On March 30th, Rene Liu got up early.

>First, I replied to several work emails and looked at the outline of the visit arranged that day. Then, Rene Liu began to prepare a lunch box for his son, wake him up and send him to school.

>On the return trip, Rene Liu also turned to the hospital to visit her sick grandmother. When she got home, she began to exercise, take a bath and have lunch with the old public. Before leaving in the afternoon to become a female star, Rene Liu arranged dinner for the whole family, and did not forget to tell her husband when leaving the house. Remember to pick up her son from school and be on time.

>Rene Liu’s visit on that day lasted from afternoon to evening. Rene Liu said frankly that he didn’t adapt to the "business" for the new album released after a lapse of six years. One of the discomforts is that she is not used to focusing only on the "announcement" nowadays. In addition, she found herself unfamiliar with the current media (showbiz) environment, "it seems that I am a newcomer and everything has come back."

>Rene Liu

A female singer who no longer tore her heart out.

>In March this year, Rene Liu released a brand-new album "Everybody Be Well". It’s been six years since the release of her last album. At first glance, not releasing a film for six years seems to be quite "serious" for a singer, but Rene Liu is not sensitive to it. If it weren’t for the "six years" label repeatedly mentioned by propaganda copywriters and netizens, she didn’t realize that she had stopped recording "business" for so long. She will also quip: "People should think that I won’t come out to release an album, right? So there is nothing to expect. Now it suddenly comes out, but it’s … … Surperise! There is nothing’ waiting for a long time’ for everyone, okay? In fact, you are not waiting at all! "

>There is such a thing circulating among the people. Before making her last album, Rene Liu felt that she was "unable to sing" and that in the music world where new people came forth in large numbers, few people would like to listen to her "old girl" sing again. When she met at the airport, Jonathan Lee "knocked" her: the new girl certainly has the fragrance of the new girl, but the old girl also has the mellow fragrance of the old girl. Your feelings about life, your life story can be recorded and continue to sing. In Jonathan Lee’s view, Rene Liu’s unique emotional expression when singing is also precious.

>Rene Liu, who was "spurred", then launched her first work "I want you to be fine" after she became a mother, and she was also convinced that expressing her life and self-status with songs was something she could do — — But that’s not limited to the "album" form. As in the past two years, she has made several singles in different situations, and influenced by last year’s epidemic, she has accumulated more studio works, and the company has assembled them into an album. Rene Liu said frankly that this new edition is more like a selected "collection". Some of these songs, because the recording time has been too long, I can’t remember the mood at that time, which is quite like a lifetime ago.

>Rene Liu

>Although Rene Liu told herself that the outside world was not waiting for "Old Girl" to release an album, in fact, because she had sung too many popular golden songs in the past, the public still expected her to "return with a heavy weight" this time and bring a few more national karaoke songs like Later, Crazy for Love and Perfect.

>After the release of the album, Rene Liu saw some discussions, especially some "old fans" who listened to her songs all the way. "They will think that when this album comes out, they can listen to it for two days first, then have a good drink at KTV and sing it with me. But now I may feel that this album is not available. " Rene Liu concluded that the so-called songs that the outside world felt "not provided" were more "commercial" and more "passionate". There are also voices that she has some repetitions on some lyrics issues, such as talking about the theme of "loneliness".

>Regarding the interpretation of songs, Rene Liu has his own thoughts: "For example, people say that I am not passionate enough, and I am deliberately practicing this singing method when I am making this song. Because I think at my age, if I sing at the top of my lungs again, it doesn’t seem very appropriate. I hope it is a feeling of slowly coming. "

>Rene Liu

>As for the theme selection, Rene Liu said: "Although some topics will be repeated, with different experiences, my views on some things are no longer the same as before. Is its’ grey’ dark grey or light grey? Is its’ red’ bordeaux or purplish red? I think there is a difference. "

>Of course, Rene Liu admits that she hopes that the songs of this album can be "appealing to both refined and popular tastes": "I’m not that’ born’, just consider a work that makes me happy. After all, it takes a lot of resources to do, and it is to get the market (docimastic)。 But I also honestly say that I think Chinese pop music is still relatively young. What kind of songs should a Chinese female singer sing at this age? What kind of album is it? I don’t have many seniors to guide me. For example, I judged "All Lovers" and "Flying Day". Wow, this should belong to KTV, but you don’t think it is, so there is no way … … "After thinking about it, Rene Liu tidied up his expression:" Let’s just say that entertainment, I think whether listening to songs or watching movies, provides what I want to provide now. If someone likes it, they like it. If you don’t like it, I thank you. "

>Rene Liu believes that every piece of music will still attract its "stratosphere" audience, and she is not too anxious about it. Compared with the song "right", it is after the album is finished. How to promote it? This is the biggest challenge for Rene Liu.

>Rene Liu’s new album MV

A female star trying to keep up with the trend

>One day at the beginning of the year, Rene Liu sent Weibo to express his "shock". In the video, the "female star" scurried along the street, mumbling: When I came out of the company, my mind was full of the staff’s "new word" … … It turns out that my daily life is really too small. They said that I had to watch more programs outside my comfort zone so that everyone could "know me" and "know me" and let everyone know that I wanted to release a film … … What programs should I be on?

>It turned out that La Rene Liu, a colleague of the company, held an album enterprise promotion meeting that day. At the meeting, my colleague told Rene Liu that it was the Internet age, and she was asked to try some online programs, or she could take the initiative to shoot some videos for netizens to watch and spread. At that time, the team listed a lot of popular online synthesis types in the entertainment circle, and also selected a representative issue for each program to show to Rene Liu. "They thought I would fully understand and promise after reading it. But after reading it, I said, well, I really can’t do it … …”

>In fact, take the nearest inner entertainment circle as an example. In recent years, visible to the naked eye, many senior artists in the circle have begun to set foot in various variety shows. Or "ride the wind and waves" on the stage, "cut through thorns", or mix and match performances with the new generation of love beans, or collide in reality shows. Rene Liu’s novelty lies in the fact that artists need so many kinds of ways to promote themselves, but in "their time", they were nothing more than going to the radio, shooting magazines and holding autograph sessions.

>Rene Liu

>The reason why Rene Liu worries about her "no" is that she knows that she is not a variety personality. "Like my previous programs in fei chang and Yu-Ching Fei, they will throw me questions. For example, people like Figo will say,’ Hey?’ Then expect me to go on, but I will only’ hey!’ This way. So if I go to those programs, I will be very cold, and this kind of cold may be scolded by everyone, and I am’ blx’, afraid of being scolded, so I go less and make fewer mistakes. "

>existYuli studioAfter questioning, Rene Liu thought of two kinds of programs that she could accept: "One is a program of close friends, and I will feel very at ease. For example, He Jiong, if he asks me, I will be happy to go. In addition, I also like the program of Teacher Venus. "

>Rene Liu said with a smile that it is really difficult for his staff to carry out their work. "I often feel that there are not many opportunities left for me. Many (publicize) way, I said this is not suitable for me, maybe I was asleep at that time. In order to promote the album and increase exposure, they are also trying to find something I can do spontaneously, which is more in line with the media environment. "

>A few days ago, Rene Liu bought two unpacking videos online. One is unpacking electronic products; The other one introduced a fashionable toy. The idea of shooting out the box came from Rene Liu’s propaganda team. As it happens, when her husband gave Rene Liu a pair of headphones, she decided to "start" from the headphones and take the step of "new new human beings".

>Unpacking attempt from Rene Liu.

>At first, Rene Liu recorded a video at home. Having had experience as a film director, she carefully edited and packaged the material. However, after sending it to the team, it was mercilessly rejected by colleagues: "The video is too long", "I didn’t catch my eye for 5 seconds" and "there is no popular network language at all" … … Listening to colleagues constantly "counting down", Rene Liu chanted without grievances: "What do you say that if you can’t catch your eyes in the first 5 seconds of the video, you will be (netizen) brush it off, but I can’t be Ready at all for 5 seconds! "

>She even wrote a long letter to her colleagues, saying that she had tried her best to keep up with the trend of the times, but she also asked her colleagues to understand her. "Then I mean, netizens who really watch my videos and can stay are true friends to me. If you brush me off in five seconds, forget it. In addition, after all, online celebrity, who has lived in the Internet age for a long time, has a new language and ability that I can’t learn. I am afraid that if I imitate others too much, I will lose my original appearance and rhythm. "

>Finally, Rene Liu reached an agreement with her colleagues, and her short video content was taken over by her colleagues. Just as we are chatting, Rene Liu is stillYuli studioMake sure several times: "Did you see the final version? Do you think it’s ok? "

>Rene Liu and Martha filmed Vlog together.

>Occasionally, when Rene Liu brushes Weibo, she will find that Andy Lau, Tang Wei and Kwai Lun Mei who she thinks are great have entered the "live broadcast room" one after another. "That will make me feel that live broadcast with goods is a new way of publicity. And it’s real-time, and you can know immediately what others think. I am interested in going myself. In fact, for me, it’s still fun and can’t be forced. Because when I am forced to do something, it is counterproductive. So I still have to find a way that suits me. "

Homesick wife and mother

>When talking about my old friend He Jiong’s program,Yuli studioAsked a sentence: "That’s similar to his" Life of Desire ",let you go to a small village to live for a while, can you?" "I think it’s ok," Rene Liu thought for a moment. "I’m a lot of ok and restricted now because I want to be with my son and my family. I cherish my time with them."

>Unlike many artists who avoid talking about their families in media interviews, Rene Liu is particularly generous in sharing family. In a few moments, her daily topic will be trivial, which makes me suddenly feel that I am chatting with my next-door neighbor.

>She will share it naturally. In the family, her husband "Mr. Zhong" is much more fashionable than herself. 3C products, street brand co-branded, he will Update to her as soon as possible, "so will music. For example, when I was exercising today, he played a very nice song, and I especially asked him the name of the song, and then he would share it with me immediately (Note: John Mayer, New Light)。 But sometimes he will suddenly say, "Are you still a musician? Hum. "

>Since their marriage in 2011, it goes without saying that Rene Liu and her husband are also friends. The birth of his son in 2015 made Rene Liu more immersed in family roles. Even when we talk about her long-term exercise, she will correct: "I exercise, largely because I am a star." The main reason is that I have reached this age and my children are still young. I think it is quite important to try to stay healthy. "

>When my son was born, many people said to Rene Liu: You should seize this golden period and come out to work, because he sleeps most of the time. "But I was already very reluctant at that time. I think it is very important to take care of his life, such as feeding him, changing diapers and taking a bath. I hope to do it myself. " As his son grew up and became more capable of taking care of himself, Rene Liu found that he didn’t let himself go, but his dependence on his children became more serious.

>"Because he will communicate with me now," said Rene Liu with a gentle smile when he mentioned his son. "Like when I went to the Mayday concert in Tainan that day, he would think why not take him? I came back from the high-speed train early the next morning, got off the bus and went straight to the place where they had lunch. Then my son hugged me as soon as he saw me. God, at that moment, I felt that I would never travel again! What’s more, it is time for children to establish upbringing and values. I feel that I have the responsibility to stay with him. "

>In his early years, Rene Liu enjoyed the life of a lone ranger. After she tasted the beauty of "adventure" when she broke into the United States alone at the age of 16, she often flew around alone. In the album "Closed Daily Life", Rene Liu also sang a state of freedom: cleaning at home one scene before/booking a plane ticket the next. But whenYuli studioAsk her: "Can you still be in such a state now?" "no!" Rene Liu immediately shouted, "I can book a plane ticket in the next second, but I have to take my family with me. If I don’t take them, I can’t play enough. "

>Last summer, Rene Liu spent a lot of time making a summer vacation plan and taking a summer trip with his family, except that he took the stage by chance to "get a job". On the day of our chat, Rene Liu has already started to book hotels for his family this summer. "Don’t be surprised, it’s really necessary! Nowadays, there are few opportunities to go out by plane, children have the same holiday time, and there are only a few hotels suitable for the whole family, so there will be fewer choices. Like I couldn’t book it this morning! " Say and Rene Liu revealed a discouraged expression.

>Rene Liu

I don’t want to get old, but I’m also adapting to the aging Rene Liu.

>Referring to the most "heart-wrenching" work in the album, Rene Liu did not hesitate to choose "Golden Age". The lyrics write: The years can’t come back/Time is catching up/How lucky I am at this moment/I feel my body is getting old … … "It is very honest about my current state and my mood."

>Rene Liu recalled that when she heard the DEMO of this song, she was adapting to the physical and psychological changes brought by age. Different from the previous abstract feelings, the traces of time are more and more concrete in Rene Liu’s life. "For example, you are no longer so free to move. When you stand up from the ground, you will really subconsciously’ Oh, my God’ to make such an exclamation; Or you used to lose weight, maybe you lost a few kilograms in three days, now you have to lose a month, then eat three meals, and your weight will come back. "

>When interviewed many years ago, Rene Liu admitted that he was afraid of being old. "Because I am afraid that others will take care of me. Besides, I am afraid of losing my creativity, my enthusiasm and my quiet inside." Now standing at the threshold of 52 years old, Rene Liu feels: "I think my curiosity about the world and passion for things have not changed. However, one day before, my agent sent me a series of photos, and I suddenly found that my time did not allow me to accept light things for so many years. Because I am busy with more chores of life every day, there is no way to brush what is the most popular and what is hot search forever. Some things may have passed in a flash, and when you know it again, people will think it was before, and the times are so fast now. So … … Everyone is old, and no one is not old … …”

>Rene Liu and Martha.

>When "I Dare to Be Alone in Your Arms" was released in 2014, Rene Liu wrote in a "letter to himself": Be old happily, justly and elegantly. Rene Liu mentioned it again in the last song of the new album "Today is My Birthday".

>When talking about this "golden sentence", Rene Liu said with a smile: "I was looking through some notes a while ago, only to find that I write this word for myself almost every birthday. It seems that I really haven’t improved. However, every year the expectations are the same, but the mood is different, and it is getting harder and harder. Indeed, in the trivial, it is really difficult to remain elegant. Are you justified? Nobody seems to care either. For example, many things are’ black’ and’ white’ to me, and there can’t be gray. But people often come back to me and say, that’s not important. But for me, the word’ that’s not important’ makes me panic, and I get hysterical. Therefore, I have been learning. "

>A few years ago, when someone asked Rene Liu "when is the most beautiful", she would answer "when she was plain". In recent years, after a day’s chores, when she occasionally looks in the mirror at night, she will be "shocked" by her appearance. "That’s really not elegant." In the era when the whole people advocate medical beauty, whenYuli studioWhen asked whether Rene Liu would consider using some medical and aesthetic means to maintain her state, she first made a careful understanding to us, and then generously said that if necessary, she would not be excluded in the future. "I think it is a very good thing if I can make myself feel good and make others happy. But I must be very cautious. Because although I don’t want to get old, I don’t want to get weird. "

>At the end of the chat, Rene Liu andYuli studioShe shared two things that made her feel happy recently: one was to attend a concert of her friend Mayday a few days ago. "There are really too many feelings with them. For example, I took a special photo of them that day,’ As long as you are ordinary and happy in this life, who said that this is not great’. I think it’s right. It’s the same as my album’ How are you?’ You are ordinary now, but you are happy. I think this is super great. "

>The other is that on the night of a business trip, my husband and son sent her a video of a father and son making caramel pudding together. "They are also waiting for me to go home and make it for me. These seem to be small things, but they are all my happiness. "

>Occasionally, Rene Liu will miss the lonely self in the past, but she is also willing to end her life with "You can tell yourself/this little life in the past/not only ok/just ok". "It is richer than I thought. Although I have experienced stumbling and falling all over, I regret some things I did. But then again, that’s what I want to do and want to do now. Of course, I also have many wonderful experiences, so,’ OK’. "

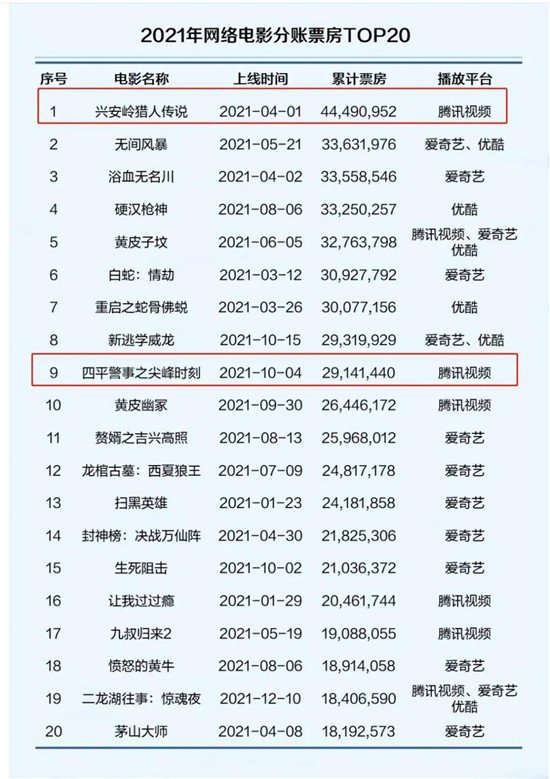

Film critic Wei Junzi and director Jing Wong started an online conversation.

Film critic Wei Junzi and director Jing Wong started an online conversation.