For today’s China retail digitalization, there are still many problems to be solved urgently, which are like "fishbones" stuck in the "throat" of the growth of retail enterprises.

Author | Doudou

Editor | Pi Ye

Producer | industrialist

Bustling crowds, dazzling new year’s goods, festive Spring Festival couplets, blessings and window grilles … I don’t know when the supermarket has become a gathering place with a strong flavor of the year.

On the other hand, the Spring Festival just passed has also provided an excellent sales "stage" for retail enterprises.

A big data from multi-point DMALL shows that from the beginning of 2024 to January 12, the overall search volume of drinks increased by 48% month-on-month, and the sales volume of fresh products increased by over 30% year-on-year. The strong data corresponds to the consumer’s demand for consumption during the Spring Festival.

Up to now, it can be said that retail enterprises including Shangchao are facing the annual sales peak challenge. How can we stand out in this "competition"? Or how to better complete the promotion and then grasp the golden period? This is a problem that all retail enterprises are trying to solve.

In fact, from a larger perspective, with the changes of China’s supply chain in the current era, such as the decentralized arrangement of people and goods yards, and the trend of diversification, customization and fragmentation of time and space in consumer demand, the challenges faced by retail enterprises at present are not only from festivals, but also from daily life.

Digitalization is the fundamental way to solve these challenges. But how to digitize and what is the really effective digital transformation model for retail enterprises? Where is the node that plays the value? In the past few years, what we can see is a group of retail head enterprises’ attempts and explorations on digitalization, which include not only simple software access, but also the establishment of a series of retail middle stations including CRM, OA, CDP and COP.

However, there are still many problems that need to be solved urgently for the digitalization of retail industry in China today, which are like "fishbones" stuck in the "throat" of the growth of retail enterprises.

Standing at the node of 2024, we try to take stock and observe where the digitalization of retail enterprises in China has gone. Where will its next trend go? And is the current market an opportunity or a challenge for enterprises and service providers?

First, the invisible "thorn"

In a second-tier city, a small and medium-sized supermarket chain named "Hui Life" has increasingly felt the ceiling limit of revenue brought by the traditional model in the long-term development, and decisively tried to make a breakthrough in digital transformation.

But this is not an easy thing.

The most obvious problem is that, when the specific solution comes to the ground, because of its small scale, backward IT infrastructure and weak digital skills of employees, "Hui Life" can’t effectively connect with and make full use of the complex system provided by the digital service provider.

Although the solution is powerful, the high implementation cost and follow-up maintenance cost are beyond the budget of "Hui Life" supermarket. And the internal business process of "Hui Life" is relatively simple, and the standardization system of this scheme has not been customized for its special needs, resulting in some functional redundancy, but the core pain points have not been solved.

In addition, employees of "Hui Life" have a low acceptance of new technologies, and it is difficult to master new digital tools in a short time, which makes the utilization rate of the new system not high and the effect is not ideal.

The end result is that although service providers provide industry-leading solutions, it is not the best solution for small retail enterprises like Hui Life. What they need is a digital service that is more suitable for their actual situation, easy to implement and has a high cost performance.

One current situation is that the development of retail digitalization has now gone deep into the bone marrow, and the solutions provided by many digital service providers have covered all aspects from supply chain optimization, omni-channel integration to customer relationship management.

For example, in the refined marketing, SaaS service providers such as Youzan and Weimeng help enterprises to collect, integrate and analyze membership data by providing applet mall, membership management system and marketing automation tools, so as to realize accurate marketing and personalized service.

For example, in the CRM stage, service providers such as SalesEasy can provide more comprehensive CRM solutions for enterprises. Achieve all-round management of customer relations, from potential customer mining, sales follow-up, contract management to after-sales service, and comprehensively improve the sales efficiency and customer satisfaction of enterprises.

Another example is enterprises like Tencent Enterprise Point, which can accurately grasp customer needs through data analysis capabilities and provide personalized marketing solutions for enterprises. Connect with CRM, ERP and other enterprise application systems to form a complete enterprise digital ecosystem, which helps enterprises improve work efficiency and reduce operating costs.

When we look at it, we can see that many digital service providers are constantly trying to solve the problem of digital transformation of retail industry and solve special problems in all aspects of retail digitalization (marketing acquisition, supply chain distribution, local retail, etc.). However, as the first case shows, not all retail digital solutions in the current market meet the actual needs of retailers, and not all retailers can find their own solutions.

In a survey of global enterprises, IDC pointed out that on average, less than half (about 40%-50%) of enterprises’ investment can be transformed into visible business results when they are undergoing digital transformation. This means that a large part of digital investment did not immediately produce the ideal return.

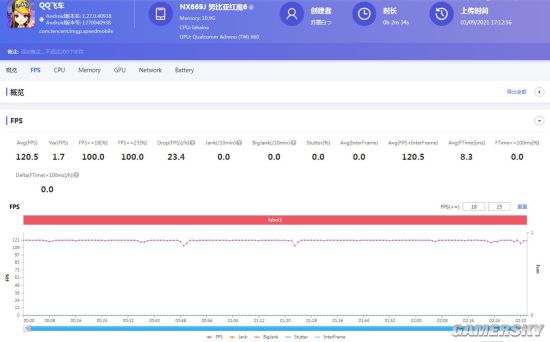

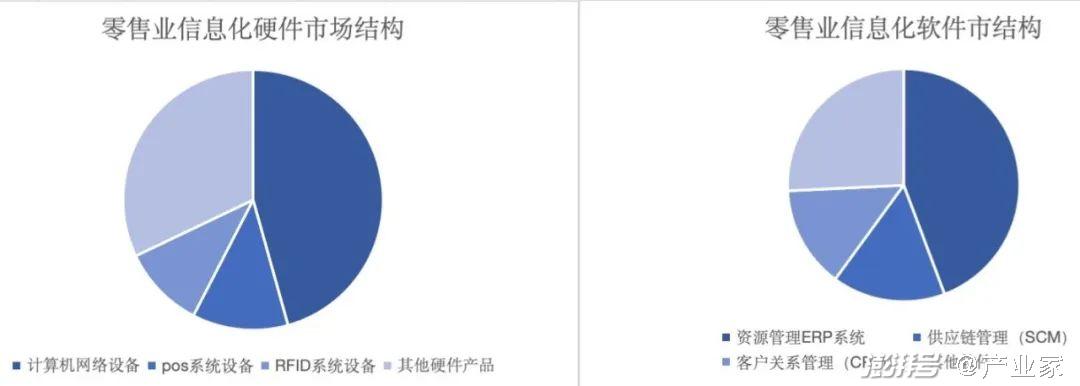

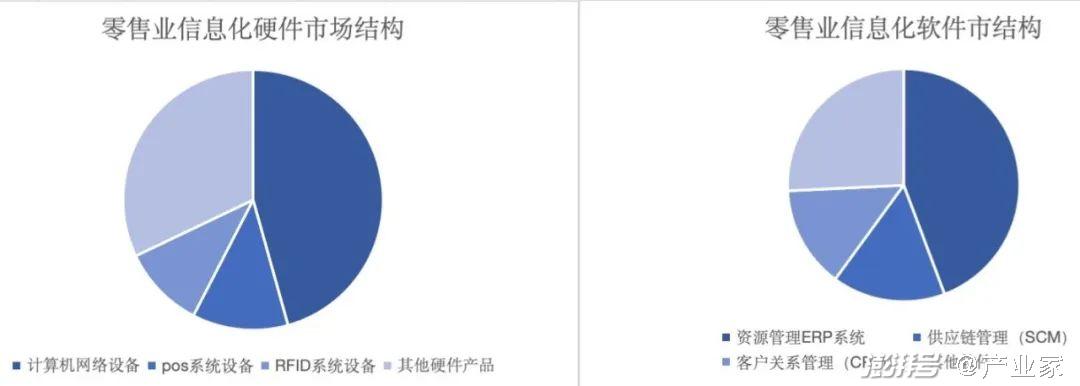

The same is true in the retail sector. From the perspective of retail information hardware market structure, computer network equipment accounts for the most, accounting for 45.67%, followed by pos system equipment, accounting for 11.92%, RFID system equipment, accounting for 10.33%, and other hardware products accounting for 32.08%. From the retail information software market, resource management ERP system accounts for the most, accounting for 44.27%, followed by supply chain management (SCM) accounting for 15.78%, customer relationship management (CRM) accounting for 14.18% and other software accounting for 25.77%.

Source: Zhiyan Consulting

The high proportion reflects the large demand, and the transformation of retail enterprises needs to invest a lot of money from the beginning. This makes retail enterprises often fall into confusion and uncertainty when choosing digital solutions.

These problems have gradually become an imperceptible "thorn" for retail enterprises and digital manufacturers. Behind it, the greater inducement comes from the complexity of the retail industry.

That is, different retail enterprises have different business models, scales and demand levels, which makes it difficult to have a "universal" digital solution in the market. That is, the digitalization of the retail industry is not as simple as buying a few software and hardware from offline to online. It is necessary to "prescribe the right medicine."

Second, retail digitalization, "unable to copy"

Retail has always been a very complicated industry.

Retail industry includes many sub-fields, such as clothing, electronic products, food, cosmetics, etc. Each field has its own specific product characteristics, supply chain management, sales strategy and customer experience. This diversity of tracks and links requires retail solutions to be flexible enough to meet the specific needs of different fields.

In addition, in addition to diversity, there are regional characteristics. That is, there may be significant differences in consumer demand, consumption habits and purchasing behavior in different regions. Therefore, retail solutions need to consider regional differences and be able to adapt to specific market environments in different regions.

In addition to these environmental factors, in the current digital age, the retail industry is destined to be a rapidly changing industry, with rapid changes in market demand and consumer behavior. Therefore, the retail solution needs to be real-time and can quickly respond to market changes and changes in consumer demand.

In addition, modern consumers pay more and more attention to personalized needs and experiences, and they hope to obtain customized products and services. Retail solutions need more personalized features to meet the specific needs of consumers.

This also makes the problems faced by retail enterprises in digital transformation more complicated.

The digitalization of any industry is inseparable from physical equipment and technical facilities. In the retail field, POS (point of sale) systems, self-checkout machines, intelligent shelves, RFID tags and readers, electronic price tags, mobile payment terminals, Internet of Things devices, etc. are the infrastructure of retail digitalization. However, different from other industries, the problems of high hardware investment cost, difficult maintenance and data security risk in retail industry are becoming more and more obvious and complicated.

In order to better contact with consumers, the transformation and upgrading of online and offline retail channels is also a necessary step. For example, through physical stores, official websites, e-commerce platforms, social media, own apps, small programs and other ways to reach consumers.

In this process, enterprises need to integrate scattered data sources, so as to improve cross-channel marketing effect and customer management efficiency. However, it is difficult to get through data between multiple systems, and online and offline data fusion and precision marketing have always been a problem. Therefore, the consistency of multi-channel services is not high and the customer experience is uneven.

In this process, retailers need to integrate scattered data sources based on ERP, CRM and other management systems under the premise of ensuring customer privacy, so as to improve cross-channel marketing effect and customer management efficiency. This is not an easy task.

Member management is also a crucial step in the process of retail digital transformation. At present, enterprises mainly collect and analyze consumer data through CRM system, and implement personalized marketing and services. However, in this process, the online membership, the opening of online and offline membership management system, and the distribution of benefits after the opening of online and offline membership systems need to be solved urgently.

From now on, behind many successful cases of membership management and precision marketing, there are still the voices of "harassing" marketing and big data killing, which constantly plague consumers and retail enterprises. For retail enterprises, not only high-quality user data is needed, but also privacy needs to be protected. At the same time, customers’ needs are accurately positioned and personalized services and offers are provided. These requirements make it difficult for enterprises to find suitable solutions.

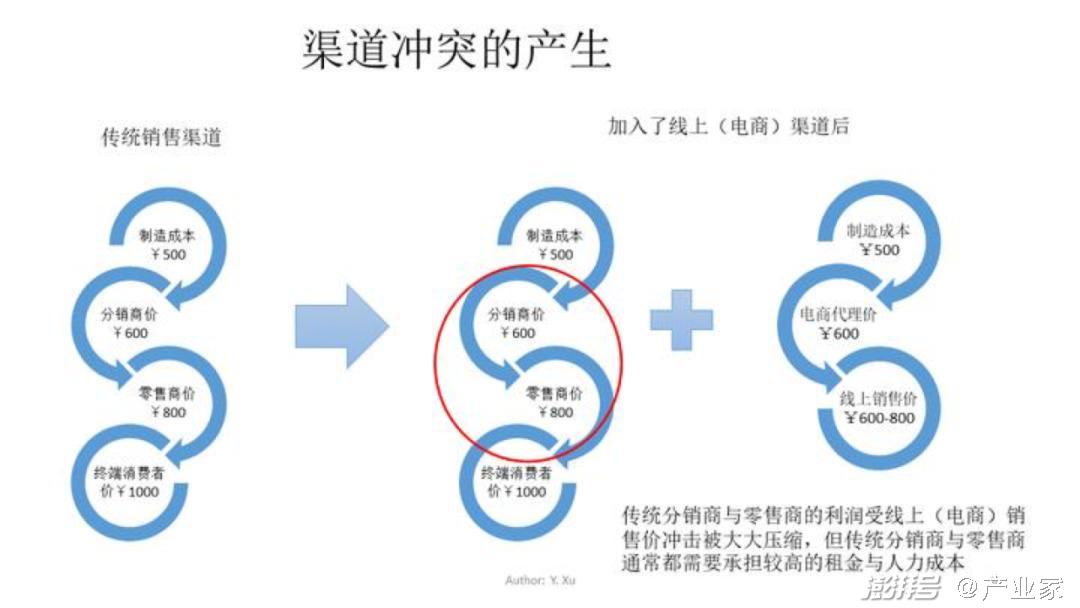

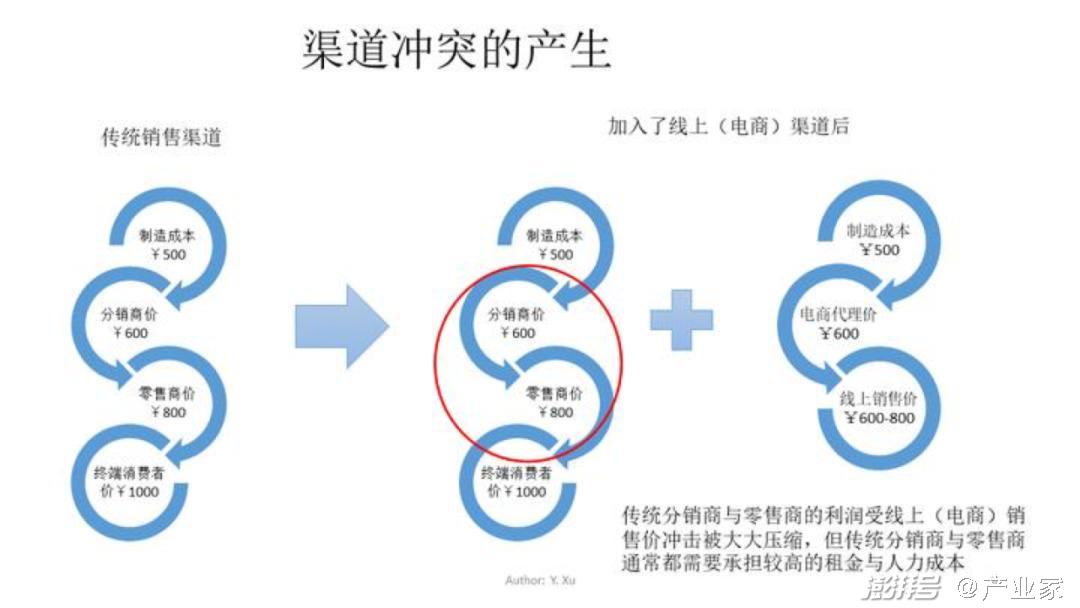

There are also online and offline distribution links. The combination of online and offline means to ensure that products can circulate smoothly and respond to market demand quickly, whether in physical stores or e-commerce platforms. The pain lies in the difficulty of inventory sharing and real-time synchronization, the optimization of logistics distribution network, the efficiency and accuracy of order processing, and how to balance online and offline price strategies to avoid channel conflicts.

In fact, behind these problems, they are inseparable from the supply chain. An efficient supply chain needs to connect all nodes based on software such as supplier relationship management, order processing system, warehouse management system (WMS), transportation management system (TMS), demand forecasting tools and real-time inventory monitoring, so that information flow, business flow and logistics are unimpeded. However, in the retail industry, the supply chain is more complicated because of the complex fields involved. And for the retail industry, its digital penetration rate is closely related to the digital level of various industries, which also means that the digital model of supply chain in the retail industry is more complex and three-dimensional.

In addition, there are many small and medium-sized enterprises outside large enterprises. For these small and medium-sized enterprises, most of them will face problems such as low data quality and lack of effective data analysis tools because of their low ability to pay, and it is more difficult to collect and provide valuable data statistically.

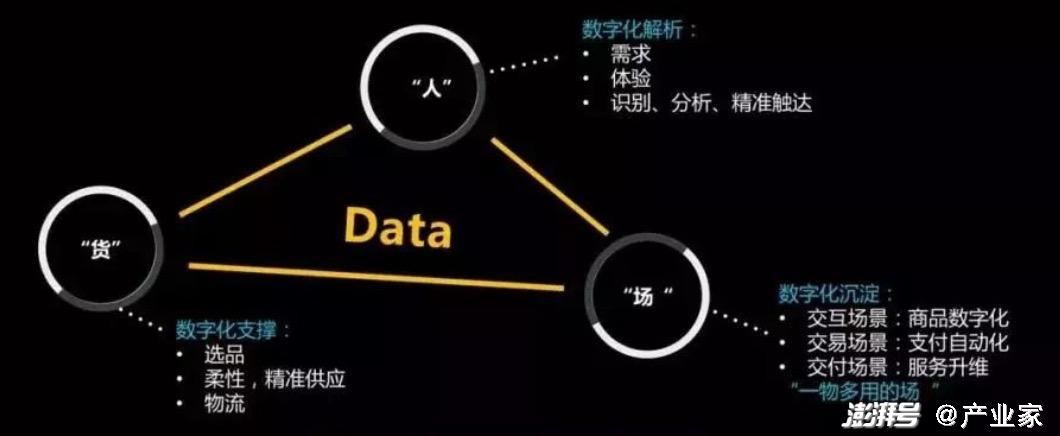

The series connection of these problems has also jointly catalyzed the difficulty in forming the modern retail supply chain model of the new "people and goods yard".

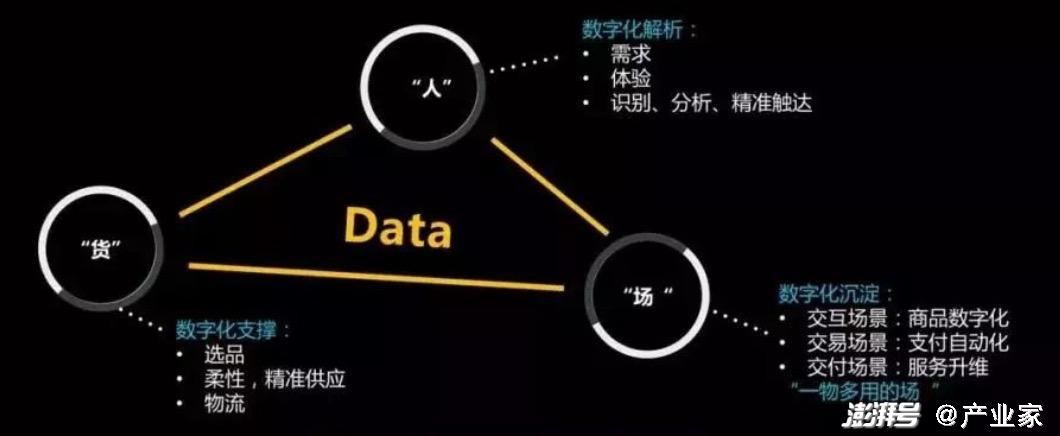

One interpretation of digital people’s goods yard is that it means adjusting commodity structure, optimizing shopping environment and providing personalized consumption experience according to consumer behavior data. However, it is difficult to collect and integrate data, which makes it impossible for enterprises to accurately grasp the dynamic needs of consumers, flexibly adjust the layout and function of "field" and quickly respond to market changes to achieve efficient matching of "people", "goods" and "field" through BI (Business Intelligence System).

The bottom foundation determines the superstructure, and many problems in the retail industry also lead to its "fear of hands and feet" when new technologies come.

In the past year, the trend of large model technology swept the world. All fields want to integrate with it and redo the track. However, the landing of a new technology also needs to be based on digitalization. At present, in the field of customer service and marketing in the retail industry, various manufacturers are constantly making efforts, but for the moment, it has not brought about real productivity changes.

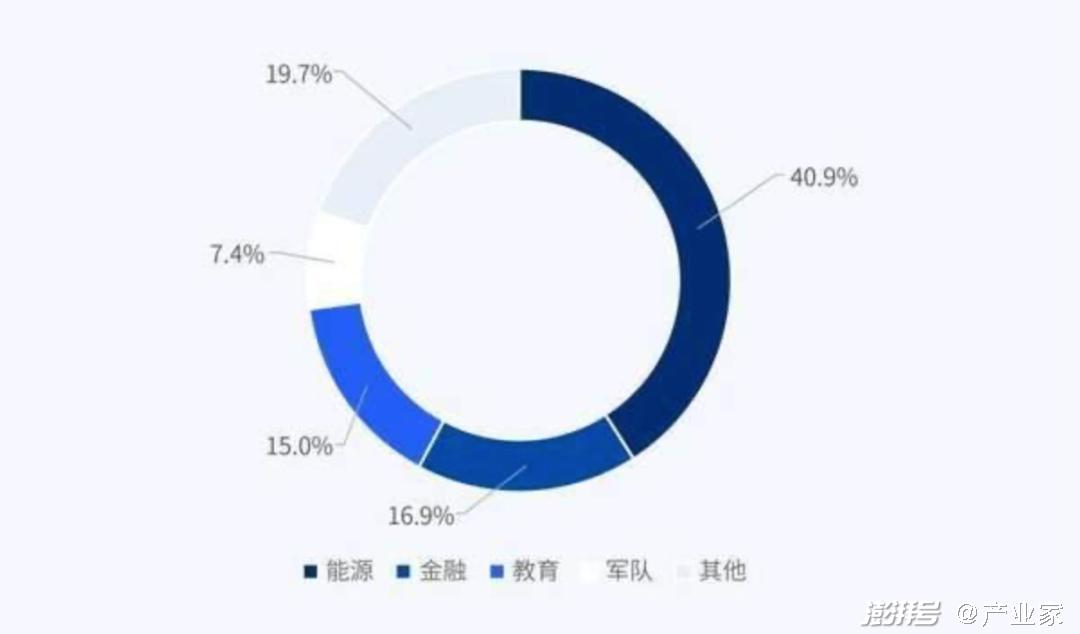

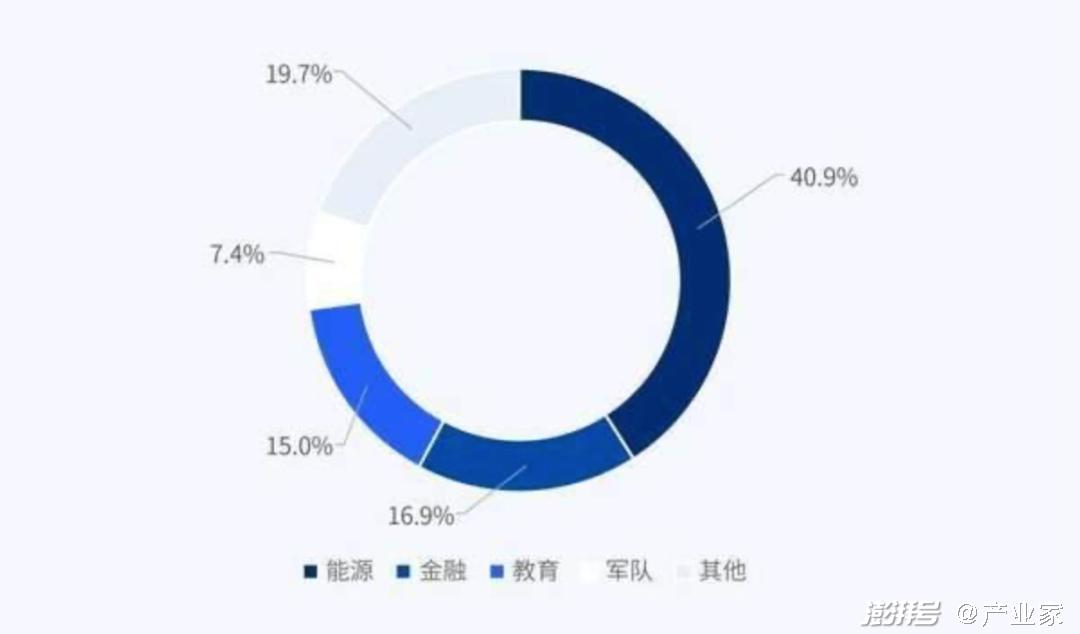

A set of data shows that there are significant differences in the landing speed of large models in various industries, and the two industries with the most active investment budget are energy and finance. The main reason is that these two industries have strong data, computing power and AI foundation. The retail industry, as the track with the most intensive consumer behavior, is not on the list.

Generally speaking, the digitalization of retail industry has many similarities with many industries, such as data collection, unpredictable cost returns, integration between systems, etc., but its difficulty is greater than that of other industries, that is, in addition to similar difficulties, the greater challenge lies in how to combine the characteristics of the industry to create solutions that meet the specificity of business processes and have efficient operation capabilities, while paying attention to the actual experience of consumers and data security, rather than simply applying the general technical architecture.

What it needs is not a general answer, but a specific answer.

Third, the "universal" retail digital scheme, pull out the "thorn"

Starbucks, in almost every busy street, will appear the figure of this enterprise. The data shows that up to now, Starbucks has a total of 38,038 stores worldwide, with more than 20,000 international stores, with a net increase of 816 new stores in the fourth quarter. Among them, there were 326 new stores in China in this quarter.

With such a large volume, the inherent operation mode of the traditional retail industry does not match the rapidly changing market environment and consumer behavior, so it is necessary to bridge this gap through digital means, so as to achieve efficient operation and sustained growth.

Starbucks’ approach is to launch the "Star Club" membership program to encourage users to register and bind mobile applications. Through this platform, Starbucks can not only integrate and analyze members’ consumption data, but also push customized offers and services according to users’ preferences. At the same time, strict privacy policy ensures the security of member information and avoids over-marketing. So as to do a good job in membership management.

In terms of channels, Starbucks online mall and offline stores cooperate with each other, and users can purchase goods or redeem points in any channel to realize O2O (online and offline integration) mode. For example, the function of online pre-ordering and picking up goods at the store breaks the service boundary of traditional stores and enhances customer stickiness.

At the same time, advanced supply chain management system is introduced to monitor inventory in real time, predict demand and optimize replenishment process. In addition, combined with big data analysis, raw material procurement and logistics are finely managed, thus reducing the impact of uncertain factors and ensuring the stable and efficient operation of the supply chain.

Starbucks uses data analysis to adjust its product mix and store layout to meet the preferences of consumers in different time periods and regions. The application of intelligent POS system and Internet of Things technology has also greatly improved the work efficiency of employees, made the service more personalized and flexible, and reconstructed the logic of people and goods yard.

It can be said that with the help of digital tools and strategies, Starbucks has effectively solved the problems of high cost of offline store renovation, complex personnel training and online and offline collaboration, and successfully realized a comprehensive digital transformation from a single physical retail to a seamless connection between online and offline.

In this case, the digital transformation of retail is not a simple online and offline integration, but a comprehensive upgrade of the entire business process, operation model and profit model.

From the case of Starbucks, it is not difficult to see that retail digitalization is different from the past. With new requirements, digital service providers also need to make changes and seize new opportunities.

Therefore, for digital service providers, it is necessary to provide all-round services and products.

First of all, we should establish a close cooperative relationship with retail enterprises, and through in-depth understanding of their business model, operational needs and scale, tailor-made digital solutions for enterprises. This can not only meet the overall needs of retail enterprises, but also avoid unnecessary waste of resources.

Secondly, in order to make it easier for retail enterprises to implement digital solutions, service providers can provide modular and customizable solutions, so that enterprises can select and adjust corresponding functional modules according to their own needs, which can not only reduce the implementation difficulty of enterprises, but also improve the adaptability of solutions. Taking Tencent Enterprise Point, Antelope and JD.COM U+ as examples, in the specific service process, their service models can now be modularized and customized according to the needs of enterprises to help them build a complete digital link.

In addition, enterprises may encounter difficulties in technology, personnel and management when implementing digital solutions. Digital service providers should provide all-round training and support services for enterprises to help them successfully survive the transition period.

In order to ensure that digital solutions can bring practical benefits to enterprises, service providers should advocate results-oriented implementation strategies and ensure that they can create value for enterprises by continuously optimizing solutions.

In a word, the future retail digital scheme should be personalized, intelligent, scene-oriented, social and ecological, so as to meet the diversified needs of consumers and help enterprises achieve sustainable development. In this context, digital service providers need to constantly innovate and provide more competitive products and services to adapt to market changes.

Only in this way can the products of digital service providers be more versatile, and the balance between supply and demand can be achieved between retail enterprises and digital service providers, and the "thorn" of digital transformation of retail industry can be removed.

"Now it is not only the marketing problem that is simply solved, nor the private domain problem, but the retail design of the whole process from CDP (data center) to BA (text analysis) and MA (marketing automation), which includes consulting, and also includes the drive from data to behavior." A person in charge of a marketing company told us.

Write at the end:

Nowadays, it is not an exaggeration to say that the digital transformation of retail enterprises has become the core factor that determines the "life and death" of enterprises, especially for large retail enterprises.

A set of data shows that as of September 2022, the growth rate of online shopping of social consumer goods in China is 6.1%, of which 64% consumers choose online shopping, 36% consumers choose offline shopping, and 91% consumers choose online and offline shopping at the same time.

In other words, if enterprises can’t successfully carry out digital transformation and effectively integrate online and offline resources, then they are likely to be eliminated by the market.

In this era, consumers’ consumption habits have undergone fundamental changes. It is more and more inclined to shop online. For offline physical stores, it expects more convenient and personalized services. If enterprises can’t meet these needs, then enterprises are likely to lose consumers and face a crisis of survival.

Digital transformation does not just mean moving from offline to online, or returning from online to offline. It refers to how enterprises can upgrade their business by using new technologies and new models in the face of today’s fierce market competition to better meet the needs of consumers. In this process, enterprises need to break the original business model and deeply integrate online and offline channels to realize global marketing.

The digital transformation of retail enterprises in China is a great challenge to the survival and development of enterprises. Only those enterprises that can actively respond, be good at innovation and be brave in reform can stand out in this transformation and realize sustainable development. For service providers, retail digitalization is also a difficult but promising industry track, and service providers with full-link service capabilities from data to behavior-driven and effect-paid will also become the ultimate beneficiaries and winners.

Retail, from the ancient merchants to the modern digital "people and goods yard", is welcoming a new era of change under the blessing of software and AI.