At 13: 24 and 15: 13 on March 19, the first batch of two free high-speed trains from Hubei to Guangdong started from Jingzhou Station in Hubei, and transported 1,631 Jingzhou migrant workers to 898 Guangdong enterprises. All of them applied for Hubei health code and passed the nucleic acid test. In the near future, 40,000 Hubei migrant workers will go to Guangdong to return to work with their health code.

With the orderly progress of resumption of work and production, the national mutual recognition of health codes is pressing the shortcut key. On March 20th, Mao Qunan, director of the Planning Department of the National Health and Wellness Commission and deputy director of the National Aiwei Office, said: "At present, the the State Council E-government Office and the National Health and Wellness Commission have provided three paths for mutual recognition and sharing across provinces. Please choose to implement them according to local conditions."

How to get through the health code information in each province, and what are the problems in the use process? The reporter conducted an in-depth interview.

Focus: health code embraces those who return to work.

How do mainlanders enter Hubei in the process of resuming work and production? On March 19th, Hubei Province issued a notice that people from other provinces can apply for Hubei health code through the "Hubei Office" App, the national "internet plus Supervision" applet, the Alipay applet and the "Hubei Office" WeChat applet, and pass through Hubei with the "green code".

At the same time, Hangzhou, Zhejiang Province took the lead in "embracing" the returning workers in Hubei Province. From March 18th, Hubei people can go back to work in Hangzhou with health codes without isolation. Why is Hangzhou moving so fast? It has to start with the health code more than a month ago.

In Yuhang District, Hangzhou, due to the large floating population and large flow, at the beginning of the epidemic, local prevention and control encountered a "pain point" problem-how to reduce personnel contact and paper duplicate registration. On February 4th, Yuhang District proposed to build a digital scheme as a digital health certificate during the epidemic period. As a result, Alipay, Nail, Alibaba Cloud and other teams worked with the local authorities to develop health codes. "During that time, everyone slept for two or three hours a day, and the product was iterated half an hour before it went online, and it was iterated half a day after it went online." The staff responsible for the health code project in Yuhang District said.

On the evening of February 7th, Yuhang, Hangzhou launched the first health code in China-"Yuhang Green Code". Yuhang residents can travel and return to work with the health code in their mobile phones. Subsequently, on February 11th, Hangzhou Health Code was first launched in Alipay, creating the red, yellow and green dynamic health code model.

The spillover effect brought by health code soon appeared. On February 16th, when some areas were still worried about the "three-return" personnel flow caused by the resumption of work, Zhejiang started to resume work by using the health code. That night, the first special train for people returning to work in China arrived in Hangzhou East from Guiyang North, the starting station, and nearly 300 Guizhou passengers returned to Hangzhou smoothly. On February 19th, Hangzhou West Lake Scenic Area was also the first to open.

In just two weeks, the health code has been promoted from one city in Hangzhou to 200 cities across the country, and it has gradually promoted mutual recognition. According to statistics, 25 provinces, municipalities and autonomous regions in China can receive health codes from Alipay. At the same time, the "national version" health code-epidemic prevention health information code, which was developed under the guidance of the General Office of the State Council, was first launched in Alipay applet, and has been available nationwide.

It is worth mentioning that Zhejiang Province has launched an international version of the health code in view of the actual situation of overseas Chinese, overseas students and other foreigners returning to Zhejiang. Appropriately distinguished from the domestic version, the international version of health code is classified into orange, yellow and green. By 12: 00 on March 16th, Zhejiang had distributed 72.092 million health codes, including 31,000 international versions.

Breaking the difficult point: data islands are being opened.

At 7: 30 pm on March 18th, six warm-hearted returning buses carrying 148 Hubei folks arrived at Yuncheng West Road, Baiyun District, Guangzhou City, Guangdong Province. The medical staff got on the bus to take temperature and check the health code. Li Xiande, a returning worker, said: "Guangzhou has long been my home."

On March 16th, Baiyun District was officially declared as the first administrative region in Guangzhou to recognize Hubei health code. Anyone who has returned from Hubei with a "green code" need not be isolated or tested. This policy has reassured people from Hubei to Guangzhou.

In Sanyuanli Street, Baiyun District, more than 6,000 Hubei nationals rented here before the Spring Festival, and more than 4,900 Hubei nationals returned to their hometown to visit relatives during the Spring Festival. Baiyun District People’s Social Security Bureau said that it will continue to open a through train for returning to work, arrange special personnel to follow up the work of returning to Guangzhou, lodging, entering the factory and entering the village (community), and open up the whole process of "point-to-point" transportation for employees returning to work to help migrant workers get to work safely and healthily.

In Shandong, Song Yuying, who lives in Jiaheyuan Community, Fulaishan Street, Yantai Development Zone, returned to her hometown in Heilongjiang in the New Year. Recently, she returned to Yantai because of the start of business. After Song Yuying returned to Yantai with the "Heilongjiang Health Card" issued by Suihua City, Heilongjiang Province, she completed the inter-provincial mutual recognition in the neighborhood Committee for 5 minutes and successfully changed the "Shandong Health Pass Card".

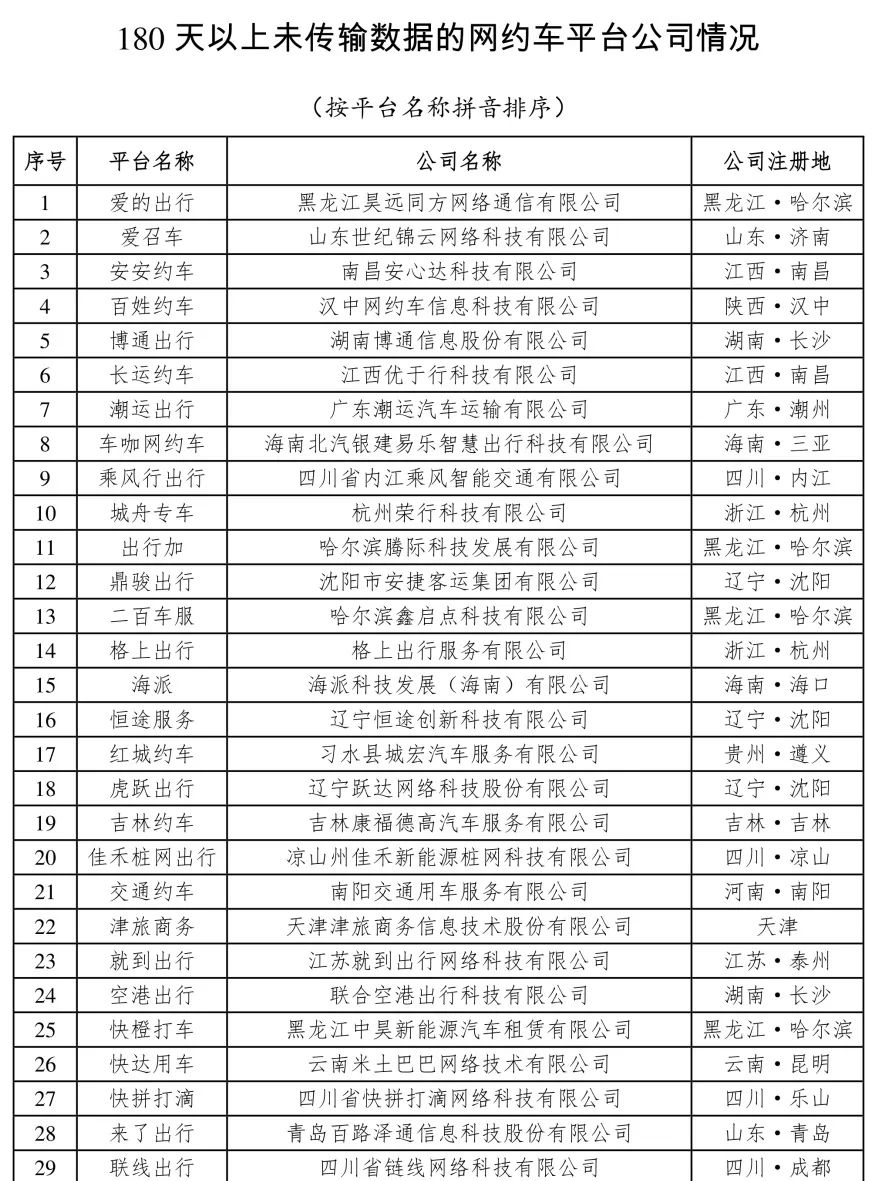

Mutual recognition, so that data islands in various places are being opened. From March 19th, all the cities in Shandong Province will recognize and release those who have mutually recognized and shared provinces as long as they can show their health codes, and guide them to apply for Shandong electronic health codes by using the "Lailu Declaration" module. For those who can’t show their health pass codes and who have not signed a mutual recognition memorandum, the policy of isolation for 14 days will continue to be implemented. At present, Shandong has promoted the establishment of inter-provincial mutual recognition mechanism of "bright code" and "transcoding" with 19 provinces with more personnel mobility.

Zhejiang and many places have realized mutual recognition of health codes. As early as February 28th, Hainan and Henan signed mutual recognition agreements on health codes with Zhejiang respectively. At present, Zhejiang has achieved mutual recognition of health codes with at least 10 provinces and cities such as Hainan, Henan, Sichuan and Hubei.

The use of health codes is also being further optimized, and some provinces have achieved one-time filling and mutual recognition. Nowadays, Hubei people apply for Hubei health code in Alipay, and they can return to their local jobs with the health code, so there is no need to apply for Hangzhou health code repeatedly. On March 18th, a group of migrant workers in Xianfeng County, Enshi Prefecture, Hubei Province just took the bus and returned to Hangzhou with their health codes.

Make up the shortcomings: realize mutual recognition and sharing of information in multiple ways

On March 21st, Mao Qunan said at the press conference of joint defense and control mechanism in the State Council: "We have realized mutual recognition and sharing of basic data. On the national national health information platform and the national integrated government service platform, the databases of confirmed and suspected patients, possible close contacts and county epidemic risk levels in COVID-19 were released, thus realizing the unified mutual recognition of the basic databases. "

Mao Qunan said that China has provided three paths for cross-provincial mutual recognition and sharing:

—— First, under the condition of not changing the existing local health password, the cross-regional mutual recognition function is added to the local health password through the data sharing of cross-regional epidemic prevention health information;

-Second, the local health pass codes are connected with the epidemic prevention information codes of the national integrated platform, and the epidemic prevention information codes on the national integrated platform are used as the intermediary to convert, so as to realize the mutual recognition of cross-regional health pass codes;

Third, for those areas that have not established the local health pass code, the epidemic prevention information code on the national integrated platform can be directly adopted.

At present, is there a "short board" in the process of mutual recognition of health codes? Mao Qunan believes that the difficulties in mutual recognition of health codes are mainly the differences in epidemic prevention and control situations and policies in different places. At present, the low-risk counties in China have accounted for 98%, and all provinces are speeding up the collection of catalogues of epidemic prevention health information in their own areas to the national integrated platform in accordance with unified data format standards and content requirements.

"From the current point of view, promoting mutual recognition of health codes in an orderly manner is also constantly optimized and iterated. This is a positive measure and the effect is worthy of recognition." Zhu Wei, deputy director of the Communication Law Research Center of China University of Political Science and Law, said.

Zhu Wei believes that because prevention and control involves public interests, the measures to introduce health codes are very timely. In this process, the collectors are informed and the government is fully involved, so it conforms to the provisions of the network security law and belongs to the scope of rational use of personal information.

"It should be noted that the health information collected is personal core information, and China should strengthen the protection of personal information security during the implementation process." Zhu Wei said.(Reporter Zhang Zheng, Lu Jian, Aring Zhang, Wu Chunyan, Zhao Qiuli, Wang Zhongyao, Fan Feng)