Yuewei Maternal and Child Letter [2020] No.12

Municipal Health Bureau (Commission) and Finance Bureau at all levels:

In order to implement the spirit of the National Comprehensive Prevention and Control Plan for Birth Defects (No.19 [2018] of the National Health Office for Women and Children) and the Healthy Guangdong Action (2019-2030), further strengthen the comprehensive prevention and control of birth defects in our province, prevent and reduce birth defects, and improve the quality of the birth population, the Management Plan for the Comprehensive Prevention and Control Project of Birth Defects in Guangdong Province (2021-2023) is hereby issued.

In case of problems in the implementation, please timely feedback to the Provincial Health and Wellness Commission and the Provincial Department of Finance.

Guangdong Provincial Health and Wellness Committee Guangdong Provincial Department of Finance

December 31, 2020

Preventing and reducing birth defects and putting life health first are important measures to improve the quality of the born population and promote the construction of a healthy China, and are the inherent requirements of adhering to the people-oriented principle and promoting sustainable economic and social development. In order to thoroughly implement the spirit of the 19th National Congress of the Communist Party of China and the National Conference on Health and Wellness, this plan is formulated according to the National Comprehensive Prevention and Control Plan for Birth Defects (Guo Wei Ban Maternal and Child Development [2018] No.19) and the Opinions of the Guangdong Provincial People’s Government on Implementing the Healthy Guangdong Action, which will guide the comprehensive prevention and control of birth defects in Guangdong Province from 2021 to 2023.

I. Project objectives

(a) the overall goal. By 2023, we will build a three-level birth defect prevention and control system covering urban and rural residents, including pre-marriage, pre-pregnancy, pregnancy, newborns and childhood, provide fair, accessible, high-quality and efficient comprehensive prevention and control services for birth defects, prevent and reduce birth defects, and improve the quality of the birth population and the health level of children.

(2) Annual targets. The awareness rate of birth defect prevention knowledge reached 80%; The screening rate of couples’ prenatal thalassemia (blood routine) reached 95%, the screening rate of maternal prenatal fetal chromosomal abnormalities and structural abnormalities reached 80%, the screening rate of neonatal hereditary metabolic diseases reached 98%, and the screening rate of neonatal hearing reached 90%. Serious birth defects such as congenital heart disease, Down syndrome, deafness, neural tube defects and thalassemia have been effectively controlled.

Second, the project tasks

(a) to carry out primary prevention and popularize knowledge of birth defects prevention. We will implement pre-marital medical examination programs, free pre-pregnancy eugenics examination programs, and supplement folic acid to prevent neural tube defects. Focusing on people of childbearing age, pre-marriage, pre-pregnancy and pregnancy health care groups, using radio and television, posters, the Internet, WeChat WeChat official account, health talks and other propaganda means, we will promote the use of the WeChat applet of Guangdong Maternal and Child Health E Manual, the platform of internet plus pregnant women’s school and parents’ school, vigorously carry out publicity and education on birth defect prevention and control knowledge, and popularize the knowledge of birth defect prevention and control.

(two) to carry out secondary prevention, reduce the birth of serious birth defects. Prenatal screening institutions and prenatal diagnosis institutions shall carry out prenatal screening and diagnosis of thalassemia, prenatal screening and diagnosis of fetal chromosomal abnormalities (including Down syndrome) and prenatal screening and diagnosis of fetal structural abnormalities, and popularize the application of appropriate prenatal screening technologies to realize that pregnant women receive prenatal screening at least once before 24 weeks of pregnancy; For high-risk pregnant women, we should guide them to receive prenatal diagnosis technical services in medical institutions with prenatal diagnosis qualifications in time; Give timely medical guidance and suggestions to the cases of severe birth defects such as severe congenital heart disease, severe open neural tube defects, Down’s syndrome and other serious fatal and disabling chromosomal diseases, severe thalassemia and other serious fatal and disabling monogenic genetic diseases, so as to reduce the birth of severe birth defects.

(3) Carry out three-level prevention to reduce the occurrence of congenital disabilities. Newborn genetic and metabolic diseases (congenital hypothyroidism, phenylketonuria, G6PD deficiency (bean disease), congenital adrenal hyperplasia and other genetic and metabolic diseases) were screened by provincial and municipal neonatal genetic and metabolic disease screening centers and blood collection institutions, and newborn hearing screening was carried out by midwifery institutions. Do a good job in follow-up, diagnosis, treatment and intervention of cases with positive retinopathy of prematurity screening and neonatal disease screening, carry out screening, diagnosis and treatment, promote early detection and treatment, and reduce the occurrence of congenital disabilities.

Third, the project population

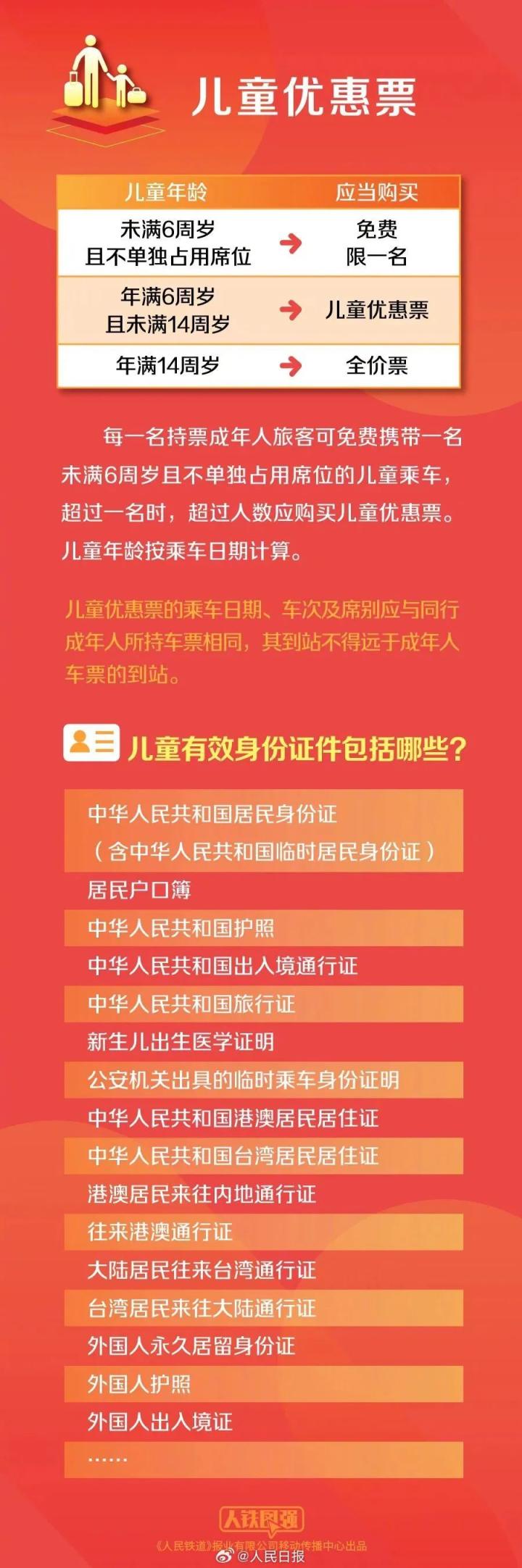

(1) Prenatal screening intervention: pregnant women with household registration in Guangdong Province (including spouses with household registration in Guangdong Province) or pregnant women with floating population with valid residence permit in Guangdong Province.

(2) Screening of neonatal diseases: newborns delivered by the above pregnant women.

Fourth, the principle of service

(1) Free screening. Those who meet the requirements (pregnant women and newborns) can receive a prenatal screening or neonatal disease screening for free. Prenatal diagnosis projects are given a fixed subsidy, and the insufficient part is voluntarily borne by the patient.

(2) Informed and voluntary. Service agencies do a good job in publicity and guidance, and the screening and diagnosis inspection items are voluntarily participated and informed by the masses.

V. Funding arrangement and management

(1) Funding arrangements.

1. From 2021 to 2023, provincial funds for comprehensive prevention and control of birth defects will be mainly used to support the screening and intervention of designated diseases of fetal and neonatal birth defects in economically underdeveloped areas, as well as the project management of provincial birth defect prevention and control management centers and city and county intervention centers. Conditional areas can be combined with local conditions, adopt new technologies and methods, and increase the free screening of diseases, and the required new funds will be solved by local finance.

2. The project of supplementing folic acid to prevent neural tube defects, free pre-pregnancy eugenics health examination and eliminating mother-to-child transmission of AIDS, syphilis and hepatitis B shall be implemented according to the corresponding plan and solved by the existing funding channels.

3. The funds needed for the implementation of the project in the Pearl River Delta region shall be solved by local finance.

(2) Subsidies from suppliers.

The financial subsidy funds are allocated to the provincial, city and county birth defect prevention and control management (intervention) centers. The standard is: 5.1 million yuan at the provincial level, which is used for the management of birth defect prevention and control projects, personnel training, health education, information system construction and maintenance, quality control, etc. 120,000 at the municipal level and 90,000 at the county level, mainly used for business backbone training, supervision and evaluation, quality control, information management, publicity and education, management exchange, etc.

(3) Subsidies from the demand side.

one.Demand side subsidy content.

(1) Eligible pregnant women can get free prenatal screening and fixed prenatal diagnosis for thalassemia and other serious fatal and disabling monogenic genetic diseases, Down syndrome and other serious fatal and disabling chromosomal abnormalities, anencephaly, encephalocele, open spina bifida, visceral eversion of chest and abdomen wall defect, monocentricular heart and fatal cartilaginous dysplasia. Grant 16 inspection items, including:

① A re-screening of hemoglobin electrophoresis and gene detection for thalassemia (both husband and wife);

② First trimester (11-13)+6Week) or second trimester (15-20+6Weeks) serological screening for Down syndrome;

③ First trimester (11-13)+6Weeks) ultrasonic screening for severe fatal and disabling structural deformities (including NT);

④ One ultrasound screening (level II prenatal ultrasound examination) for severe fatal and disabling structural malformation in the second trimester (18-24 weeks);

⑤ Prenatal screening of peripheral blood free DNA with a fixed subsidy (Tang Screen is a critical risk pregnant woman);

⑥ Prenatal diagnosis with a fixed subsidy (screening for high-risk pregnant women): genetic diagnosis (karyotype analysis, chromosome microarray analysis, genome copy number variation sequencing analysis) of high-risk pregnant women with severe thalassemia, other fatal and disabling monogenic genetic diseases, Down syndrome and other serious fatal and disabling chromosomal abnormalities, class III ultrasound prenatal diagnosis of severe fatal and disabling ultrasonic structural abnormalities, and color Doppler ultrasound examination of fetal heart with severe congenital heart disease.

(2) Eligible newborns can get free screening and re-screening for neonatal genetic metabolic diseases, neonatal hearing and retinopathy of prematurity. Grant 12 inspection items, including:

① Primary screening of congenital hypothyroidism and re-screening of those with positive primary screening;

② Primary screening of phenylketonuria and re-screening of those with positive initial screening;

③ Primary screening for G6PD deficiency and re-screening for those with positive primary screening;

④ Primary screening of congenital adrenal hyperplasia and re-screening of those with positive primary screening;

⑤ Primary screening of hearing screening and re-screening of those with positive primary screening;

⑥ Primary screening of retinopathy of prematurity and re-screening of those with positive primary screening;

2.Demand-side subsidy standard.

Finance at all levels shall pre-allocate the subsidy funds of the demander according to the standard of 620 yuan for pregnant women/fetuses and newborns of 214 yuan/case, and settle the accounts according to the actual number of cases completed by each inspection item and the financial settlement standard. Pre-allocation and settlement shall be made according to the principle of 6: 2: 2 sharing of subsidy funds of provincial, municipal and county finance (see Annex 1).

(4) Requirements for fund management.

one.According to the actual settlement:Finance at all levels shall pre-allocate annual funds according to the annual target population (see Annex 2), and settle accounts in the following years according to the actual number of completed cases registered in the provincial maternal and child health information platform and the provincial financial settlement standards. The designated service institutions shall settle the subsidies in the previous month before 30 days of each month by the actual number of cases registered in the provincial maternal and child health information platform.

2.Graded settlement:Each prefecture-level city, in combination with the actual situation, formulates the local demand-side subsidy measures with reference to the provincial demand-side subsidy scope, and clarifies the project fund allocation and settlement methods. All localities can adopt "grading settlement", that is, municipal designated institutions are settled by the municipal level, and county-level designated institutions are settled by the county level. For the prenatal diagnosis and neonatal genetic and metabolic disease screening projects that need to be completed in medical institutions at or above the municipal level, each project city can directly allocate the funds of the demand side of the project to the corresponding institutions and settle in full according to the financial settlement standards.

three.Local relief:The designated service institutions can directly implement the screening and diagnosis of the target population in accordance with the corresponding link stage, and obtain the relief at this stage. The designated service institutions will reduce the quota on the spot, according to the rules and facts. Projects that have been reimbursed through medical insurance are no longer included in the scope of financial subsidies.

four.Earmarking:Project subsidy funds must be earmarked and accounted for in special accounts, in which the demand side subsidy is accounted for as medical business income and the supply side subsidy is accounted for as financial subsidy income. No unit or individual may intercept, misuse or misappropriate special subsidy funds. Belong to the "People’s Republic of China (PRC) government procurement law" and the relevant provisions of the provincial government procurement management, must be strictly implemented in accordance with the government procurement system.

VI. Organizing implementation

(1) Project management. The provincial birth defect prevention and control management center (located in the provincial maternal and child health hospital) and the city and county birth defect intervention center (located in the city and county maternal and child health hospital) are responsible for the comprehensive prevention and control project management of birth defects.

one.Provincial birth defect prevention and control management center.Mainly perform the following duties: promote the implementation of birth defect prevention and control projects in the province, organize talent training, technical evaluation, business guidance, supervision and management and health education and publicity for birth defect prevention and control; Organize the implementation of quality control of birth defects prevention and control; Organize the collection, collation, analysis, reporting and related information management of birth defects prevention and control data, and gradually establish and improve the routine monitoring data collection and analysis system for the implementation of birth defects prevention and control projects on the basis of the provincial maternal and child health information platform, so as to monitor, analyze and evaluate the implementation effect of the projects in a timely and scientific manner; Co-ordinate the management of provincial special technical guidance centers for prenatal diagnosis, neonatal disease screening centers and other institutions, and guide the three-level prevention of birth defects such as premarital examination, prenatal eugenics examination, prenatal screening and diagnosis, and neonatal disease screening.

2.City-level comprehensive intervention centers for birth defects.Mainly perform the following duties: organize and implement the prevention and control of birth defects in the jurisdiction according to the requirements of the higher authorities, be responsible for the screening and diagnosis of birth defects in the local city, and provide professional guidance and quality control to the institutions in the jurisdiction that undertake services such as premarital examination, pre-pregnancy eugenics health examination, prenatal screening, prenatal diagnosis, laboratory detection of neonatal genetic and metabolic diseases, and neonatal hearing impairment detection. Carry out training, health education and information management of comprehensive prevention and control personnel of birth defects in the jurisdiction. Do a good job in project progress monitoring, summary and analysis, and assist in the management of project funds in this area. Strengthen the construction and standardized management of screening centers for hereditary and metabolic diseases of newborns in the city.

3. County-level comprehensive intervention center for birth defects.Mainly perform the following duties: organize and implement the prevention and control of birth defects in the jurisdiction according to the requirements of the higher authorities, be responsible for the screening of birth defects in the jurisdiction, and undertake the pre-marital examination, pre-pregnancy eugenics health examination, midwifery institutions and basic medical and health institutions’ personnel training. To carry out information statistics, report and analysis on the initial screening of birth defects, and assist in the management of project funds in this area. Establish cooperation and referral mechanisms with relevant midwifery institutions, premarital examination institutions, pre-pregnancy eugenics health examination institutions, prenatal screening institutions, prenatal diagnosis institutions, neonatal metabolic disease screening laboratories, and neonatal hearing impairment diagnosis and treatment institutions, combine birth defect monitoring with maternal and child health management, and do a good job in the referral, follow-up and intervention of high-risk pregnant women and newborns with birth defects in their jurisdictions.

(2) service agencies. All midwifery institutions, pre-pregnancy eugenics health examination institutions, prenatal screening institutions, prenatal diagnosis institutions, neonatal genetic and metabolic disease screening laboratories, and neonatal hearing impairment diagnosis and treatment institutions should jointly do a good job in the prevention and control of birth defects in accordance with their respective functions and duties, in accordance with the requirements of fixed-point service, first-visit responsibility and convenient service.

one.Fixed point service.The comprehensive prevention and control project of birth defects shall be managed territorially and completed by designated service institutions. Institutions that can provide midwifery services, maternal and child health care services in the province can apply to the local health administrative department to become the designated service institutions of the project. According to the actual situation, the local health administrative departments reasonably determine the designated service institutions, announce them to the public, implement inter-agency settlement, improve birth defect screening and diagnosis services for the clients in accordance with the service process (Annex 3), and reduce the relevant fees on the spot.

2.The first diagnosis is responsible.

(1) prenatal screening institutions and medical institutions that file during pregnancy are responsible for the implementation of free prenatal screening or referral services for pregnant women:One isSerological screening of Down syndrome and other fatal and disabling chromosomal abnormalities;The second isUltrasonic screening of severe fatal and disabling structural deformities.The third isHemoglobin electrophoresis screening of thalassemia in couples with positive blood routine.

(2) prenatal diagnosis institutions, responsible for the implementation of prenatal diagnosis of birth defects (high-risk couples) gene prenatal diagnosis or ultrasound prenatal diagnosis services.

(3) delivery institutions, responsible for the implementation of free screening or referral services for neonatal diseases:One isHeel blood blood film collection of neonatal hereditary metabolic diseases;The second isHearing screening;The third isScreening for retinopathy of prematurity.

(4) The municipal screening center for neonatal genetic and metabolic diseases: responsible for the implementation of the screening organization, laboratory testing, recall of positive cases, follow-up and treatment of neonatal genetic and metabolic diseases in the city. For specific requirements, see the working guidelines of the screening center for neonatal genetic and metabolic diseases (Annex 4).

three.Convenience service.

(1) Designated service institutions in various cities should simplify the subsidy service process, establish a screening green channel, and provide on-site free screening and diagnosis services for eligible pregnant couples and newborns. Clients can confirm their identities through the Guangdong Maternal and Child Health Information Platform (hereinafter referred to as the provincial platform) and the WeChat applet of the Guangdong Maternal and Child Health E-Manual, and reduce fees on the spot in the whole city for the convenience of the masses.

(2) Designated service institutions should strictly follow the technical route of the birth defect prevention and control project, and the screening and diagnosis of the target population at the stage of corresponding links can be directly included from the stage of conformity, so as to obtain relief and improve efficiency.

(3) Information management.

Designated institutions shall, in accordance with the requirements of the Notice of the Office of Guangdong Provincial Health and Wellness Committee on Printing and Distributing the Work Plan of Guangdong Maternal and Child Health Information Platform (Guangdong Health Office Maternal and Child Letter [2020] No.3), fully launch and apply the Guangdong Maternal and Child Health Information Platform (hereinafter referred to as the provincial platform), set up pre-marital medical examination, pre-pregnancy eugenics health examination, pregnancy files and birth defect prevention information electronic files for the masses on the provincial platform in time, and popularize and apply the "Guangdong Maternal and Child Health E Manual" WeChat. Strengthen the analysis and utilization of the data related to the information platform of maternal and child health, and leverage the "Internet+medical health" to provide people with services such as consultation and guidance, inspection and reminder, appointment for medical treatment, and inquiry of inspection and test results. Strengthen data and sample management, protect people’s privacy, and ensure information security and human genetic resources security.

one.Provincial platform filing.Each designated service institution shall arrange a special person to be responsible for logging on to the provincial platform, and when the object participates in premarital examination, pre-pregnancy eugenics examination, pregnancy examination and neonatal disease screening, it shall file a file for the object and guide the object to scan and use the "Guangdong Mother and Child Health E Manual" WeChat applet.

2.Project e-voucher:After the project target population establishes the maternity file on the provincial platform, the provincial platform will generate an electronic voucher for the birth defect project and send it to the "Guangdong Mother and Child Health E Manual" WeChat applet on the mobile phone of pregnant women. Pregnant women receive free or quota reduction services for prenatal screening, prenatal diagnosis and neonatal disease screening at designated service institutions with electronic vouchers.

three.Information input:The designated service institutions confirm the identity of the clients according to the electronic vouchers of "Guangdong e-Manual on Mother and Child Health", and reduce the fees on the spot. And in accordance with the principle of "who serves, who reports and who is responsible", the results of the birth defect prevention and inspection projects undertaken by this institution (including provincial financial subsidies, medical insurance payments or self-funded projects) will be reported (entered) to the provincial maternal and child health information platform within 3 days. The masses can check the inspection result information through the e-Manual of Mother and Child Health.

VII. Relevant requirements

(1) Strengthen organizational leadership. In order to promote the implementation of the comprehensive prevention and control project of birth defects, a provincial leading group for the prevention and control project of birth defects was established, which is responsible for major decision-making, organization, coordination, supervision and management of the project. Local health administrative departments should attach great importance to it, set up corresponding working groups, actively promote the prevention and control of birth defects into the local annual work plan, into the important content of health work, implement the local expenditure responsibility, clarify the work objectives, and ensure the smooth implementation of the project.

(2) Standardize business management. All localities should establish and improve a three-level comprehensive prevention and control service system for birth defects in strict accordance with the construction standards of the three-level comprehensive intervention center for birth defects, with maternal and child health service institutions as the main body, basic medical and health institutions as the foundation, comprehensive hospitals and medical colleges as the supplement, covering urban and rural areas, covering all stages of pregnancy, pregnancy and newborn, and do a good job in three-level prevention of birth defects such as pre-marital examination, prenatal examination, prenatal screening and diagnosis, and neonatal disease screening. Implement the responsibility of territorial management, strictly carry out the responsibility system of fixed-point service and first diagnosis, and hospitals and blood collection institutions shall not send the samples of prenatal screening, prenatal diagnosis and neonatal genetic and metabolic diseases screening to a third-party institution other than the fixed-point service institution for testing.

(3) Promote personnel training. Standardize the on-the-job training and continuing education of professionals, gradually expand the talent team for birth defect prevention and control, and continuously improve the professional level. Relying on the training network composed of the talent training base for birth defect prevention and control in the whole province and the cooperative units, a standardized and orderly training model for birth defect prevention and control is established, focusing on eugenic genetic counseling, prenatal screening and prenatal diagnosis, differential diagnosis and treatment of birth defects, etc.

(4) Strengthen quality control. Strengthen the quality management of birth defect prevention and control projects, establish a long-term mechanism of quality control and continuous improvement by means of information technology, do a good job in the quality management of the whole service process of three-level birth defect prevention and control, improve the homogenization and equalization of prevention and control services, improve the service level and consolidate the prevention and control effect.

(5) Strict performance evaluation. All localities should strengthen the assessment of the implementation of birth defect prevention and control policies, project implementation, fund management, work situation, etc., and timely summarize and promote effective practices and experiences in birth defect prevention and control. The Provincial Health and Wellness Committee will timely organize supervision and inspection of the comprehensive prevention and control of birth defects in various places and inform the progress of the work. Ensure to provide high-quality, continuous and satisfactory comprehensive services for the prevention and treatment of birth defects.

This plan will be implemented as of January 1, 2021.

Attachment: