The beauty industry in 2021 is even more "rolled up" than in previous years.

In the general environment, the growth rate of cosmetics retail market has slowed down, and various new regulations of the industry have gradually landed, and the business pressure of enterprises has suddenly increased; On the brand side, new domestic products are cold, and many imported products "fail" in China; At the channel end, the online traffic dividend disappears, the live broadcast frequently rolls over, the offline channel is still in the winter, and the new species boom is no longer; At the supply chain end, it has also begun to enter a new reshuffle period …

Looking back on the past year, it is undoubtedly a year of "pain" in the industry. In the new year, only by aiming at the pain points and attacking accurately can we find the certainty of the development of the enterprise itself in the turbulent market.

1. The "pain" of the market twists and turns

According to the data of the National Bureau of Statistics, from January to November 2021, the total retail sales of social consumer goods reached 39,955.4 billion yuan, a year-on-year increase of 13.7%. Among them, the total retail sales of cosmetics was 367.8 billion yuan, up 15.3% year-on-year, which was 9.5% higher than that of the same period last year.

However, compared with previous years, cosmetics retail is obviously insufficient in 2021. According to cosmetics observation statistics, from January to June, the growth rate of total retail sales of cosmetics showed a downward trend month by month; In July, the growth rate of cosmetics retail sales slowed down to 2.8% year-on-year, and it was 0% in August, and rose to 3.9% in September, but compared with the same period in history, it was the lowest value in the same period in the past 10 years.

2. The "pain" of industry supervision

With the formal implementation of the Regulations on the Supervision and Administration of Cosmetics on January 1, 2021, the cosmetics industry has ushered in the era of "the strongest supervision in history".

According to the incomplete statistics of cosmetics observation, at least 16 relevant management regulations/methods/provisions and draft for comments will be issued in 2021. While raising the industry threshold, many problems have surfaced one after another.

The speed of new product development becomes slower. On May 1, 2021, the Measures for the Administration of Cosmetic Registration and Filing, the Provisions for the Administration of Cosmetic Registration and Filing Data and the Provisions for the Administration of New Cosmetic Raw Materials Registration and Filing Data were officially implemented, which clarified the safety monitoring system for new raw materials and the requirements related to cosmetic registration and filing, which made the R&D cycle of enterprises longer, the development speed of new products slower and the registration threshold higher.

Operating costs have increased substantially. As required, since January 1, 2022, cosmetics registrants and filers who apply for special cosmetics registration or ordinary cosmetics filing shall evaluate the efficacy claims of cosmetics. However, according to industry insiders, the testing cost of a single product has risen sharply compared with before, and the operating costs of enterprises have risen.

Advertising has become more difficult. From May 1 this year, the Measures for the Administration of Cosmetic Labels will be officially implemented, which puts forward regulatory requirements for enterprises to advertise or publicize their efficacy through cosmetic labels. Last year, many enterprises were fined for false propaganda.

3. The "pain" of new domestic products when they are cold

Since 2021, news of the closure and clearance of domestic cosmetics brands has frequently come out. According to the incomplete statistics of cosmetics observation, as of December of that year, nearly 20 domestic beauty brands were shut down or closed down. Such as Cindy, CROXX, Paiji, KACH, etc. Among them, make-up brands are the main brands.

Someone in the industry once said that the competition of new domestic brands is very cruel, and it is difficult for some niche brands and new brands that have not run out of popularity to live for a few years. In fact, many brands didn’t know it existed until they were about to close down.

This is related to the "killing" of many domestic brands in the low-end market. In a market with limited traffic, the continuous influx of new brands will only aggravate the "involution". Once the capital stops "blood supply", new domestic products will only come to an end silently.

4. The "pain" of sluggish imports"

It is reported that Yueshi Fengyin, owned by Korean Amore Pacific Construction Group, will retreat in the China market, and the number will eventually be reduced to 140, which is 76% less than the 600 stores in the peak period. In March 2021, the group’s Yiti House has completely closed all offline stores in the China market.

The retreat of Yueshi Fengyun is just a microcosm of foreign beauty companies in China.

According to the incomplete statistics of cosmetics observation, in 2021, more than ten international beauty brands withdrew their cabinets, cleared their warehouses or even stopped operating in China. In the counted cases, the groups of imported brands are mainly international beauty giants, such as WASO under Shiseido, BECCA under Estee Lauder, Copley under Unilever, etc., involving skin care, make-up and care.

5. The "pain" of online channel turmoil

Double 11’s "dumb fire" is a watershed from hot to cold for online e-commerce. In the past 13 years, Ali Double Eleven ushered in single-digit growth for the first time, with an increase of 8.45%. This result is related to the end of the traffic dividend and the increasing cost of traffic.

Some popular anchors have bluntly said that in the past five years, the price of traffic on various platforms has increased tenfold, and the business of merchants has become more and more difficult to do, and it has become increasingly difficult to make money, because they are all working for platforms and KOL. According to the data of the research and development department of CITIC Securities, the promotion expenses of some platforms reach more than 26% of the sales, and the brands burn a lot of money, but they just "kill one thousand and lose 800", and finally they can only go lonely.

The field of live online delivery, which was once in the limelight, also suffered a blow.

Since 2020, more than 20 laws and regulations on live broadcasting have been promulgated, and the statement that "the lowest price of the whole network" was originally the killer of live broadcasting began to become illegal propaganda.

As for anchors, Viya, Sydney and Lin Shanshan were all fined for tax evasion, totaling more than 1.4 billion. Their accounts in Weibo, Tik Tok, Taobao, Aauto Quicker, Xiaohongshu and other platforms have also been blocked. The tax storm has bid farewell to the barbaric growth of live broadcast, and practitioners have begun to re-examine this ups and downs.

6. The "pain" of shrinking offline channels

The offline channel is still in the "winter". Market research shows that the passenger flow of offline channels continues to decline, and the events of clearance, bankruptcy, store closure and career change have never stopped in the industry. However, due to the impact of the epidemic and online, the cold winter of offline channels is far from over.

Take some foreign brands that reduce the market as an example, many will also take offline channels to "cut the knife first". For example, after entering the China market in 2014, the care brand Fulv Deya mainly used department stores. At the beginning of 2021, Fu Lu Deya was reported to have cut down a lot of department store counters, which was the result of the brand shifting its strategic focus to online. In addition, Bei Lingfei, a subsidiary of LVMH Group, and Julie Kou, a subsidiary of POLA, also withdrew a large number of offline counters.

7. The "pain" of low tide of new species

According to incomplete statistics, since 2020, there have been nearly 20 new beauty collection stores in the beauty market, which have more than 1,000 stores nationwide. However, since 2021, some new species have begun to spread rumors of losses and even closing stores. At the same time, the expansion speed of "old players" in stores is no longer the grand occasion of the past. Last year, only a few "new players" such as "Zero Beauty Optimization", "SUKI BOX" and "BOEM’SBOOK Collection" entered the stadium.

Some insiders believe that in this context, capital also holds a wait-and-see attitude towards new species, and many new species have entered the threshold of life and death. Whether they can establish their own profitability will determine their life span.

8. The "pain" of supply chain reshuffle

In 2021, the supply chain ushered in a new reshuffle period. This year, supply chain enterprises have experienced many rounds of pressure, such as supervision, price increase and power cut.

The first is supervision. Strong supervision on banned raw materials has greatly affected enterprises. On May 28th, the State Food and Drug Administration issued the Catalogue of Prohibited Raw Materials for Cosmetics and the Catalogue of Prohibited Plant (Animal) Raw Materials for Cosmetics. Among them, the list of prohibited raw materials for cosmetics reached 1,284, while the list of prohibited plant (Animal) raw materials for cosmetics was 109, and cannabis raw materials were definitely banned. In addition, the regulatory authorities have redefined the concepts of stem cell cosmetics, brush acid beauty and food-grade cosmetics.

The second is the price increase. In January, 2021, cosmetic packaging boxes took the lead in opening the price increase tide, and nearly 20 paper enterprises successively issued price increase notices, with the highest increase reaching 20%. In March and October, the raw material side also started to raise prices several times, with the highest increase of 118%.

Then there is the power cut. At the end of September last year, industrial electricity consumption in many places in China was tight, and various places took measures such as limiting electricity and stopping production for enterprises under their jurisdiction. Jiangsu, Guangdong, Zhejiang and other major chemical provinces were also deeply affected, which undoubtedly made matters worse for cosmetics manufacturers who were already in the trend of price increase.

By 2022, CiE Beauty Exhibition will solve the pain points of the whole industry in one stop.

The pain points mentioned above are, in the final analysis, that the beauty industry has reached an important turning point in history, and the people and goods yard has undergone earth-shaking changes. Only by innovation, only by opening up and linking the excellent resources of the whole industry chain can we solve the above problems.

CiE Beauty Innovation Exhibition, with the slogan of "new brand, new buyer, new ecology", is the first exhibition in the beauty industry focusing on new resources and taking "innovation" as its core competitiveness. The 2022CiE Beauty Innovation Exhibition also provides innovative solutions for the beauty industry.

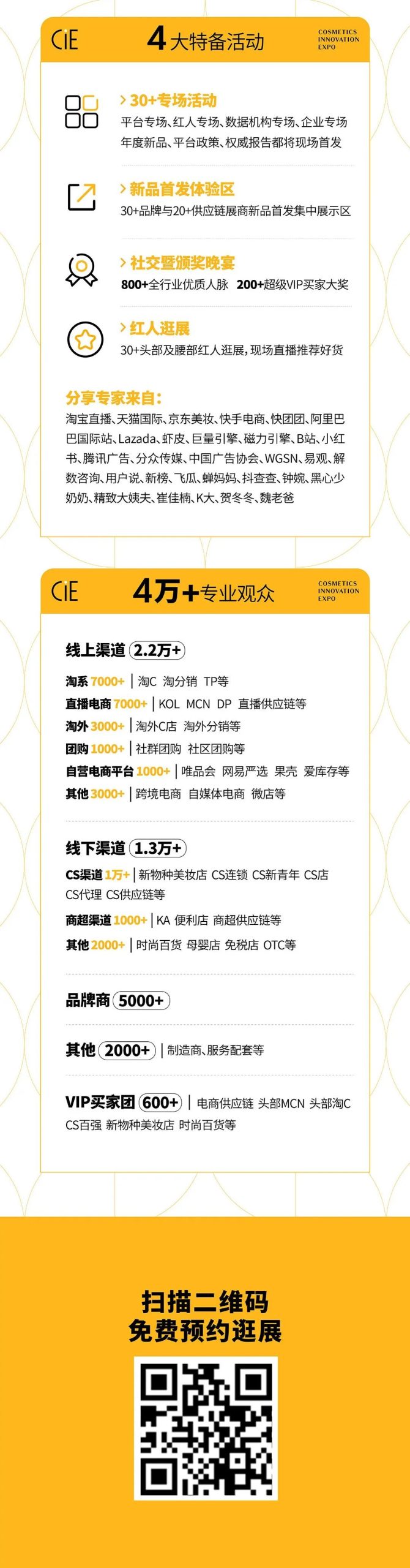

It is reported that the 2022CiE Beauty Innovation Exhibition includes five exhibition halls with an exhibition area of 60,000 square meters and 800+ high-quality exhibitors. It is estimated that there will be more than 40,000 professional buyers. The highlights are mainly reflected in the following three aspects-

800+ quality exhibitors. The exhibition covers 800 exhibitors, including more than 400 brands, including new domestic products, imported products, special categories and other market trends; There are more than 200 supply chains, covering foundries, packaging suppliers, raw material suppliers and testing institutions. There are more than 150 ecological resources such as MCN and e-commerce platforms.

More than 30 special events. The exhibition will hold special events such as e-commerce and marketing platforms, data & trends and celebrities. More than 30 experts from Taobao Live, Tmall International, JD.COM Beauty, Aauto Quicker E-commerce, bilibili and Xiaohongshu will share the development trend of 2022 beauty, the latest policies of e-commerce platforms and the advanced tactics of traffic marketing.

40,000+professional audience. It is estimated that there will be more than 40,000 exhibitors, including about 22,000+visitors from online channels and 12,000+customers from offline channels, gathering high-growth channel buyers in the beauty industry.