cylinder engine with higher output replaced the original engine, which made the power performance of Porsche 911 go up to a higher level: the 911S was equipped with a Type 901/02 engine, and the output power increased by 30Ps to 160Ps, which brought better power performance to the 911S.

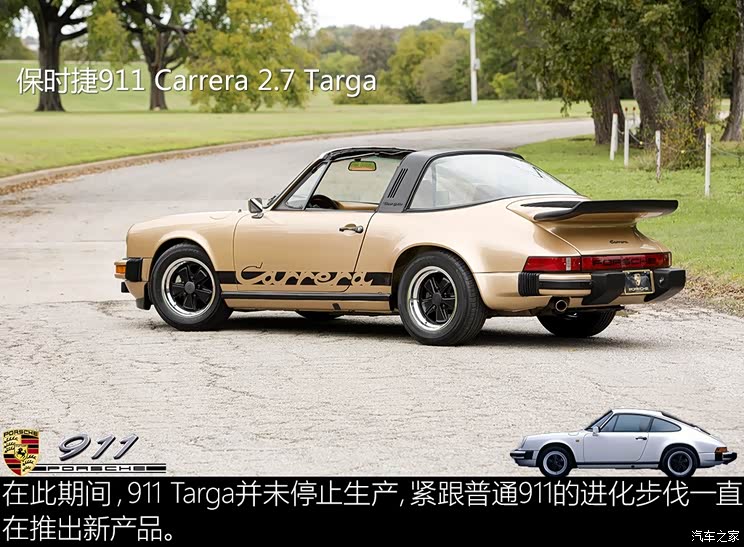

Because the American High-speed Safety Committee stipulated that there was a risk of head injury when the fully convertible structure was overturned, Porsche 911 Targa installed a T-beam similar to the roll cage to reduce the hidden danger of head injury during the rollover. This design earned the 911 Targa the title of "the safest convertible in North America", and this design became the classic styling feature of the Porsche 911 Targa model, which was in short supply after listing. This "T-shaped roof" designed for legal compromise later became a classic design form of 911 convertible, which has both aesthetic feeling and safety. The Targa model has been accompanied by the 911 to this day, which has created the sales miracle of the 911 model in the convertible market.

Speaking of the change of Porsche 911, if you are not a fan of Porsche 911, you should not be able to see where it has been changed. Indeed, every time 911 changes the money, it gives consumers the feeling that they are playing "Let’s find fault". Although the appearance has not changed much, every change is perfect for this "car that has been changed for more than 50 years" in terms of details and machinery.

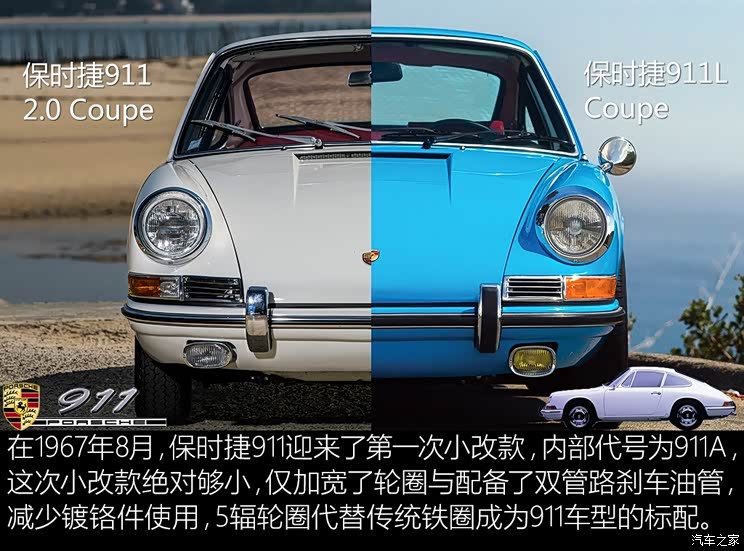

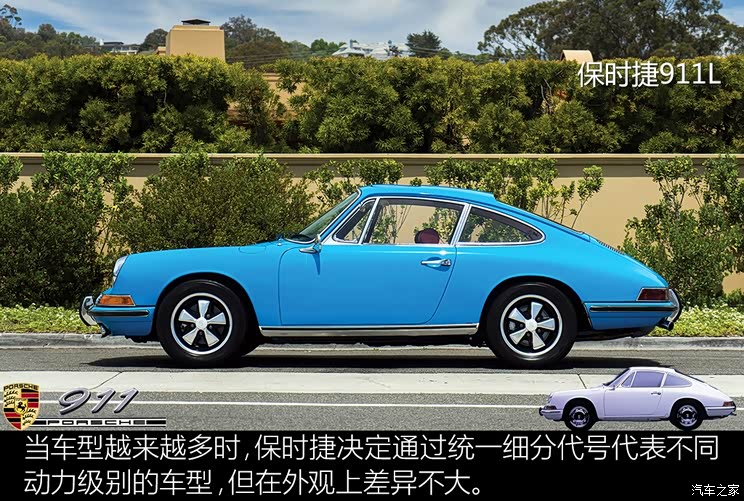

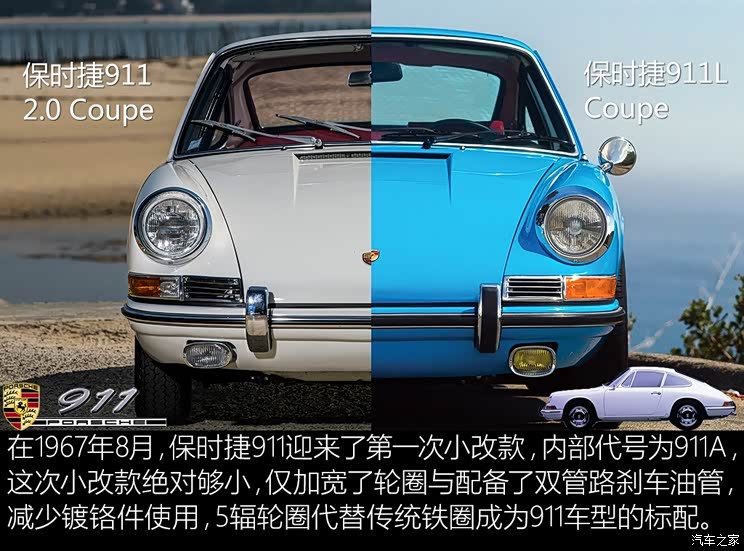

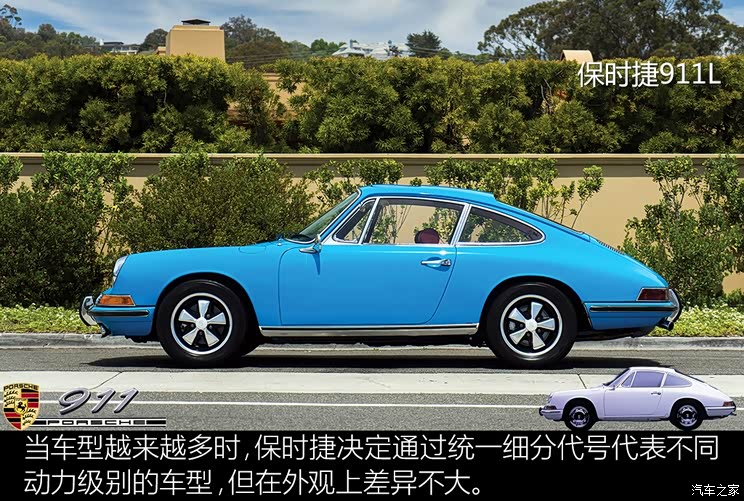

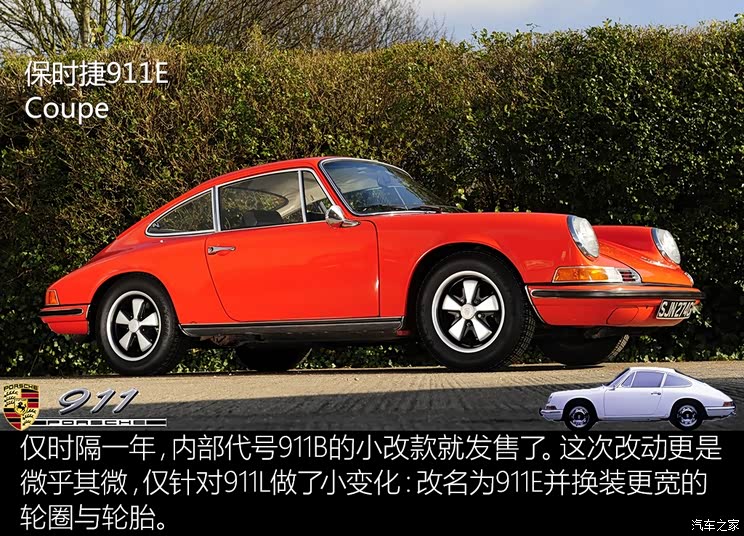

In the early days, 911+ letters were used to represent vehicles with different power levels: 911T stands for 110Ps output version, which was released in 1968 to fill the market gap between 911 and 912; 911L stands for 130Ps output version; 911S stands for the 160Ps output version, that is, the high-power version, and all of them can be equipped with the Sportmatic semi-automatic gearbox. Even the most basic version of the 911T, Porsche can still win the Monte Carlo Rally twice with its excellent performance.

In the first generation of 911 models, every small change in appearance is minimal, but in terms of details, these seemingly minor improvements are an improvement for the 911 car series.

This change, code-named 911C, can be regarded as a relatively big change in the first generation model: the biggest change in this adjustment is the engine, which is upgraded from 2.0 displacement to 2.2 displacement, and the corresponding engine power is also improved. In order to cope with the problem of too sensitive handling under extreme conditions, the wheelbase is increased from 2211mm to 2268 mm.

After the redesign, the interior of the 911 has basically maintained its original appearance, and the five-link meter and the outer key jack are still the same. However, the color scheme of the instrument is no longer green, but close to the color scheme of some current models with red needles on white background. The application degree of plastic parts has increased to a certain extent compared with that before the redesign, and the steering wheel style has also changed.

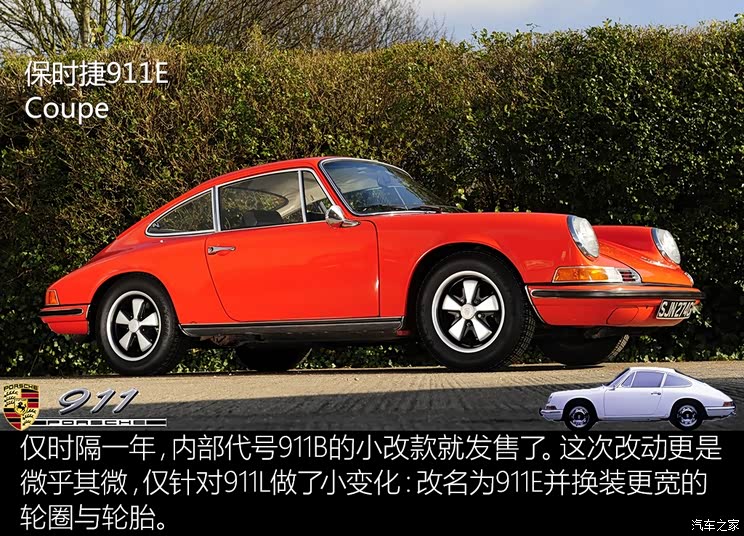

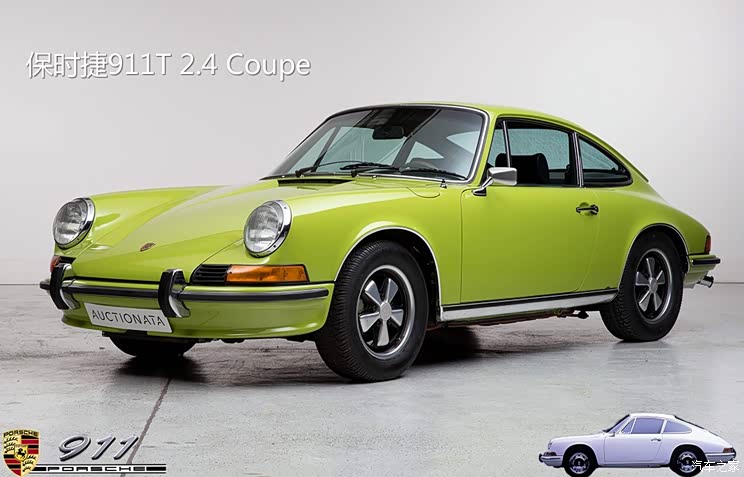

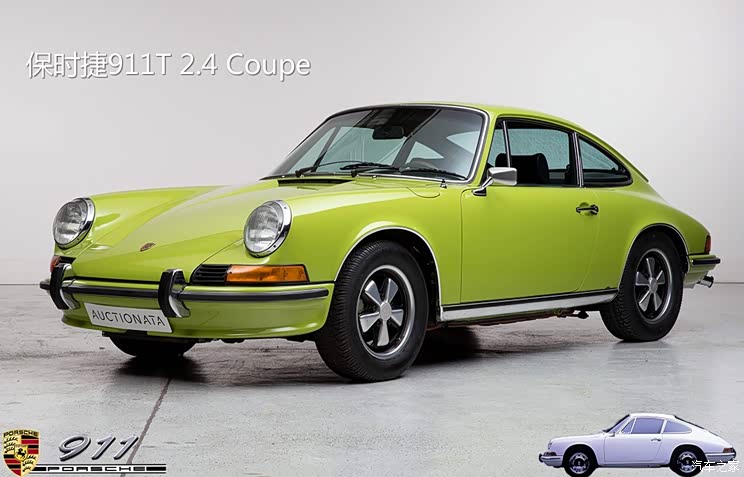

In the subsequent modifications, including three adjustments with codes 911D, E and F, the displacement was increased from 2.2 to 2.4, and Bosch mechanical injection technology (MFI) was used to achieve better fuel injection effect. In addition, there were some changes in small details such as the change of fuel filler, but the classic appearance and structural layout remained unchanged.

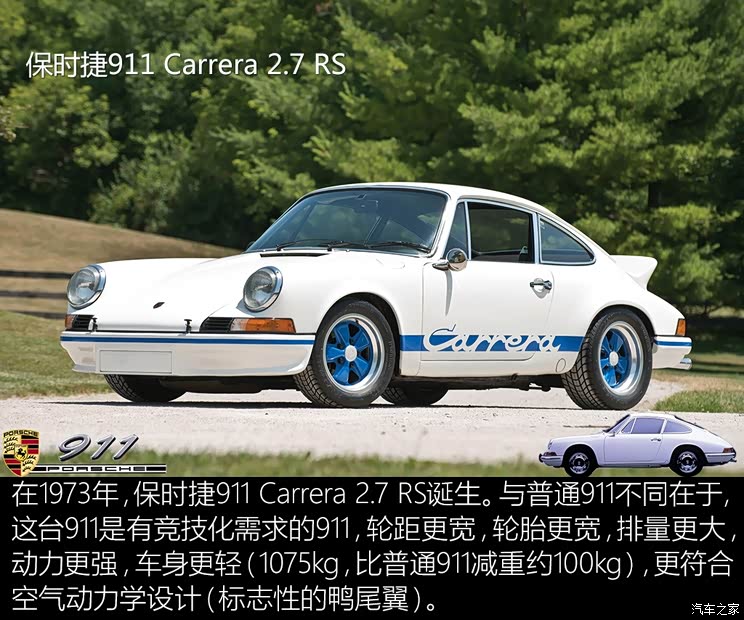

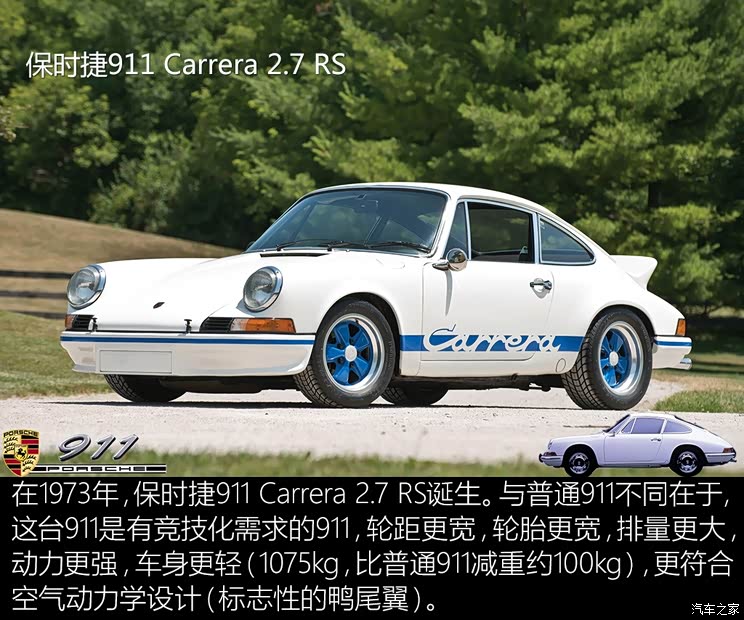

The 911 Carrera 2.7 RS, which was launched in 1973, can be regarded as the first time that Porsche launched such a mass-produced model with emphasis on competitive sports in the civilian market, and it was also the largest displacement model among the mass-produced 911 cars at that time, with a maximum speed of 245 km/h. The word Carrera originated from the race of Carrera Panamericana in Mexico. In order to commemorate the victory of Porsche in this race, the word Carrera was first used on the 356 Carrera model, symbolizing Porsche’s honor in motorsport. The classic duck tail and the newly designed front bumper became the iconic design of this car, and from this, the Porsche 911 RS series, which pays attention to competitive needs, was born.

The birth of the first generation of 911 can be regarded as a comprehensive transcendence of 356 in terms of various indicators, with larger and more comfortable handling, but accurate and extremely interesting, which contributed to the success of Porsche 911, and the development of RS models pushed the 911 car series to the direction of high performance and competitive demand.

The birth of a new model-the second generation Porsche 911(1973-1989)

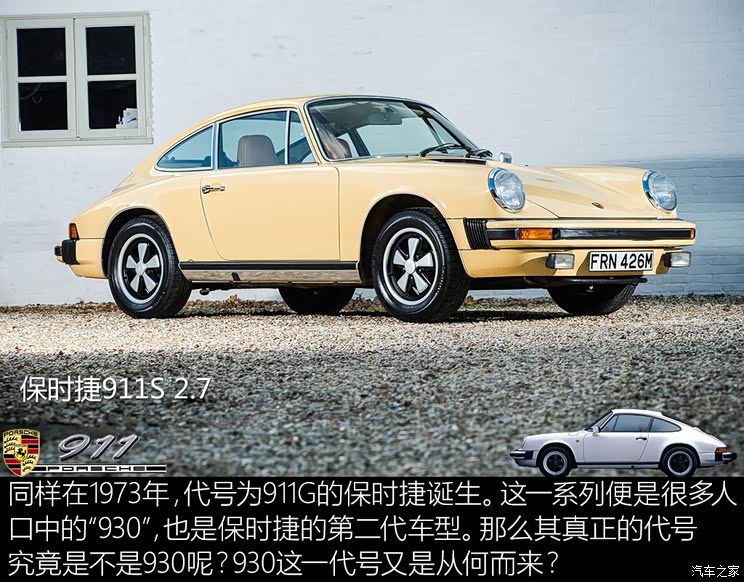

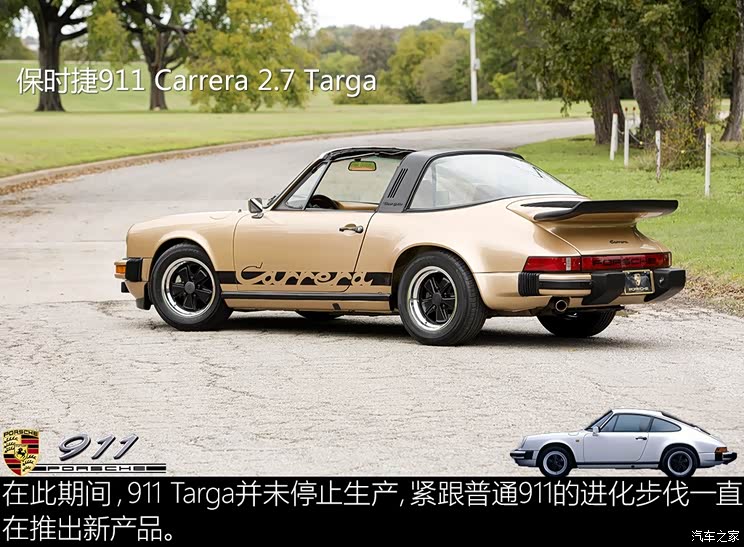

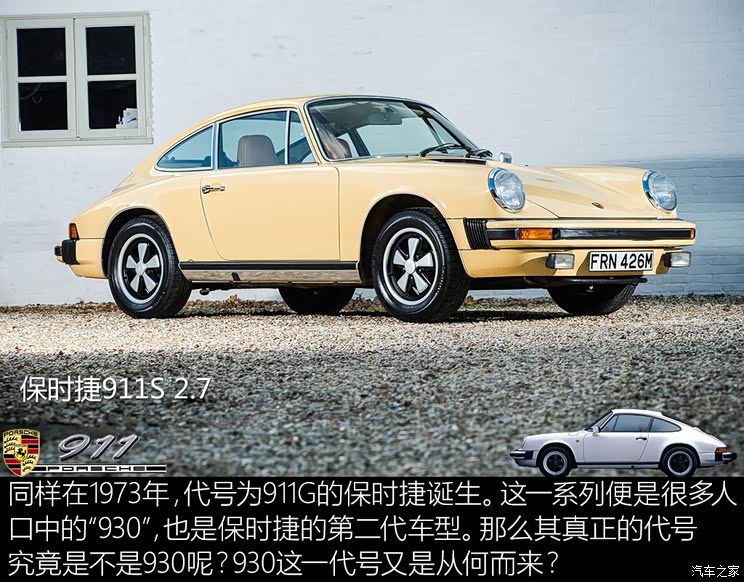

From the code point of view, many people are used to calling the second-generation 911 930, but from the official and technical point of view, the second-generation 911 has a great intersection with the first-generation 911, so what should this generation 911 be called? Can this generation continue to inherit the classics and carry them forward?

The second-generation 911 model, the accurate code name can only be said to be the 911G series model. In order to meet the strict requirements of American laws for bumpers, this generation of 911 has installed front and rear bumpers with low-speed protection and collapse function, which has better safety performance, and also gives this generation of 911 a certain degree of modernization characteristics, and the bumper with outstanding style has also become the characteristic design of this generation of 911. The overall replacement of the 2.7-liter horizontally opposed six-cylinder engine (150Ps for the 911 and 175Ps for the 911S) has finally made this generation of 911 no longer lag behind in terms of power.

In terms of interior, this generation of 911 has moved up the air conditioning outlet, changed the steering wheel style, made some adjustments in the inner door panel, added more leather materials, and improved the comfort configuration to a certain extent.

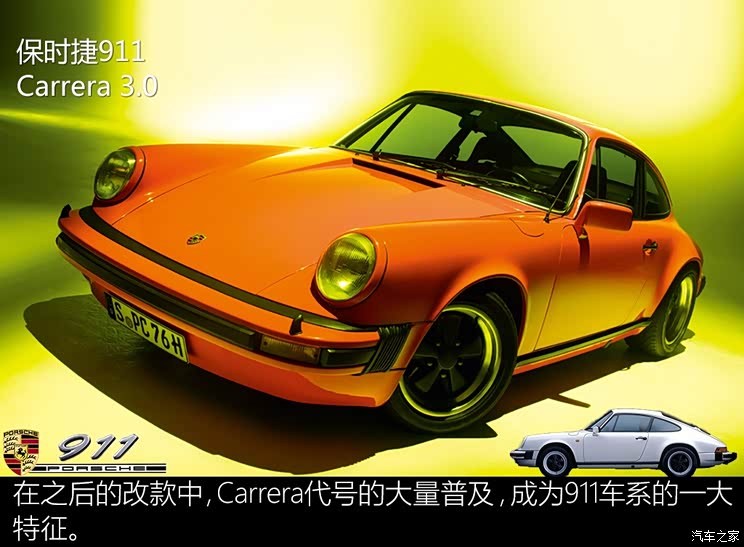

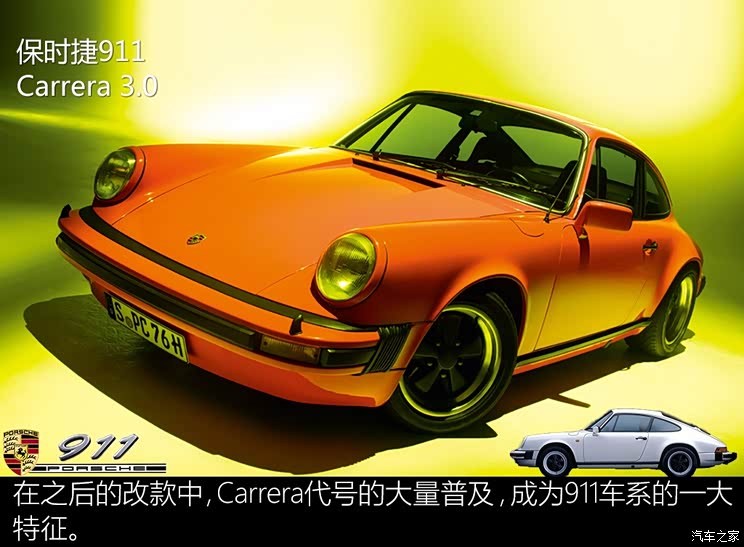

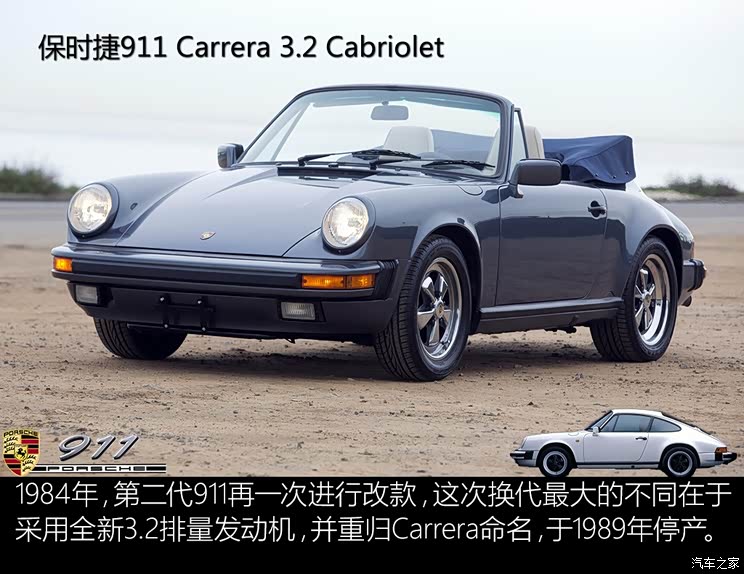

At this point, the standard version of the 911 was renamed as 911 Carrera, which made the name Carrera exist in the 911 car series for a long time. And in the process of later modification, the engine with higher displacement was gradually equipped. In 1976, it was upgraded to a 3.0 horizontally opposed 6-cylinder engine, which can be matched with a 4-speed, 5-speed manual gearbox and a 3-speed Sportmatic semi-automatic gearbox. The acceleration time of 100 kilometers is only 6.1s, and the maximum speed is 236 km/h.

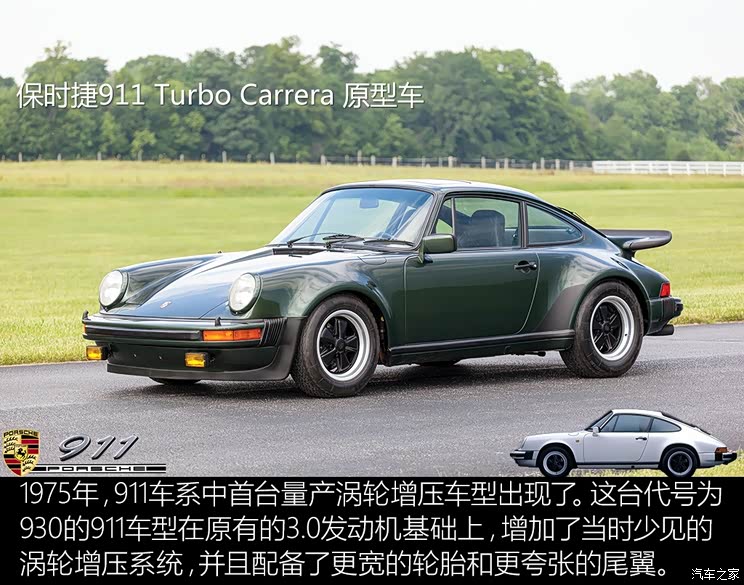

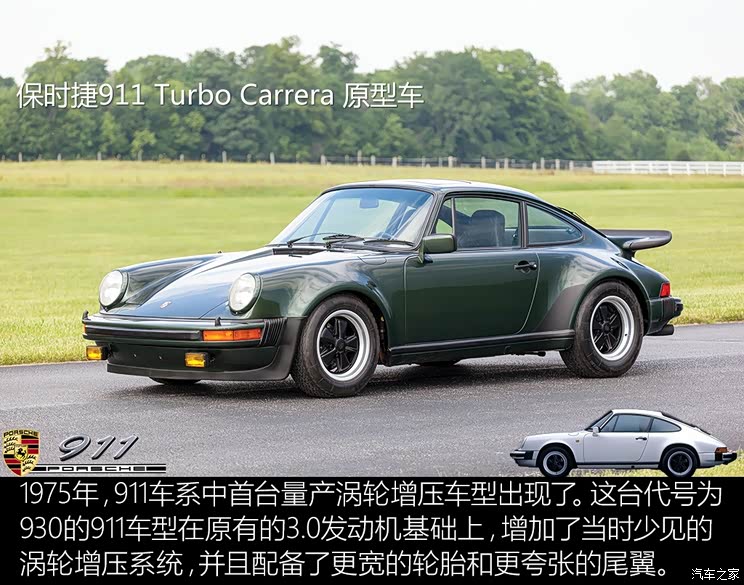

In this generation of 911, Porsche 911 Carrera Turbo 3.0, the first production version equipped with turbocharged engine in Porsche history, has its own independent code name, namely 930. The appearance of this car made Porsche 911 the first sports car with turbocharged engine.

The 911 Carrera Turbo 3.0, which adopted turbocharging technology, had excellent output book data (matching with a 4-speed manual gearbox, the measured acceleration per 100 kilometers was only 5.2s, and the maximum speed was 250km/h) compared with competitors of the same level at that time, which opened a big gap in performance. In order to control this engine with strong output, Porsche has equipped it with a wider wheel arch to match the wider tire and track and ensure the grip. This "fat ass" design, combined with the new duck tail, will become a body form in the 911 car series in the future, and it will not only be matched in the Turbo model, but also be matched in some performance models from time to time.

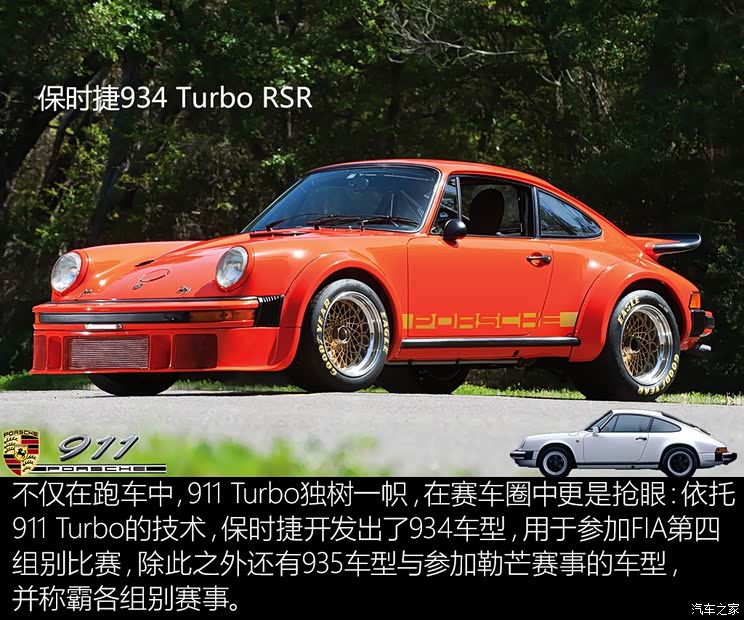

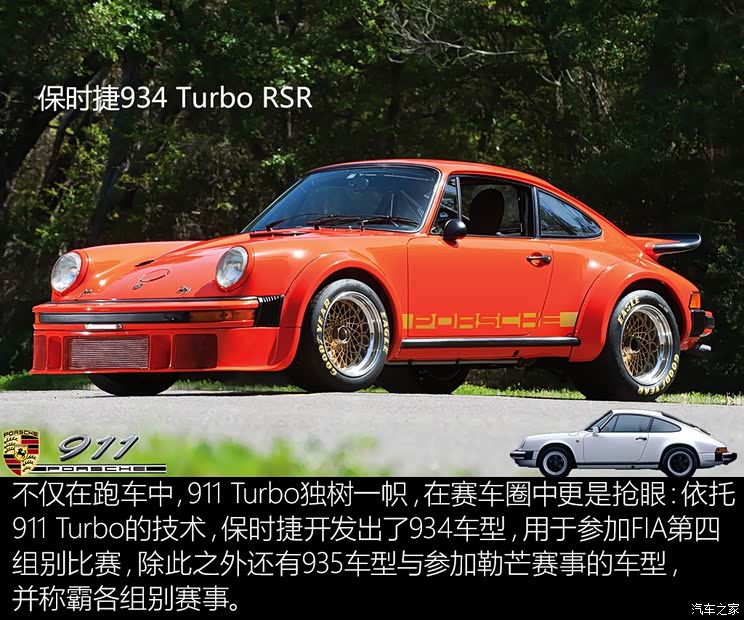

Based on the 911 Turbo model, Porsche has also developed a lot of racing cars specially for racing, which makes the 911 Turbo model not only famous in the sports car industry, but also swept the champions in various races. It is absolutely eye-catching to know that a 911 can perform as well as those racing cars (such as Ferrari, Lamborghini, etc.) transformed from super-running. The 934 Turbo RSR racing car pictured above has also been rumored to be the source of inspiration for RWB. As for the truth, different people have different opinions, and the eye-catching widened wheel eyebrows are really eye-catching.

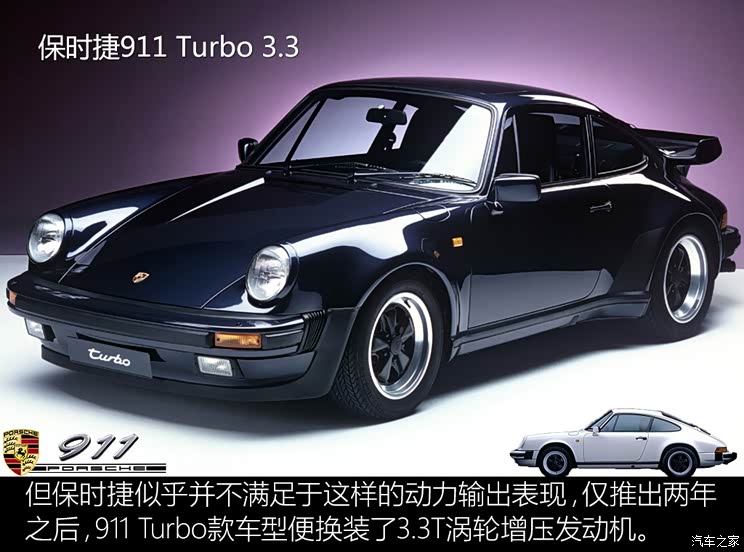

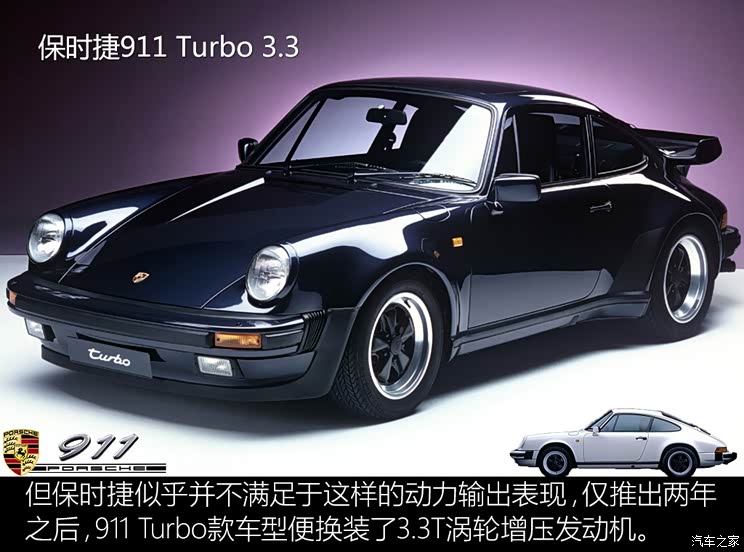

While everyone is still amazed at the powerful output of this 3.0T horizontally opposed six-cylinder turbocharged engine, only two years later, the Porsche 911 Turbo model with a 3.3T horizontally opposed six-cylinder turbocharged engine replaced the 3.0T version, and its power performance was even more amazing (up to 300Ps and matched with a 5-speed manual gearbox, the measured acceleration per 100 kilometers was 5s, and the maximum speed was 260km/h). In addition, the 911 Turbo model was named after Carrera, and it became a relatively independent positioning model different from Carrera model, and it was replaced with a new tail form. In the instrument panel part of the interior, a turbocharger meter is added to the tachometer.

In addition to the general version of the 911 Turbo model, the 911 Turbo also appeared a flip version model named Flachbau Coupe in the same period, realizing more diversified choices. The success of the 911 Turbo made the second generation Porsche famous, and this generation of Porsche 911 Turbo did not officially stop production until 1989, and reluctantly bid farewell to the historical stage.

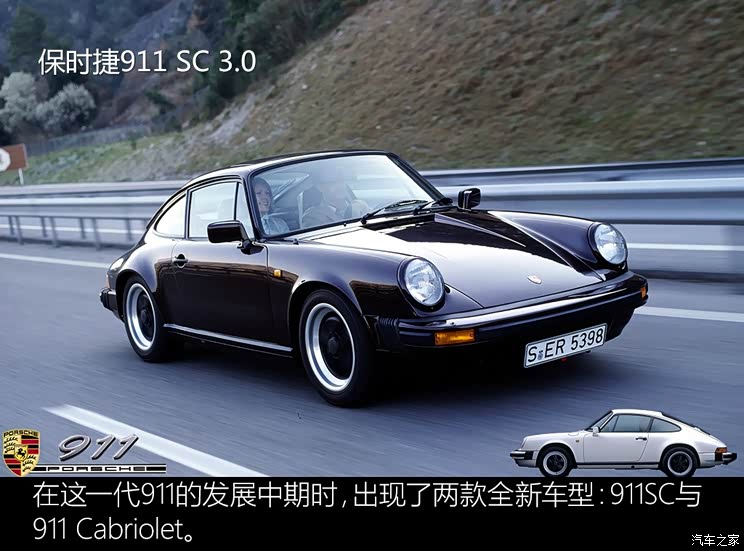

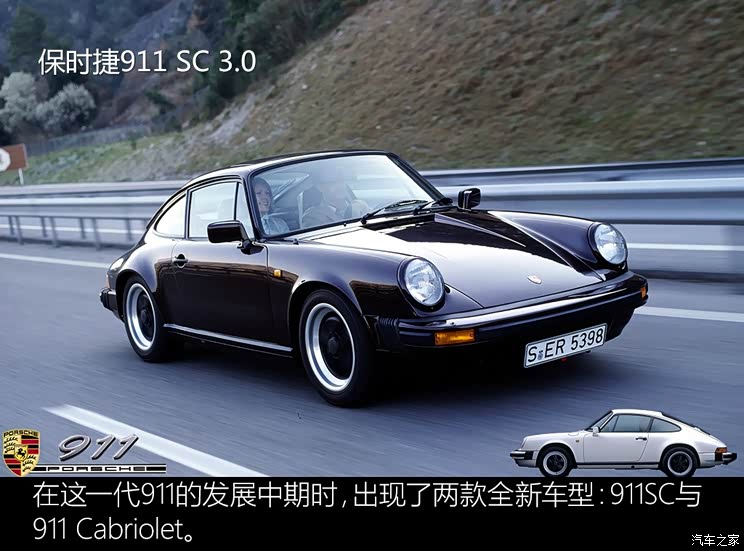

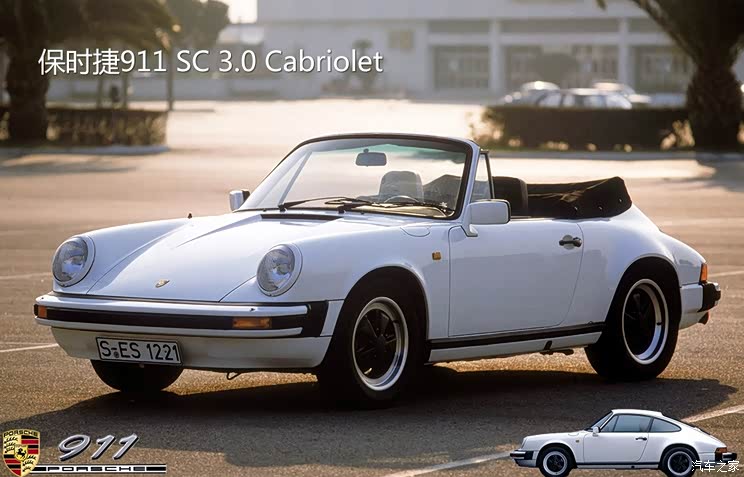

It is not accurate enough to say that 911SC is a brand-new model: 911SC first appeared in 1978, and SC stands for Super Carrera, which is the renamed successor model of 911 Carrera. The car adopts Bosch K-Jetronic fuel injection system, which has a power output performance of more than 180Ps (later upgraded to more than 204Ps).

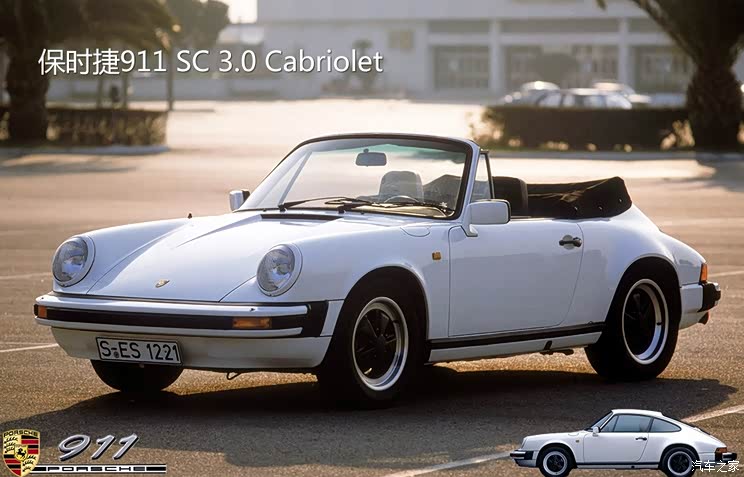

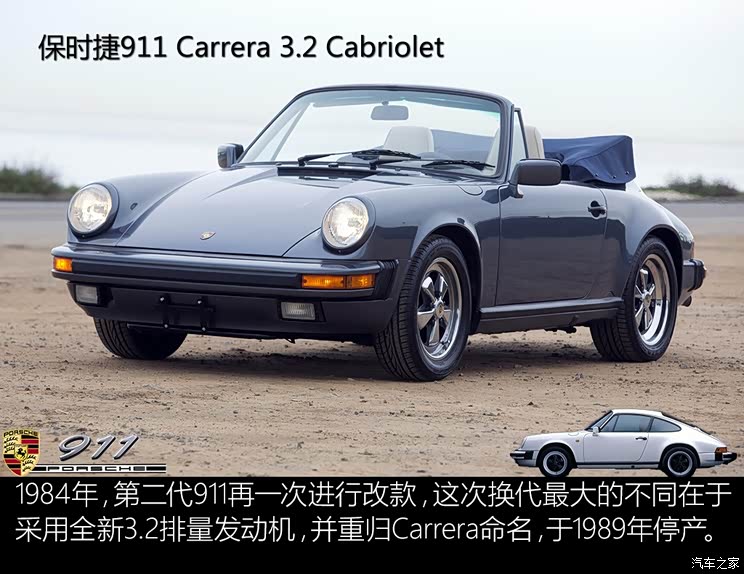

And if the Cabriolet model is said, it really appeared for the first time in the history of 911. This orthodox 911 series convertible first appeared in 1982, and it is also the first convertible of 911 after 356 Cabriolet for many years. The difference between the 911 Cabriolet and the 911 Targa is that this car does not have a B-pillar design similar to the roll cage, and it is a standard convertible structure.

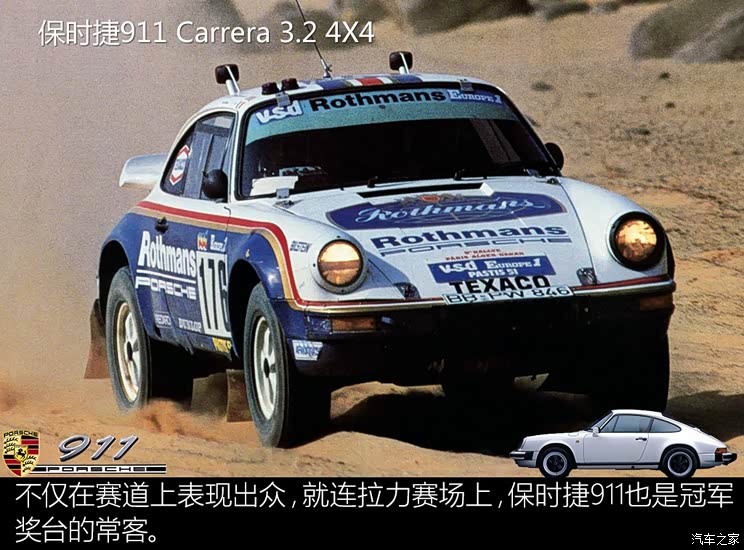

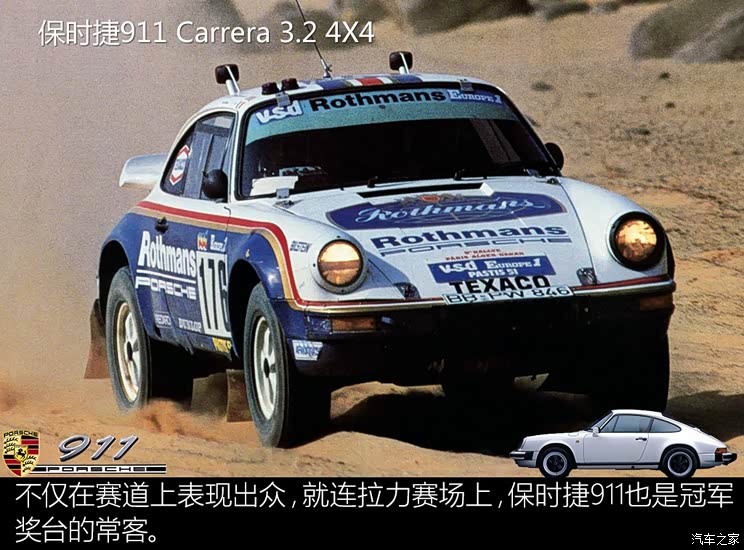

This generation of Porsche 911 also participated in the Paris-Dakar Rally in 1984 (the 911 Carrera 4X4 car above), which not only finished the whole race, but also made Porsche win the championship for the first time. Not only that, in the following two years, Porsche won the 1985 Pharaoh Rally and the 1986 Dakar Rally with the 959 car. A sports car snatched a cross-country rally champion from many off-road vehicles, which is unique in the history of automobiles.

The Porsche 911 pictured above is the last work of the second generation 911. The Speedster model is not only a tribute to the 356 Speedster, but also a more inclined small windshield design and two-seat structure, which are different from other 911 features. When it comes to the origin of Speedster, it was originally designed for the pursuit of low wind resistance. The extreme Speedster is a closed body design with no windshield and only the driver’s seat.

At this point, we have briefly introduced the second generation Porsche 911 model. The second-generation Porsche 911 has made many initiatives in vehicle innovation: the first-generation 911 Turbo model (930) developed on the basis of the second-generation 911 has made a great breakthrough in the performance of the 911, and the 911 Cabriolet convertible has also appeared for the first time in the 911 car series. Do you understand the relationship between the second generation 911 and 930?

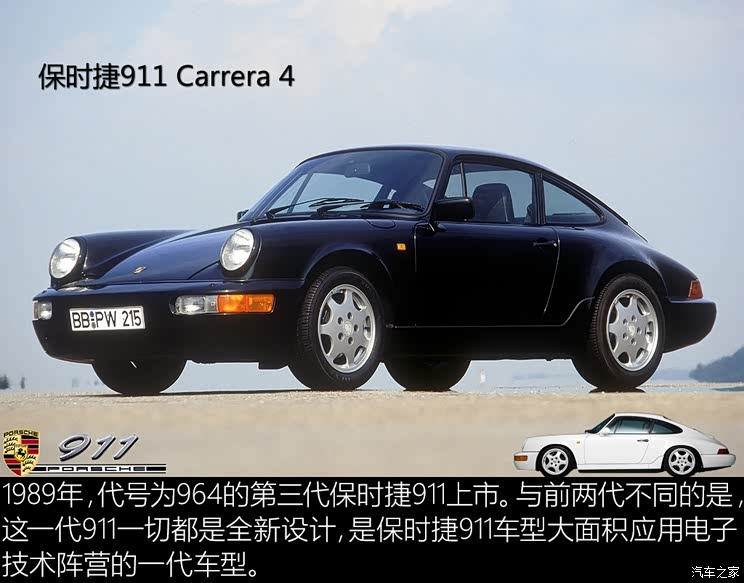

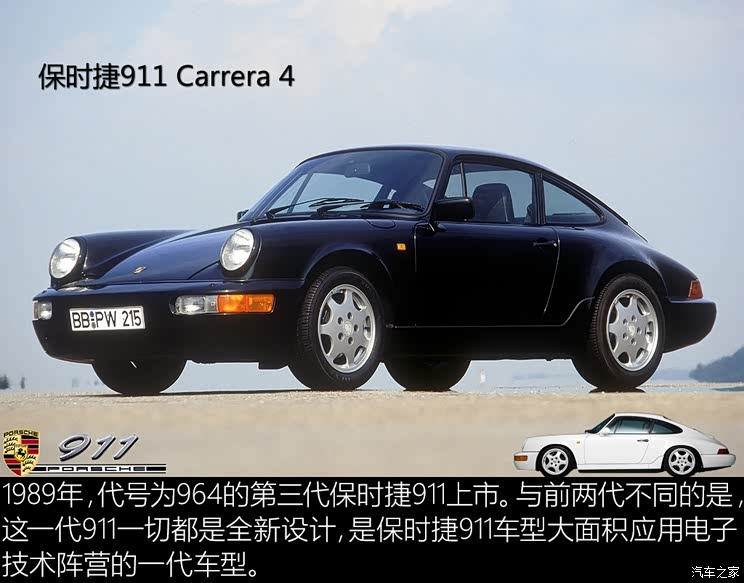

The Third Generation Porsche 911(1989-1994) Stepping into the Era of Science and Technology

The birth of the third-generation Porsche 911 marks that Porsche has entered a new era, changed its old-fashioned image and took the first step in the technological transformation of the 911 car image. Compared with the previous two generations, this generation of 911 models has a shorter production year, but the sales volume is not low, which also makes Porsche 911 successfully upgrade in the field of water testing technology and finally become a modern sports car.

Since the release of the third generation model, the intention of Porsche 911 to modernize can be seen in many aspects: the initial release model is 911 Carrera 4, a 4-wheel drive 911 model, which is unprecedented in the history of 911, and now the naming rules of 911 cars applied by Porsche Company are unified from this generation model.

In terms of technical upgrading, this generation of vehicles has done a good job: such as power steering, ABS system, Tiptronic automatic transmission (1990) and standard double airbags (1991) all appeared in Porsche 911 for the first time. When the speed is higher than 80km/h, the rear air inlet can be automatically raised by the motor to ensure better engine cooling effect and air intake efficiency. Not only in the field of science and technology, but also in terms of power, the newly upgraded 3.6 horizontally opposed 6-cylinder engine has brought 250Ps basic output power to this generation of Porsche 911 (with an acceleration of 5.9s per 100 kilometers and a maximum speed of 260km/h).

The design of the whole car is no longer decorated with a large number of chrome-plated parts, which makes the whole car look less "bling". The rounded shape makes the drag coefficient lower (Cd=0.32), the wider body and wheel track, and the bumper design with stronger overall feeling make this generation of Porsche 911 look no longer like an old car, and finally have some modern design sense.

Like the previous generation of 911 Turbo, this generation of 911 Turbo (code 965) adopts a wider track and body than the standard version, and this wide body form will also be used in the 3.8-displacement RS model. At the beginning, the new 911 Turbo still used a 3.3T turbocharged engine, but now it can release 320Ps. Two years later, the turbocharged engine based on the 3.6 engine was assembled on the car and could release 360Ps.

The retention of the 911 Targa model can actually show Porsche’s persistence in this classic convertible shape. Like the previous generation, this generation of 911 Targa can be equipped with a rear windshield made of a whole curved glass. But this kind of persistence only lasts until this generation, and there is no following. What is the next generation of Targa? It will be mentioned in the 911 model introduction on the next page.

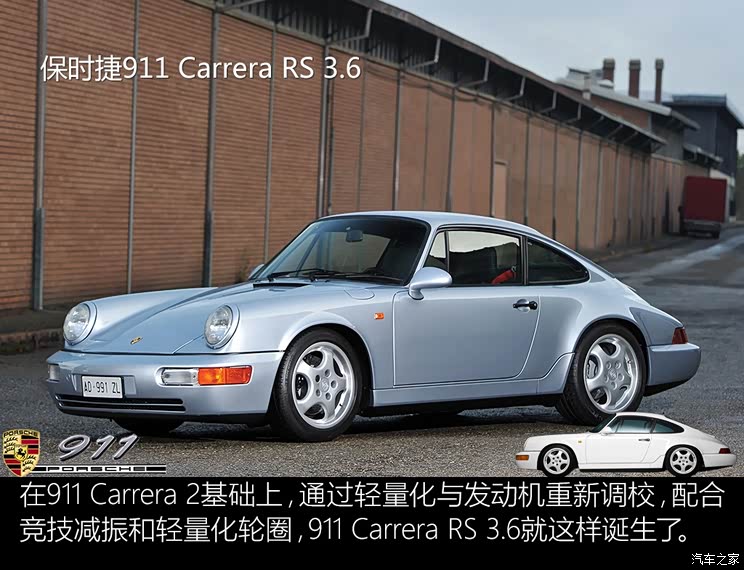

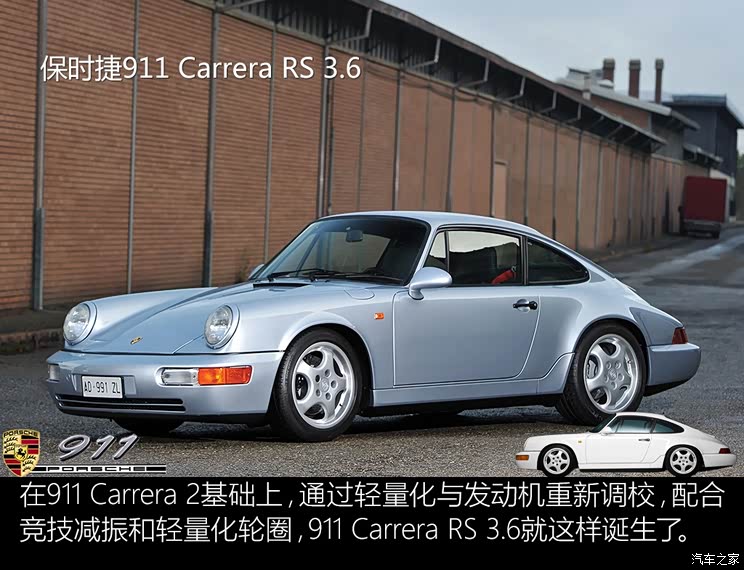

Like the first generation of RS, this generation of RS, which was born in 1991, introduced a lightweight rear-wheel drive model to meet the competitive demand. The newly changed lightweight rim has become a classic rim modeling reference style for Porsche 911 models. This car is not only the basis of the Porsche Cup car, but also a tribute to the 911 Carrera RS 2.7 and 3.0 RSR models.

However, because the 3.6-liter RS model has no obvious change compared with the standard version, the low-key appearance really makes buyers uninterested. Porsche decided to strengthen it again and developed the 911 Carrera RS 3.8 model. As you can see from the name, the displacement of this car has increased to 3.8 liters, the output power has reached 300Ps, and it has been transformed into a more competitive one: it has been replaced with a Turbo wide wheel brow body, wide tires and a more exaggerated tail. With the new competitive vibration reduction, the fighting capacity on the ground is fully demonstrated, and the performance on the field is also the same. This transformation is worthy of the name of RS.

The progress of the third-generation Porsche 911 has finally brought Porsche into line with this technology-led world. This generation of 911 initiated the first step in the history of Porsche 911′ s transformation to electronization and technology, and from then on, Porsche 911 is no longer an outdated machine that is tiring to drive, but has really become a sports car that can take care of daily use. Of course, while making progress, the classic rear drive structure remains unchanged.

The King of Air Cooling —— The Fourth Generation Porsche 911(1993-1998)

The fourth generation of 911 appeared in 1993. This generation of 911 can be regarded as a generation with great changes in appearance: the headlight design with larger inclination angle and the use of more rounded lines make it very popular in current design, and the rounded body shape and optimized body proportion make this generation of 911 the "most beautiful air-cooled 911". Of course, the most important thing is that the power and handling of this generation of 911 are outstanding.

The successful innovation of styling and the overall improvement of power level have made this generation of 911 get the evaluation of "the perfect combination of art and machinery", and this generation of 911 has also become the last generation of air-cooled engine 911 in its history. Together, these factors make this generation of Porsche 911 extremely valuable in the eyes of collectors and fans.

With the development of the times, there is still no obvious change in the interior of this generation of Porsche, but the configuration function has become much more than before, such as the optional damping adjustment suspension, which has reserved places. In addition, this generation is also the first generation of CD players.

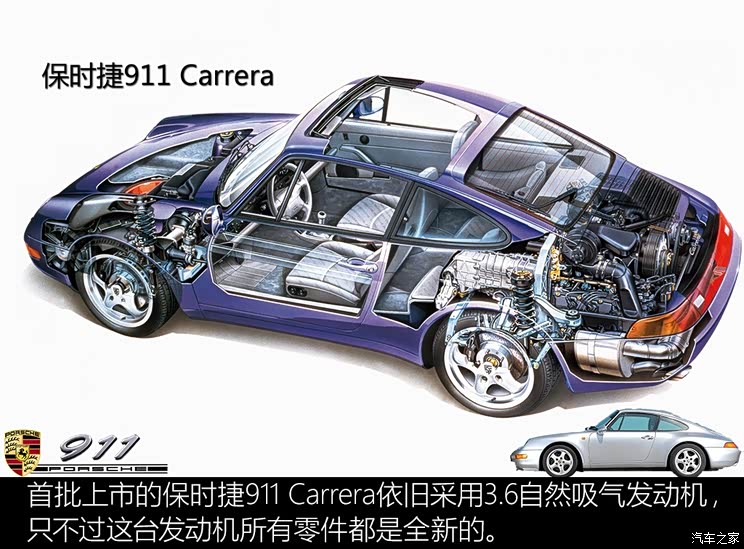

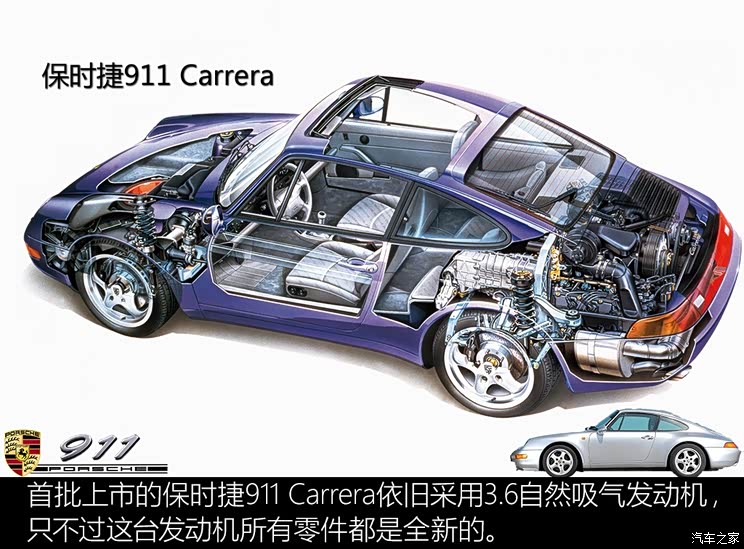

Although the displacement has not changed, this engine is brand-new, and the engine management computer (ECU) and exhaust design are optimized, and it can output 272 ps (VarioCam system was equipped in 1996, and the output power was upgraded to 286Ps, but it was followed by a high failure rate, which made many Porsche collectors more willing to buy a car before 1996), which is a great progress for a standard 911. In addition, the optimization of transmission efficiency and structural design, the application of new suspension (the rear suspension adopts multi-link structure for the first time), and the rigidity is 20% higher than that of the previous paragraph, all of which make this generation of 911 Carrera an integrated body with both aesthetic feeling and speed, and lay a good foundation for the launch of high-performance versions in the future.

In addition to the standard version of 911 Carrera, Carrera 4, Cabriolet and Targa with four-wheel drive system are also in the product line, but in this generation of 911 Targa, which was born in 1995, what we saw was no longer the classic "T-beam" design, but an openable panoramic skylight. Although this design is very futuristic and conforms to the trend of the times, this practice against the classics will inevitably disappoint many fans.

Although Targa’s new design did not achieve the expected results, it did not affect people’s enthusiasm for buying: since Targa’s classic design is gone, let’s switch to Cabriolet. Indeed, this innovative design has finally made the Cabriolet model, which was born a year earlier, a legitimate 911 convertible.

In 1995, the fourth-generation 911 Turbo was born, relying on the new 3.6-liter horizontally opposed 6-cylinder engine. By adding dual turbochargers, the data can be described as the peak: the terrible output of 400Ps and 541N·m was achieved, and the production version of 911 Turbo entered the "400-horse club" for the first time. This is not over yet. There is a higher-level version of the 911 Turbo S model in the subsequent Turbo models, and the data is as high as 424Ps. This generation is also the first 911 Turbo model equipped with a four-wheel drive system and a 6-speed manual transmission.

The powerful output depends on the powerful cooling mechanism. From the first generation of 911 Turbo, the larger and larger intercooler can be seen that in its evolutionary history, the appetite of 911 Turbo is getting bigger and bigger. Even in the 911 Turbo S model, two holes are opened on the rear wheel eyebrow to meet the higher cooling demand (911 Turbo S is only sold in North America), and this design has become a symbol in the future 911 Turbo models.

Compared with the standard model 911 Carrera without S, these two cars use the wide wheel arch body of Turbo (but have no tail) in appearance, and are equipped with new rims, larger brake discs, red calipers and sports vibration reduction, which have better sports effect and lighter weight. This car can be seen as an alternative to the previous generation 911 Carrera RS 3.6.

This generation of 911 Carrera RS has also made great efforts in weight reduction: aluminum rims and rear seat removal have made it lose a lot of weight (120kg), achieving an acceleration of 4.9s per 100 kilometers and a maximum speed of 277km/h, and a limited edition of the competitive 911 Carrera RS Clubsport version (that is, the version that replaces the old RSR model) has been launched in the future.

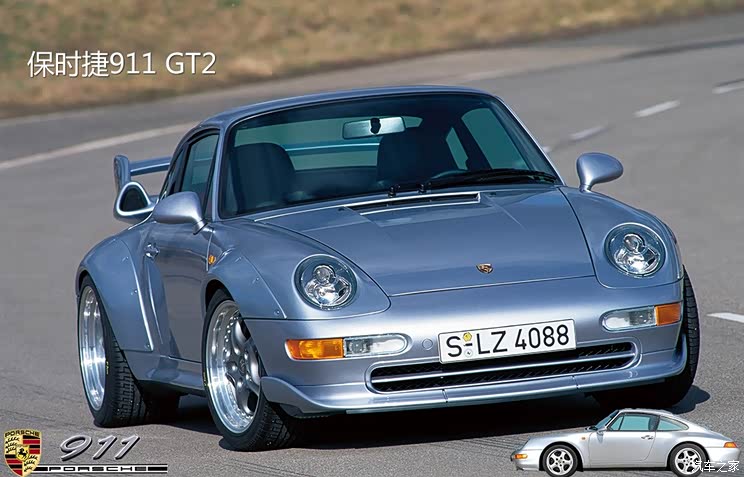

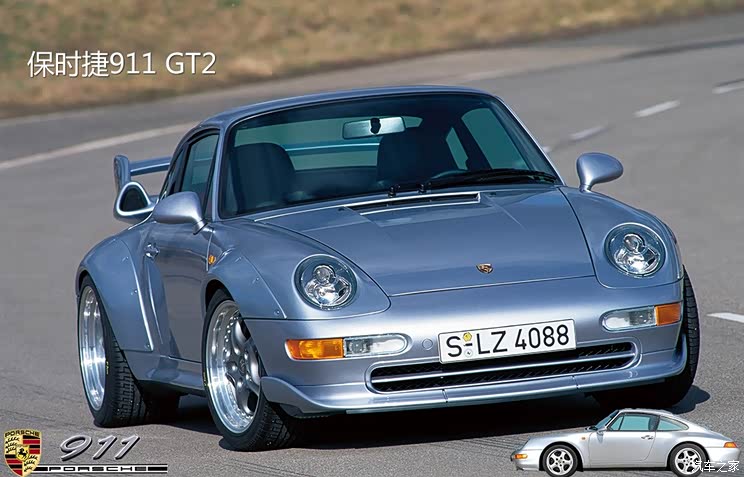

After talking about the lightweight RS version and the high-output Turbo version, this generation also produced a quasi-road racing car named 911 GT2 from 1995 to 1997. The early 911 GT2 was just a car based on the 911 Turbo, which was in line with the GT2 race group. Because of the eye-catching results, fans are very vocal about this, and Porsche decided to transform this car into a highway and go public.

The road version of the 911 GT2 is not so much an evolutionary version of the 911 Turbo as a racing car that can go on the road. The twin-turbocharged engine squeezes out 430Ps (later version 450Ps) and 586N·m, and all of them are output to the rear axle. Coupled with the highly lightweight treatment and the rivet width with racing style, the maximum speed of 4.4s and 295km/h per 100 kilometers is achieved. It was definitely the king of 911 in that year, and it was also the favorite of many fans and collectors. It was hard to find a car.

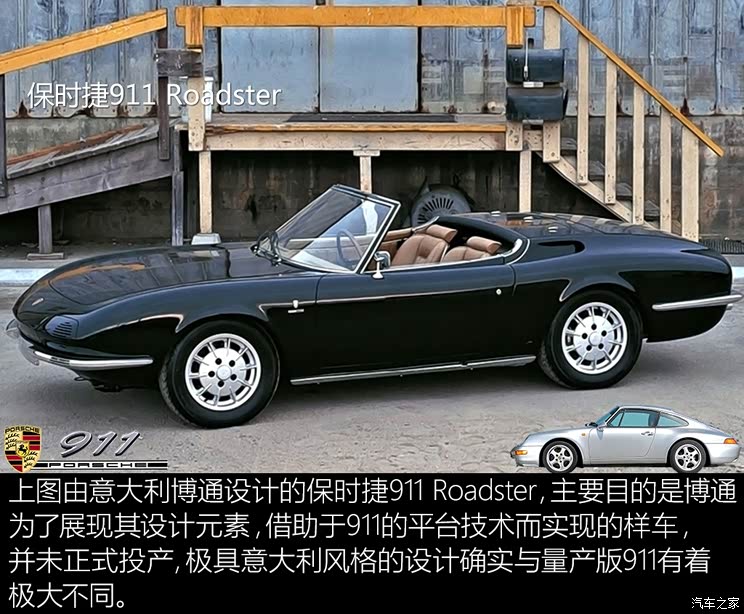

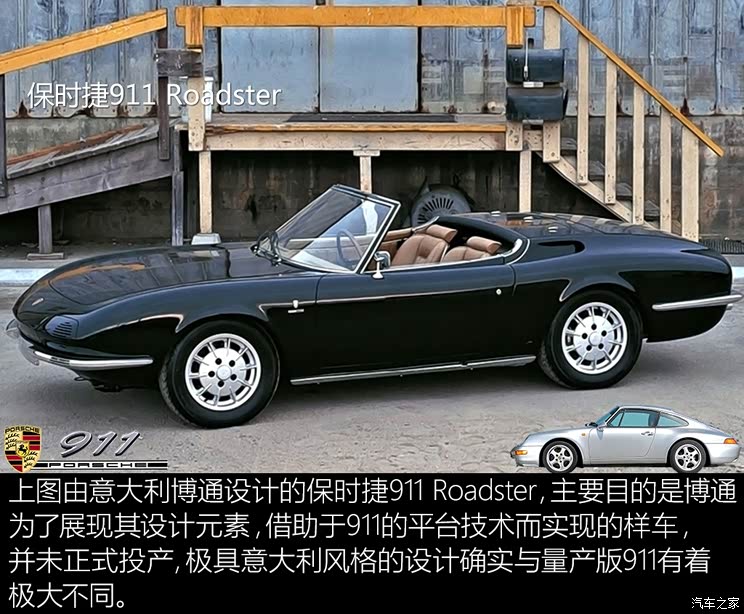

After talking about the official history, let’s look at some "eggs", which are rare to see Porsche 911:

Editor’s comment:

Conclusion:

Porsche 911 has changed from a Beetle to a world-famous sports car. From daily use to the stadium, every small improvement has contributed to its brilliant history. A driving machine of more than half a century has left a rich and colorful stroke in the baptism of years. While inheriting the classics, it is also making continuous progress and making the world remember it. (Text/Figure car home Shu Ning)

Related links:

The 10th Story Series of Porsche Logo: The Evolution History of Porsche Logo

//www.autohome.com.cn/culture/201409/843403.html

In [History of car home Cars], we reviewed the history of the first four generations of Porsche 911 with you. Their common feature is that the power system is equipped with air-cooled engines. In this article, we will continue to introduce the history of Porsche 911 with water-cooled engine from the fifth generation to the latest generation.

Opening the era of water cooling-the fifth generation Porsche 911(1997-2005)

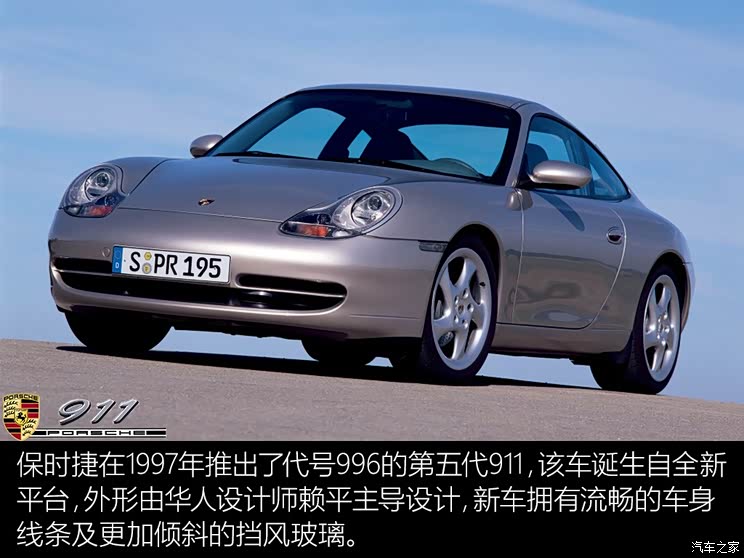

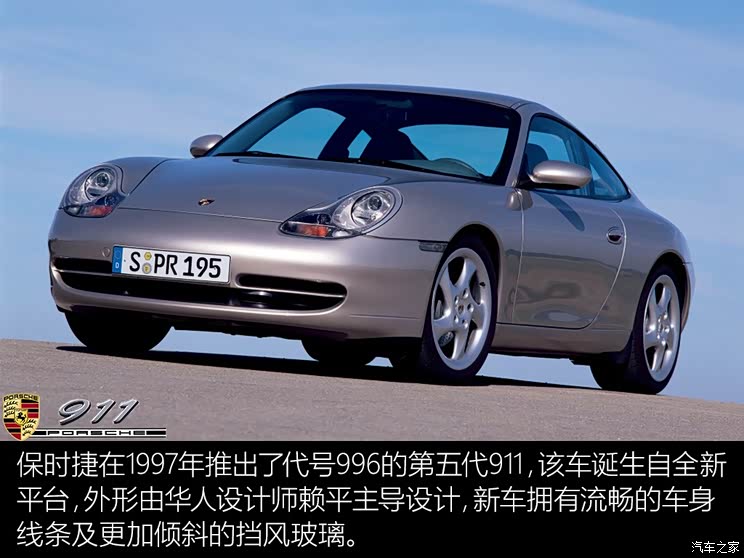

As early as 1993 ~ 1994, the fifth-generation Porsche 911 with internal code 996 had already started research and development. Unlike the previous four generations of 911 from the same platform, the fifth generation of 911 was born from a brand new platform. In September, 1997, Porsche officially released the fifth generation 911. The new car was designed by Lai Ping, a Chinese Porsche designer. The smooth body lines and the more inclined windshield made it have a low drag coefficient of 0.3.

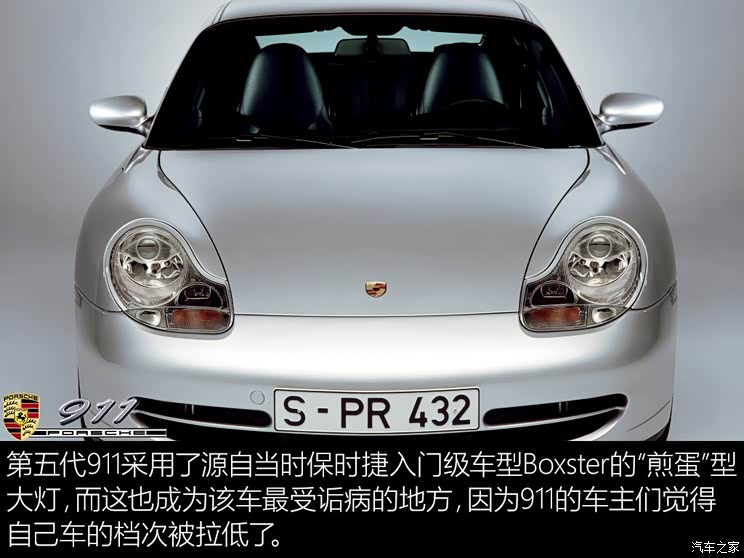

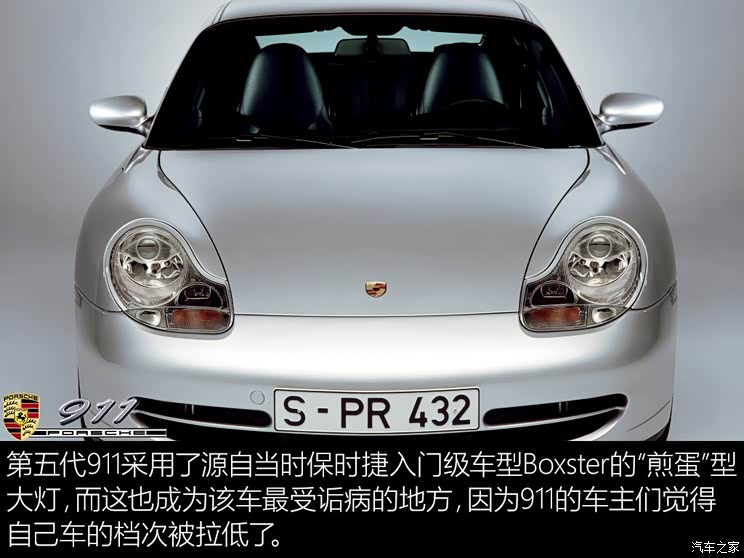

Compared with the previous model, the body size of the fifth-generation 911 has increased by one circle, and the wheelbase has also been extended by 78mm, reaching 2350mm, thus obtaining more spacious interior space. Nevertheless, the subversive changes of the fifth-generation Porsche 911 have made it difficult for fans to accept for a long time. Among them, the most criticized is the front face design. The iconic frog-eye round lamp of 911 was replaced by the "fried egg" headlights from Boxster (code 986), a Porsche entry-level model at that time, which made many 911 car owners feel that their cars were lowered.

In the interior part, the fifth-generation 911 also adopts the same style and layout as the first-generation Boxster introduced earlier. The difference is that the 911 retains the classic dashboard composed of five small dials, but the relative positions between the small dials are more compact. At the same time, the steering wheel is still in the traditional four-spoke shape, and the air outlet and buttons on the central control panel are not as flamboyant and fashionable as those on the Boxster, but appear relatively low-key and calm.

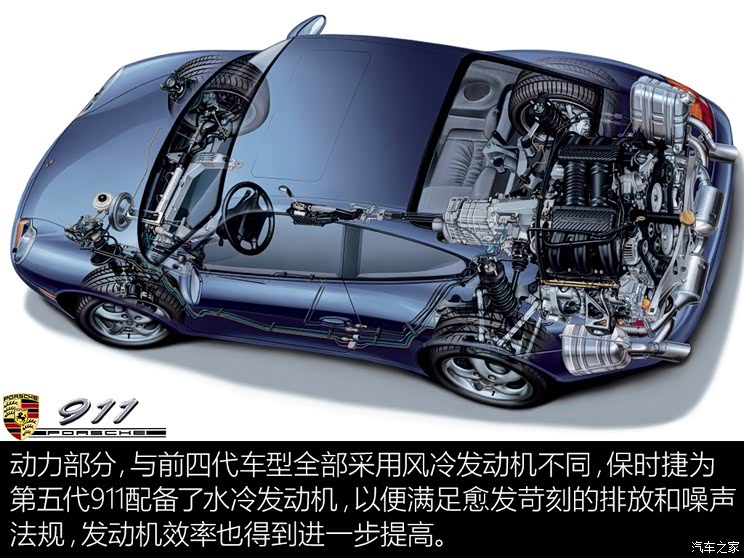

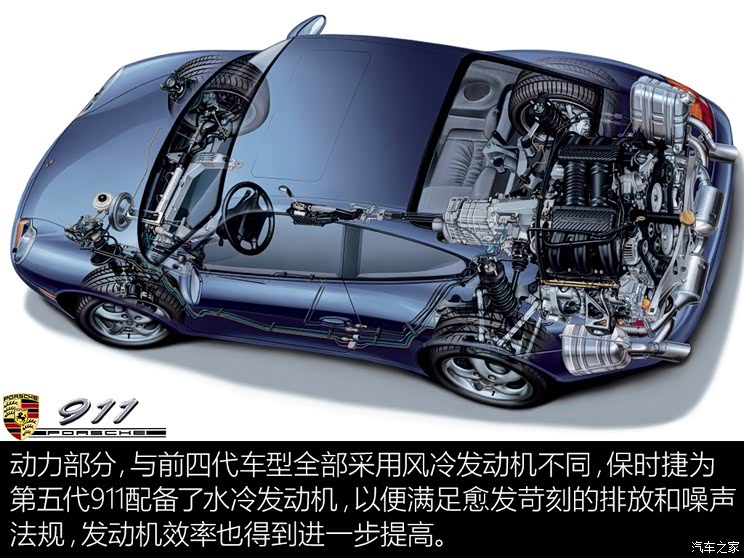

Compared with the brand-new design of appearance and interior, the most significant change of the fifth-generation model is to completely stop using the air-cooled engine of 911 series for 34 years and switch to water-cooled engine. The main reason why Porsche gave up air cooling is that the 911 series has to deal with stricter emission and noise regulations, and Porsche also hopes to further improve the efficiency of the engine.

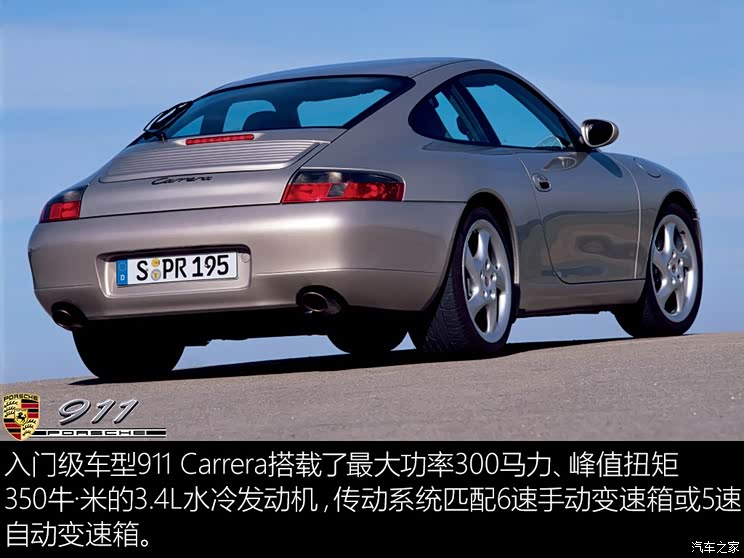

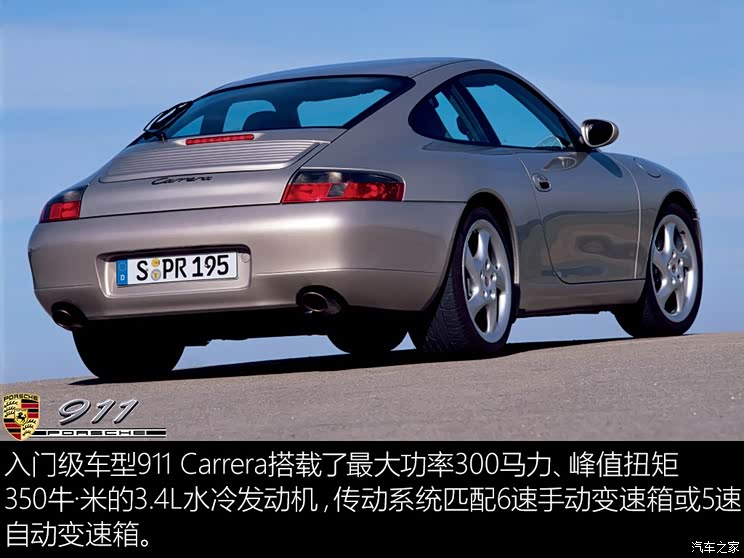

Porsche first introduced the entry-level model 911 Carrera, whose body structure is a 2-door 2+2-seat hardtop sports car, and its driving mode is rear-mounted and rear-driven. The power system of 911 Carrera is equipped with a brand-new 3.4L horizontally opposed water-cooled engine, with a maximum power of 300 HP and a peak torque of 350 Nm. The transmission system is matched with a 6-speed manual gearbox (optional Mercedes-Benz 5G-Tronic automatic gearbox), the acceleration time of 0-100km/h is 5.2 seconds, and the maximum speed is 280 km/h..

At the same time, the 911 Carrera Cabriolet with soft-top convertible design and rear-wheel drive was introduced, and then Porsche added a four-wheel drive version to the 911 series. In terms of chassis, the fifth-generation 911 adopts the former McPherson independent suspension shared with Boxster, and the latter multi-link independent suspension is derived from the previous generation 911 (code 993). In addition, it is worth mentioning that the fifth-generation 911 is also equipped with Porsche Stability Management System (PSM) for the first time, which is an electronic control system that can ensure vehicle stability and improve driving safety.

In March, 1999, Porsche released the high-performance model 911 GT3, which was based on the rear-drive version of 911 Carrera. The front bumper was redesigned and a double-layer rear spoiler was added at the rear. At the same time, the 911 GT3 has removed the rear seats and some comfort configurations for weight reduction, and the power system is equipped with a 3.6L horizontally opposed engine with a maximum power of 360 HP, which is matched with a 6-speed manual transmission. In addition, the car is also equipped with an adjustable suspension system and an upgraded braking system.

In September, 1999, Porsche released the 911 Turbo with four-wheel drive system as standard. The car adopted a brand-new aerodynamic kit, with sharper headlight group and bi-xenon headlights. When the vehicle speed exceeds 122km/h, the auxiliary spoiler on the fixed rear spoiler will automatically rise. The power system of 911 Turbo is equipped with a 3.6L horizontally opposed twin-turbo engine, which is derived from Porsche 911 GT1-98, the champion of the 24 Hours of Le Mans in 1998. It adopts variable valve timing/lift technology, with a maximum power of 420 HP and a peak torque of 563 Nm.

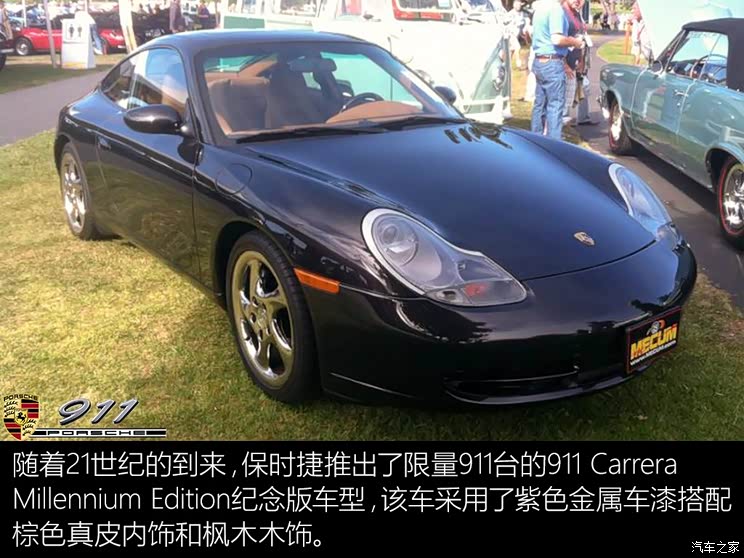

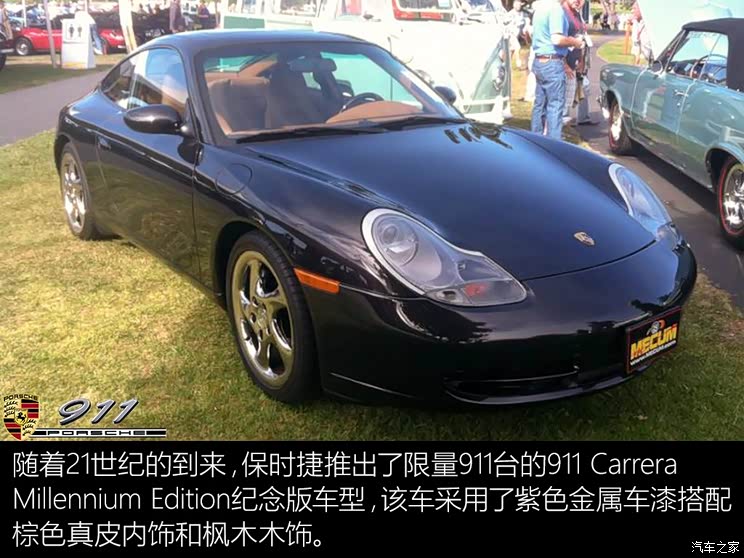

In 2000, Porsche launched the 911 Carrera Millennium Edition to celebrate the arrival of the Millennium. The car has special purple metallic paint, brown leather interior and maple wood ornaments, and it is limited to 911 sets. In 2001, Porsche introduced a more powerful 911 GT2, which uses rear-wheel drive, the aerodynamic package of the car body is more exaggerated than that of the 911 Turbo, ceramic brake discs are also standard, and the rear seats and air conditioning system are removed from the car. The power system of the 911 GT2 is equipped with a re-adjusted 3.6L horizontally opposed twin-turbo engine with a maximum power of 462 HP, matching a 6-speed manual transmission.

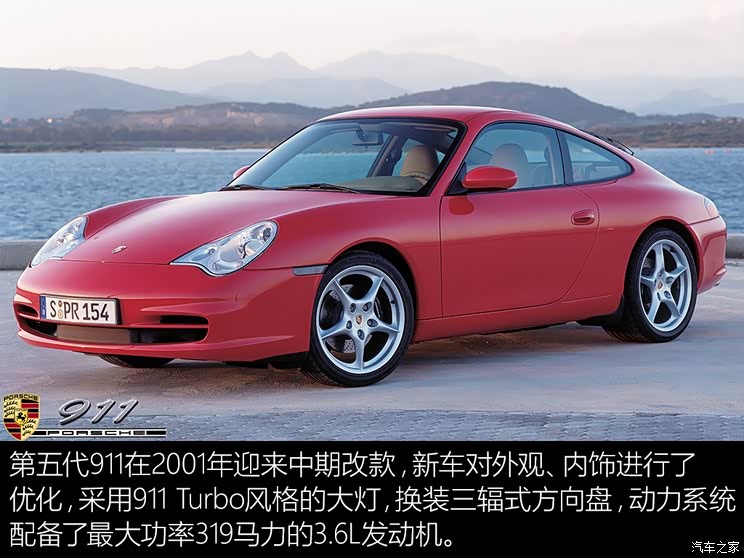

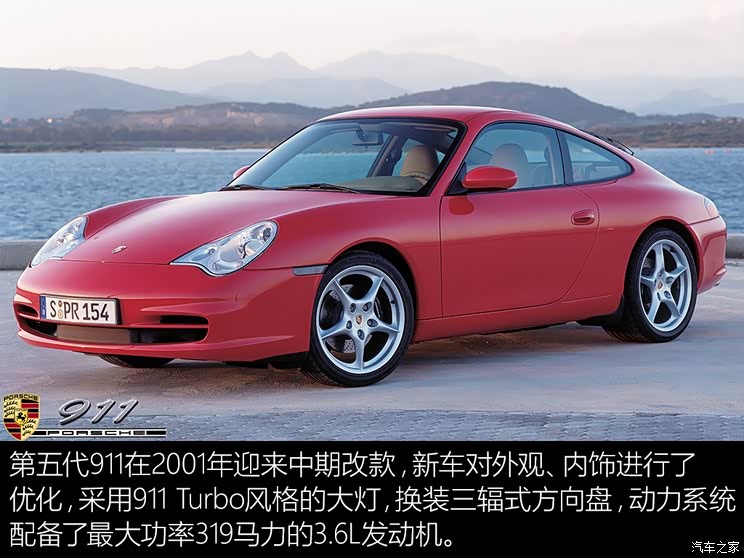

In 2001, the 911 Carrera underwent a mid-term change. First, the controversial "fried egg" headlights were replaced with the same sharp shape as the 911 Turbo. At the same time, the front safety was redesigned and the interior part was equipped with a more sporty three-spoke steering wheel. In terms of power, the 911 Carrera was replaced with a 3.6L horizontally opposed engine, and the maximum power was increased to 319 horsepower. In the same year, the fifth-generation 911 family also added the 911 Targa with semi-convertible design, and the 911 Carrera 4S with 911 Turbo appearance kit and upgraded suspension, braking and exhaust systems.

In 2002, Porsche added the "X50" power enhancement kit to the 911 Turbo, which can increase the maximum engine power by 30 HP to 450 HP. In 2003, the 911 GT3 and GT2 were redesigned, and the engine power of the two cars was increased to 380 HP and 483 HP respectively. In addition, Porsche also introduced the 911 GT3 RS, which is closer to the racing car. Its most obvious feature is the red/blue rim, the hood and rear spoiler are made of carbon fiber, and the rear window is made of plastic.

In 2003, it was the 40th anniversary of the 911 car series. For this reason, Porsche released the 911 Carrera "40 Jahre 911 ",a commemorative model with silver paint and a maximum power of 345 HP, with a limited production of 1,963 cars to commemorate the first year of 911. In 2004, the 911 series continued to introduce two new convertible models, the 911 Turbo Cabriolet and the Carrera 4S Cabriolet, providing customers with more choices. 2005 is the last year of the fifth-generation 911 life cycle. Porsche launched the ultimate version of the 911 Turbo S, which is basically equivalent to the 911 Turbo equipped with X50 suite. In addition, the car also comes standard with ceramic composite braking system. From 1997 to 2005, the fifth generation Porsche 911 produced a total of 175,262 units.

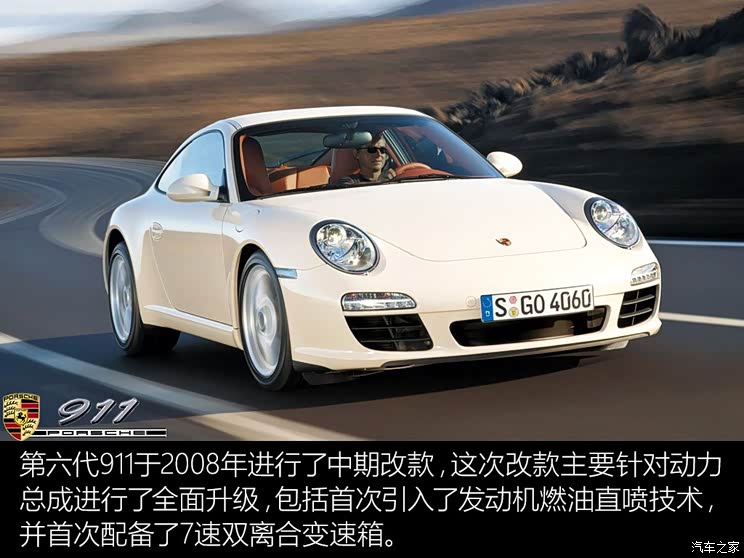

Return to Classic Round Lights —— 6th generation Porsche 911 (2004-2012)

The 6th generation Porsche 911, code-named 997, came out in 2004. The new car is equipped with oval headlights, which not only shows the classic design style of the traditional 911, but also shows a new look of the new era 911. At the same time, the body width of the sixth generation 911 is 38mm wider than that of the previous generation, while the wheelbase is still 2350mm, and the drag coefficient is further reduced to 0.28. Although it has a brand-new appearance, for the whole 911 series, the sixth generation is only an evolution rather than an innovation, because it still comes from the same platform as the fifth generation 911.

The interior design of the sixth generation 911 gives people a refreshing feeling, which is both luxurious and modern. The overall layout of the center console is regular, the functional areas are reasonably divided, and the overall sense of the central control panel is enhanced. The instrument panel still retains the classic design of five small dials, and the white characters on the black background are clear and easy to read. The three-spoke multi-function steering wheel adopts two-color matching with Porsche’s metal LOGO embedded in the middle.

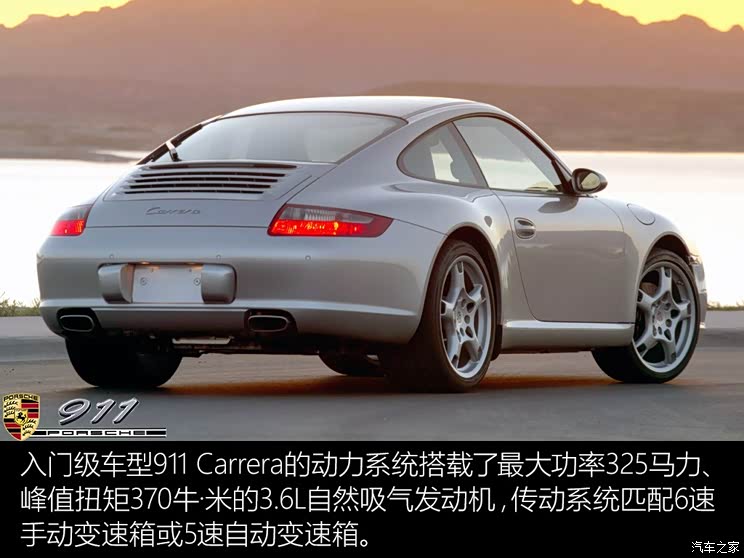

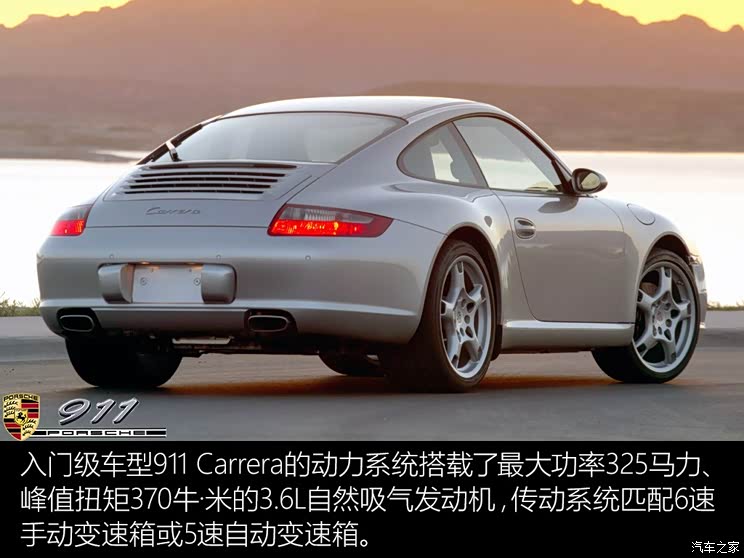

In terms of power, the entry-level coupe 911 Carrera continues to carry the 3.6L horizontally opposed engine from the previous generation (code 996). After re-adjustment, the maximum power is increased to 325 HP and the peak torque is 370 Nm. The transmission system is matched with a 6-speed manual gearbox (optional Mercedes-Benz 5G-Tronic automatic gearbox), the acceleration time is 0-100km/h for 5 seconds, and the maximum speed is 285 km/h.

This engine is also suitable for the convertible model 911 Carrera Cabriolet. Its soft top is made of new materials, and the convertible mechanism can open/close the top in 20 seconds. At the same time, the 911 Carrera S coupe is launched, which is equipped with a 3.8L horizontally opposed engine with a maximum power of 355 horsepower. In the chassis part, the sixth-generation 911 continues to adopt the structure of front McPherson independent suspension and rear multi-link independent suspension, and is also equipped with Porsche Active Suspension Management System (PASM) for the first time.

In 2005, Porsche introduced the 911 Carrera S Cabriolet, followed by the 911 Carrera 4/911 Carrera 4S with four-wheel drive. Through the multi-disc clutch, the front wheel can be distributed to 5 ~ 40% of the power output, and this version is suitable for both coupe and convertible models. In 2006, the 911 Turbo came out, and the brand-new fog lights and LED turn signals matched with the design of the large air intake to outline the unique front face shape. The rear spoiler is slightly lower than the previous generation, which has better aerodynamic performance. The power system is equipped with a 3.6L twin-turbo engine with a maximum power of 480 HP.

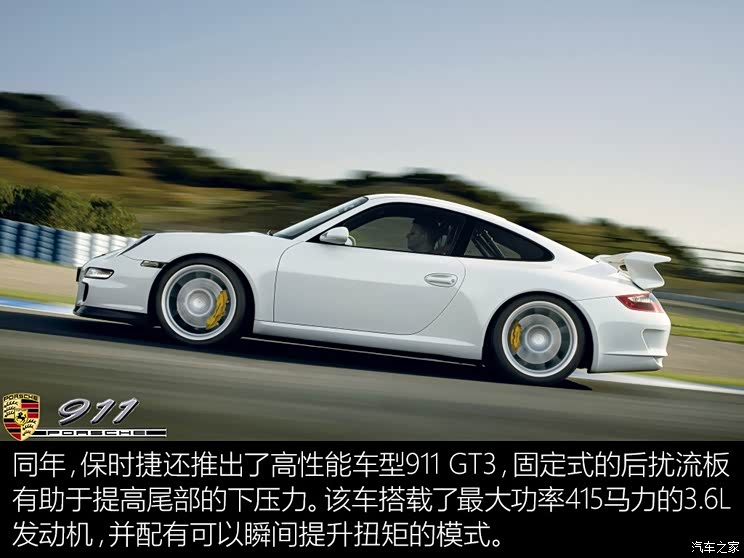

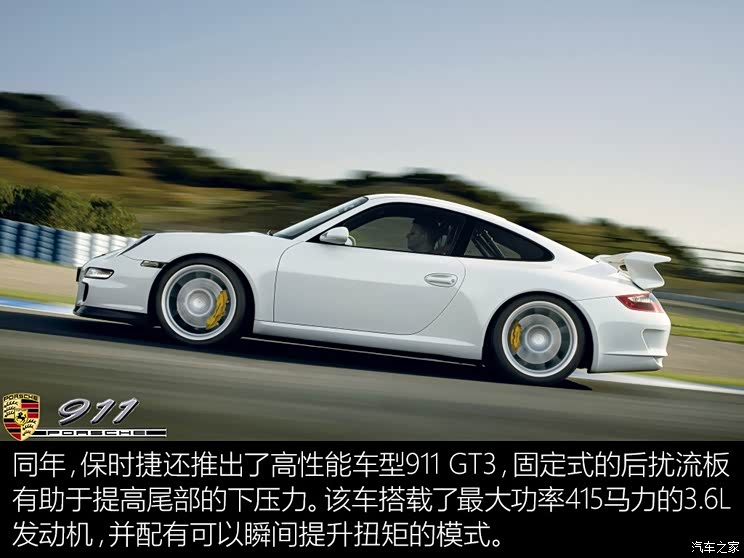

In 2006, Porsche also introduced a high-performance version of the 911 GT3, which is equipped with a fixed rear spoiler that can increase the downforce. The powertrain of the 911 GT3 is equipped with an enhanced 3.6L horizontally opposed engine with a maximum power of 415 HP. In addition, the car comes standard with Sport mode. By pressing the SPORT button, the torque output of the engine can be instantly increased by 25 Nm from 3000-4200rmp. Subsequently, the 911 GT3 RS was 44mm wider in the rear wheel position than the GT3. In addition, the whole vehicle adopted a lightweight configuration, such as the adjustable rear spoiler made of carbon fiber and a lighter plastic rear window, which made the body lose 20kg compared with the GT3.

In the same year, Porsche also introduced the 911 Targa 4 and 911 Targa 4S with semi-convertible roofs, the most notable feature of which is the large-area glass roof and folding rear window. Polished aluminum trim strips are inlaid on both sides of the roof frame, which highlights the profile of the side. In terms of power, the 3.6L horizontally opposed engine carried by Targa 4 has a maximum power of 325 HP, and the 3.8L horizontally opposed engine carried by Targa 4S has a maximum power of 355 HP.

In 2007, the convertible version of the 911 Turbo Cabriolet came out. Because of the special chassis reinforcement and the automatic extension rollover protection device installed at the back of the rear seat, the car was 70kg heavier than the 911 Turbo. In July of the same year, the sixth generation Porsche 911 has produced 100,000 vehicles, and the 100,000-th model is a red Carrera S with manual transmission. In September, Porsche introduced the more powerful 911 GT2, which is equipped with an enhanced 3.6L twin-turbo engine with a maximum power of 530 HP.

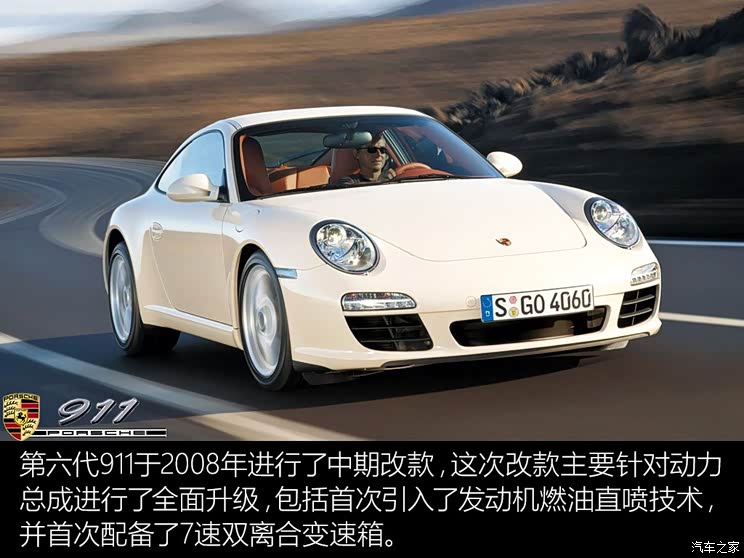

In 2008, the sixth-generation 911 underwent a mid-term change. The biggest change of the new car was the introduction of DFI direct injection technology for the first time, and the first use of ZF’s 7-speed PDK dual-clutch gearbox. The adoption of new technology has a significant effect on improving the dynamic performance of the new 911. The maximum power of the 3.6L horizontally opposed engine equipped on the 911 Carrera and other models has increased to 345 horsepower; The 911 Carrera S and other models are equipped with 3.8L horizontally opposed engine, and the maximum power is increased to 385 HP.

In 2009, the 911 GT3 and 911 GT3 RS were redesigned, and the new 3.8L horizontally opposed engine replaced the previous 3.6L model, with the maximum power of 435 HP and 450 HP respectively. In the same year, the new 911 Turbo and 911 Turbo S came out, and the power system was replaced with a new 3.8L twin-turbo engine with the maximum power of 500 HP and 530 HP respectively. In addition, Porsche also introduced the 911 Sport Classic based on Carrera S, equipped with a 3.8L horizontally opposed engine, with a maximum power of 408 HP and a limited number of 250 units.

In 2010, Porsche introduced 911 Carrera GTS and 911 Speedster, both of which were equipped with 408 horsepower 3.8L horizontally opposed engine. Among them, 911 Speedster was launched to commemorate Porsche’s first model named Speedster, 356 Speedster, with a limited edition of 356. In the same year, Porsche also introduced a 911 GT2 RS with a 620 HP 3.6L twin-turbo engine, limited to 500 units. In 2011, the 911 GT3 RS 4.0 equipped with 4.0L horizontally opposed engine came out, and the maximum power of the engine can reach 500 HP, with a limited number of 600 sets. The car also set a new Guinness World Record for braking at 300km/h-0, and the new braking record time was 6.5 seconds.

The sixth generation 911 is in China.

Porsche officially entered the China market in 2001, but Chinese people didn’t know the Porsche brand from September 11th. On the contrary, Cayenne and Panamera were more easily recognized by Chinese people. In 2005, Porsche officially introduced the sixth-generation 911 into the China market, with a price of 1.317 million. In order to meet the preferences of Chinese people, Porsche has launched models specially tailored for the China market, such as the Carrem Cup Asia Edition, which was limited to 30 cars in 2010, the 911 Edition Style, which was limited to 188 cars in 2011, and the 10th anniversary limited edition of 10 Porsche China specially built for the 10th anniversary celebration.

Replace the brand-new platform-the seventh generation Porsche 911(2011-present)

In September 2011, Porsche released the seventh generation 911 with internal code 991. The new car comes from the third brand-new platform of the 911 series and is designed by Porsche Chief Designer Michael Mauer. Compared with the previous generation, the new 911 inherits the classic roof contour and arched front fender design, but it has higher aerodynamic efficiency and smoother body lines.

The new car has widened the front wheel track and the rear spoiler that can be unfolded automatically. The wheelbase is lengthened by 100mm, the height is reduced, and the whole car is more sporty. The exterior rearview mirror has also been redesigned and installed at the top edge of the door. At the same time, the rear axle moved backward by 76mm, thus obtaining better front-rear counterweight ratio and curve performance. The new lightweight car body is also made of aluminum-steel alloy, which reduces the weight of the car body by 45kg, but greatly improves the stiffness.

The interior of the new 911 has also been redesigned, which has a typical racing style. The position of the center console is raised forward, and the position of the shift lever is also raised accordingly, which is closer to the steering wheel, making the driver and the cockpit more integrated. At the same time, Porsche’s classic elements are also very eye-catching, such as the dashboard with five circular displays (one of which is a high-resolution multi-function display) and the classic mid-tachometer.

In terms of performance, the new 911 Carrera, an entry-level model, is equipped with a 350-horsepower 3.4L horizontally opposed engine. When it is matched with a 7-speed PDK dual-clutch gearbox (a 7-speed manual gearbox can also be selected), it takes 4.6 seconds to accelerate from standstill to 100 km/h. If equipped with Sport Chrono components, the score can be further reduced to 4.4 seconds when using Sport Plus mode.

At the same time, the brand-new 911 Carrera S model was introduced, and the power system was equipped with a more powerful 3.8L horizontally opposed engine with a maximum power of 400 HP. In the chassis part, the new 911 adopts the front McPherson independent suspension and the rear multi-link independent suspension, and is equipped with an electro-mechanical power steering system with variable steering transmission ratio and steering pulse. In terms of configuration, the new 911 comes standard with bi-xenon headlights and engine start-stop technology.

In January 2012, Porsche released the new 911 Carrera Cabriolet. Its folding fabric convertible hood can be operated at the speed of less than 50km/h, and the classic 911 roof contour line is still preserved when the hood is closed, which is the first time in the half-century history of the car. In September of the same year, the new 911 car series ushered in a new member with four-wheel drive. The new car is equipped with PTM active four-wheel drive system. Compared with the previous model, the rear wheel cover is extended by 22mm, the rear tire is widened by 10mm, and the vehicle weight is reduced by 65kg.

2013 is the 50th anniversary of the 911 car series. In March, Porsche released the brand-new 911 GT3, which adopts active rear wheel steering system, and the rear axle area is widened by 44mm compared with the 911 Carrera S. At the same time, it is equipped with a large-size fixed rear spoiler, and the 3.8-liter horizontally opposed engine is strengthened, and the maximum power is increased to 475 HP. In May of the same year, Porsche introduced the new 911 Turbo and Turbo S with 3.8L twin-turbo engines. According to different adjustments, the maximum power is 520 HP and 560 HP respectively. In September, Porsche released the 50th anniversary edition of 911, with a limited production of 1,963 vehicles. In November, Porsche introduced the new 911 Turbo convertible and Turbo S convertible.

In January 2014, Porsche released the new 911 Targa 4 and 911 Targa 4S with Targa semi-convertible design. In February, after the spontaneous combustion accident of two brand-new 911 GT3s in Europe, Porsche announced the recall of all 785 delivered 911 GT3s and replaced the vehicles with new engines. In June, Porsche launched a limited edition of 80 911 Carrera Martini painted versions. In November, Porsche brought fans a brand-new 911 Carrera GTS series located between 911 Carrera S and 911 GT3, equipped with a 3.8L horizontally opposed six-cylinder engine with a maximum power of 430 HP.

In January 2015, Porsche launched the 911 Targa 4 GTS to commemorate the 50th anniversary of its birth. In March, a brand-new high-performance version of the 911 GT3 RS came out, which was equipped with a 4.0L naturally aspirated engine with a maximum power of 500 HP. In September, the seventh-generation 911 underwent a mid-term change. The biggest change of the new car was to replace the 3.4L and 3.8L naturally aspirated engines with the brand-new 3.0L twin-turbo horizontally opposed engine, and two adjustments were provided. The maximum power of the low-power version is 370 horsepower, and the maximum power of the high-power version is 420 horsepower. The new car also comes standard with an intelligent interconnection system.

In December 2015, the 911 Turbo series also introduced a new model. The 3.8L twin-turbo engine was re-adjusted, and the maximum power output of the low-power version was increased to 540 HP, and the high-power version was increased to 580 HP. At the same time, the new car also comes standard with a GT sports steering wheel with a diameter of 360mm, which is designed from 918 Spyder, with a knob that supports switching between four driving modes, and a SPORT Response button that can instantly bring a 20-second acceleration experience after being pressed.

In March 2016, Porsche launched a high-performance version of the same name to celebrate the 50th anniversary of the birth of the 911 R, with a limited sale of 991 cars. The new 911 R is based on the 911 GT3 RS, but the roll cage and rear spoiler are cancelled, which reduces the vehicle weight by 50kg. At the same time, the transmission system is replaced with a 6-speed manual gearbox, which provides drivers with the most primitive and mechanical driving pleasure.

The seventh generation 991 is in China.

The seventh generation Porsche 911 was introduced into the domestic market as an imported car in April 2012. The initial price of the entry-level model 911 Carrera was 1.476 million yuan. In 2014, Porsche lowered the official market guidance price of all 911 models, and the entry-level model 911 Carrera was reduced to 1.295 million. In addition, the price of accessories was also reduced by about 20%. It is worth mentioning that in April 2015, Porsche launched the 911 Style Edition model specially built for China market, adding Sport Chrono components, 20-inch 911 Turbo Design wheels and sports tailpipes.

More exciting videos are all on the car home video platform.

Summary:Although Porsche 911 gave up its air-cooled engine for many years, its classic body design has been passed down to this day. The new water-cooled engine, through technical innovation again and again, makes the performance of 911 more and more powerful. After the seventh generation of 911 was redesigned in mid-2015, the series has started to use turbocharged engines in an all-round way, which also indicates the beginning of a new era. (Text/car home Li Yiwen)